Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

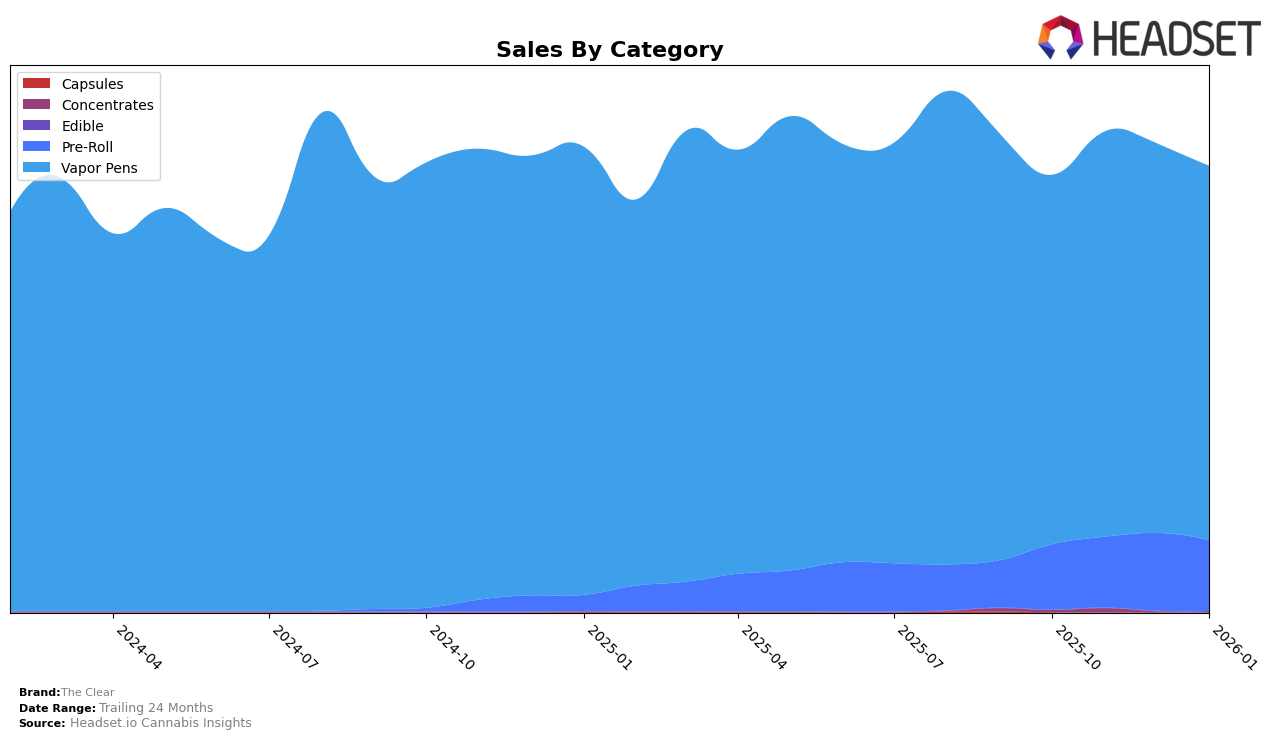

The Clear has demonstrated a varied performance across different categories and states, with notable movements in its rankings. In Colorado, the brand has maintained a steady presence in the Pre-Roll category, consistently ranking at 13th from November 2025 through January 2026, indicating a stable market position. However, its performance in the Vapor Pens category in Colorado shows more fluctuation, with a peak at 13th place in November 2025, followed by a decline to 23rd by January 2026. This suggests challenges in maintaining momentum in the Vapor Pens segment. Meanwhile, in Nevada, The Clear's entrance into the Pre-Roll category in November 2025 at 39th place and subsequent drop to 41st in December highlights a struggle to gain traction. The Vapor Pens category in Nevada also saw a decline, dropping from 20th in December to 28th in January 2026, indicating potential competitive pressures or market shifts.

