Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

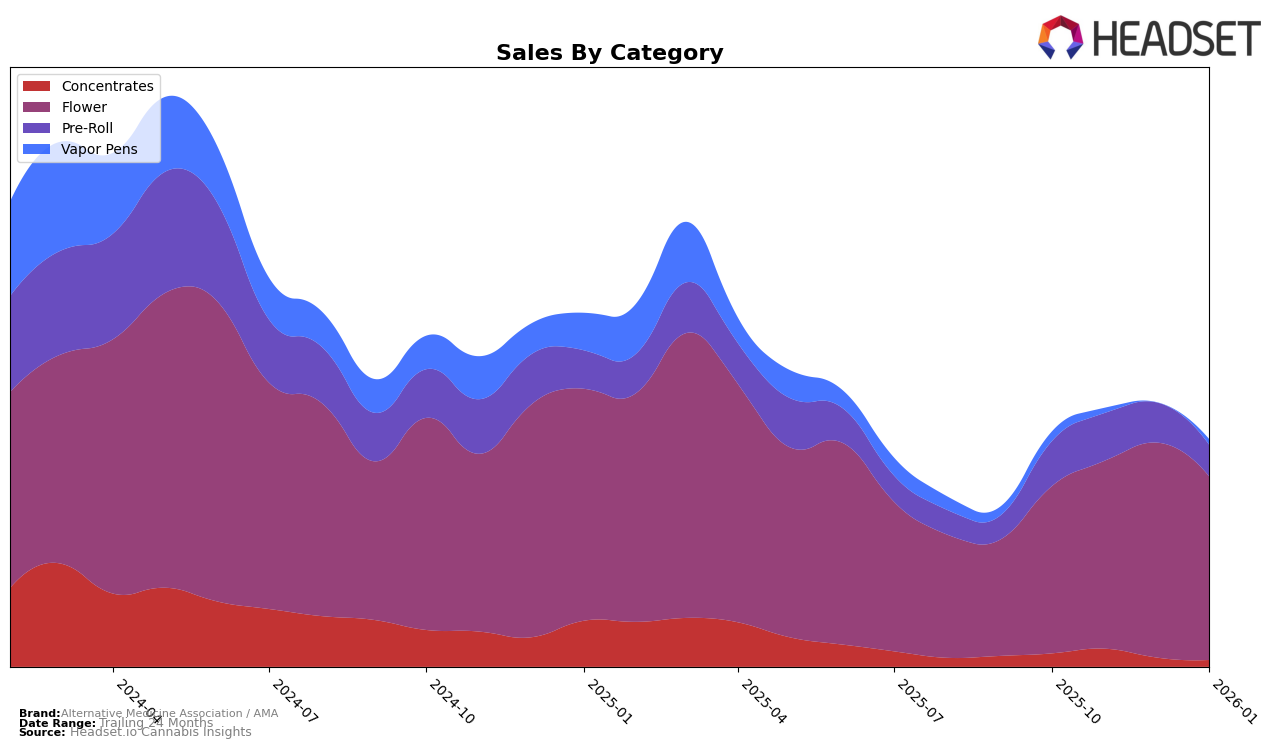

The performance of Alternative Medicine Association / AMA in the Nevada market across various categories demonstrates notable trends. In the Concentrates category, AMA consistently held the second position from October to December 2025, but experienced a decline to fifth place by January 2026. Despite this drop in ranking, the brand's sales peaked in November 2025, indicating a strong market presence during that period. In the Flower category, AMA showed impressive upward movement, climbing from the fifth position in October 2025 to second in December 2025, before settling at third in January 2026. This suggests a robust demand for their flower products, which is further supported by the sales figures peaking in December 2025.

