Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

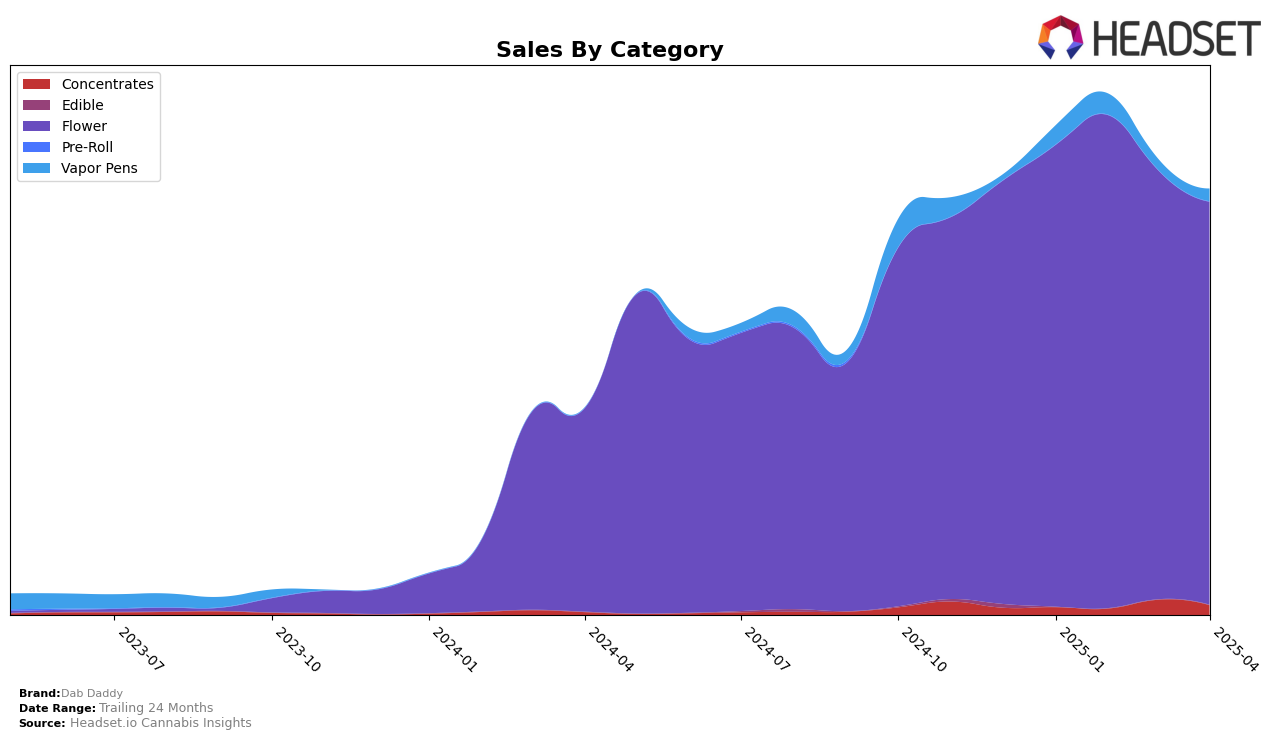

Dab Daddy's performance in the California market shows a mixed trajectory across different product categories. In the concentrates category, Dab Daddy did not make it to the top 30 brands from January to April 2025, with rankings of 73rd and 90th in March and April, respectively. This indicates a challenging period for Dab Daddy in this segment, as it struggled to capture significant market share. On the other hand, the flower category tells a different story, where Dab Daddy consistently maintained its presence in the top 30, albeit with some fluctuations. Starting at 24th in January, the brand improved to 18th position in February, before slipping back to 30th in March and April. This suggests a relatively stable yet competitive positioning in the flower category, despite the downward trend in sales from February to April.

While the brand's presence in the concentrates category in California has not been strong enough to break into the top 30, Dab Daddy's performance in the flower category highlights its ability to remain relevant in a competitive market. The sales figures reflect this, with a notable sales peak in February, followed by a gradual decline through April. The contrast between the two categories underscores the importance of strategic focus and market adaptation for Dab Daddy. It will be interesting to see how the brand navigates these challenges and whether it can leverage its strengths in the flower category to improve its overall market position. Further insights into Dab Daddy's strategies and performance in other states and categories would provide a more comprehensive understanding of its market dynamics.

Competitive Landscape

In the competitive landscape of the California flower category, Dab Daddy has experienced notable fluctuations in its market position from January to April 2025. Starting the year at rank 24, Dab Daddy improved to rank 18 in February, indicating a positive reception or strategic advantage during that period. However, by March and April, the brand's rank slipped back to 30, suggesting increased competition or potential challenges in maintaining its earlier momentum. In contrast, brands like Yada Yada maintained a relatively stable position, starting at rank 21 in January and only slightly declining to rank 28 by April. This stability may indicate a consistent customer base or effective marketing strategies. Meanwhile, Traditional Co. showed a more consistent performance, hovering around rank 28 to 30, closely trailing Dab Daddy. The fluctuating ranks of Dab Daddy highlight the dynamic nature of the California flower market and underscore the importance of strategic adjustments to maintain competitive advantage amidst strong contenders like Cookies and Almora Farms, which, despite not being in the top 20, showed significant sales figures that could pose a threat if they gain more traction.

Notable Products

In April 2025, the top-performing product from Dab Daddy was Runtz x Jealousy (14g), which climbed to the number one spot with sales reaching 1652 units. La Pop Rocks (14g) secured the second position, maintaining a strong performance with 1632 units sold, a significant improvement from its third place in March. Frosted Donuts (14g) saw a drop from first place in March to third in April, reflecting a decrease in sales to 1570 units. Rainbow Sherbet (14g) made its debut in the rankings at fourth place, while Orange Creamsicle (14g) dropped to fifth, continuing its decline from previous months. These shifts indicate a dynamic market with shifting consumer preferences among Dab Daddy's flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.