In Massachusetts, The Clear's performance in the Vapor Pens category has been less favorable, as it failed to rank within the top 30 brands by January 2026, highlighting a significant challenge in this market. Conversely, New Jersey has been a stronghold for The Clear in the Vapor Pens category, where it improved its ranking from 13th in November 2025 to 9th by January 2026. This upward trend in New Jersey suggests effective strategies or consumer preferences working in The Clear's favor. Missouri also shows positive momentum for The Clear in Vapor Pens, with a notable jump from 68th in December 2025 to 51st by January 2026, which could indicate successful market penetration or increased brand recognition. Such insights reveal the diverse and dynamic landscape The Clear navigates across different states and product categories.

Competitive Landscape

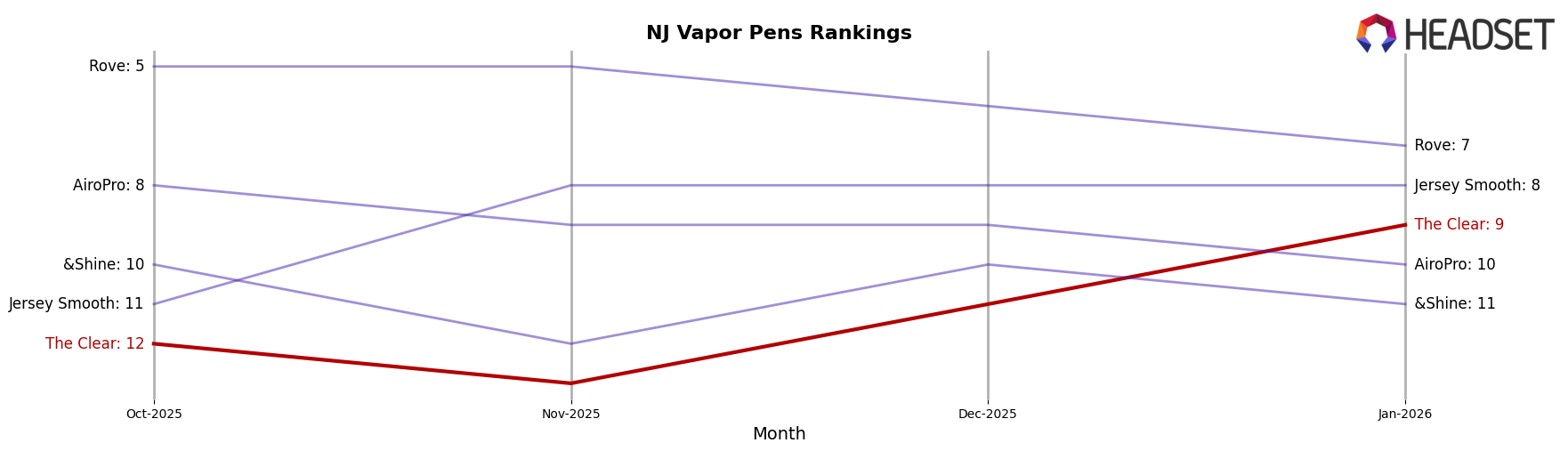

In the competitive landscape of vapor pens in New Jersey, The Clear has shown a notable upward trend in its ranking, moving from 12th in October 2025 to 9th by January 2026. This improvement in rank is significant given the competitive pressure from brands like Rove, which consistently held higher ranks, albeit with a decline from 5th to 7th over the same period. Meanwhile, Jersey Smooth maintained a stable position at 8th, indicating strong competition just ahead of The Clear. Despite AiroPro and &Shine experiencing fluctuations and a downward trend in sales, The Clear's sales figures rebounded in January 2026, suggesting effective strategies in capturing market share. This positive trajectory highlights The Clear's potential to climb higher in the rankings if it continues to leverage its market strategies effectively against these competitors.

Notable Products

In January 2026, The Clear's top-performing product was Twax - Pure Pear Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its top rank from November 2025 and achieving sales of 3132 units. Elite - Golden Goat Distillate Cartridge (2g) in the Vapor Pens category moved up to the second rank with a notable increase from its third position in December 2025. Twax - Lime Sorbet Distillate Infused Pre-Roll (1g) dropped to third place after holding the top spot in December 2025. Elite - Blue Raz Distillate Cartridge (2g) remained stable, holding the fourth position for two consecutive months. Elite - Grapevine Distillate Cartridge (2g) entered the rankings for the first time at fifth place, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.