In the Pre-Roll category, AMA maintained a steady fifth-place ranking throughout the observed months, showcasing a consistent performance in this segment. However, the sales trajectory saw a decline from November 2025 onwards, which might suggest increased competition or changing consumer preferences. On the other hand, in the Vapor Pens category, AMA's ranking fluctuated between the 21st and 25th positions, indicating a more challenging market environment for these products. Despite the lower rankings, there was a notable recovery in sales by January 2026, which could hint at a strategic adjustment or a seasonal demand shift. Overall, AMA's performance across different categories in Nevada highlights both strengths and areas for potential growth.

Competitive Landscape

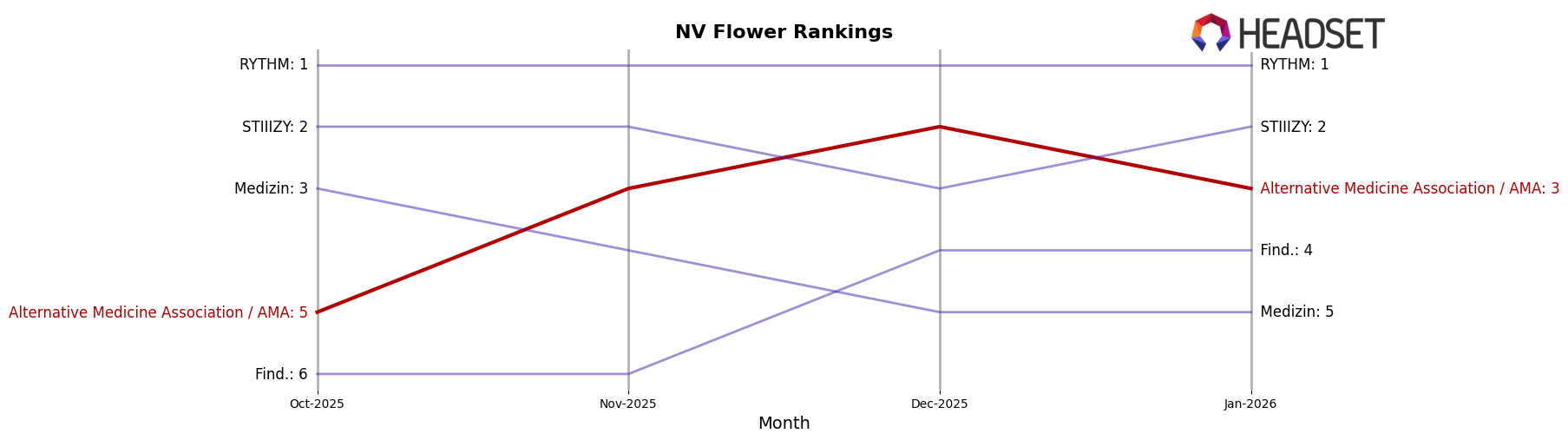

In the Nevada flower category, Alternative Medicine Association / AMA has demonstrated a strong upward trend in rankings and sales over the last few months. Starting from a rank of 5th in October 2025, AMA climbed to 3rd in November and reached 2nd place by December, before settling at 3rd in January 2026. This positive trajectory is indicative of a successful strategy in capturing market share from competitors. Notably, AMA surpassed Medizin, which saw a decline from 3rd to 5th place over the same period. Despite AMA's impressive gains, RYTHM maintained its lead, consistently holding the top position, while STIIIZY remained a close competitor, fluctuating between 2nd and 3rd place. The competitive landscape in Nevada's flower market is dynamic, with AMA's growth suggesting a strong brand presence and effective market strategies.

Notable Products

In January 2026, the top-performing product for Alternative Medicine Association / AMA was Kush Cake Pre-Roll 1g, which ascended to the number one rank with sales of 5098. The Truffle Skunk Pre-Roll 1g also performed notably, climbing to the second spot despite being unranked in the previous months of 2025. Cap Junky Pre-Roll 1g dropped to third place from its previous first place in October 2025, indicating a shift in consumer preference. Pixie Dust Pre-Roll 1g maintained a steady presence in the rankings, securing the fourth position. Garlic Sundae Pre-Roll 1g re-entered the top five, rounding out the list at fifth place after being unranked in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.