Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

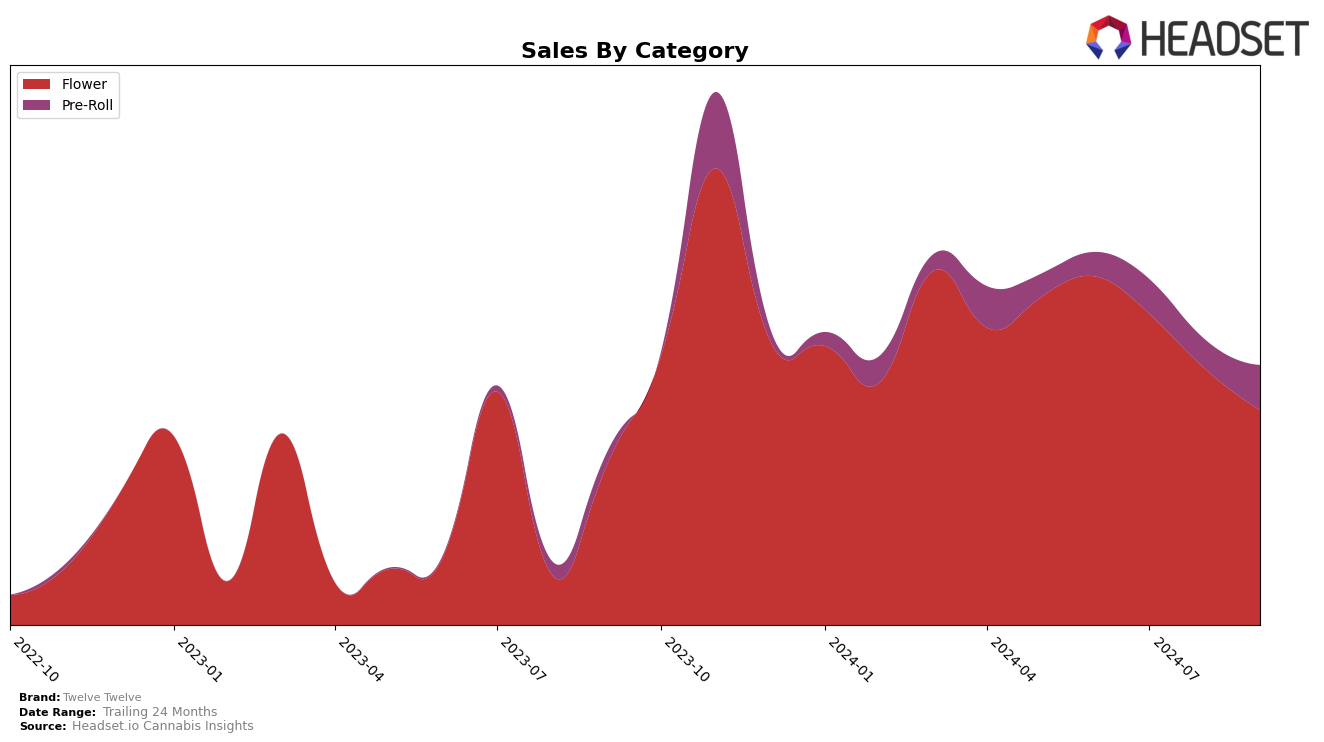

In the state of Nevada, Twelve Twelve has shown a mixed performance across different categories. In the Flower category, the brand experienced a downward trend in its rankings, moving from 14th place in June 2024 to 22nd place by September 2024. This decline in rank is mirrored by a decrease in sales, which fell from $415,397 in June to $256,265 in September. Such a drop in both rank and sales might indicate increasing competition or changing consumer preferences in Nevada’s Flower market. On the other hand, the Pre-Roll category tells a different story. Although Twelve Twelve was not in the top 30 brands in June, by September they had climbed to 32nd place, suggesting a positive momentum and perhaps a growing demand for their Pre-Roll products.

The performance of Twelve Twelve across these categories highlights significant movements that can influence strategic decisions. The decline in the Flower category could be seen as a concern, especially as they have slipped out of the top 20. Conversely, the upward trajectory in the Pre-Roll category, moving from outside the top 30 to 32nd place, suggests potential for growth and a possible area for increased focus and investment. These shifts in rankings and sales figures provide a snapshot of Twelve Twelve's current market positioning and may guide future business strategies in Nevada. Understanding these dynamics is crucial for stakeholders looking to capitalize on emerging trends and mitigate risks in this competitive landscape.

Competitive Landscape

In the competitive landscape of the Nevada Flower category, Twelve Twelve has experienced a notable decline in its market position over the past few months. Starting from a rank of 14th in June 2024, Twelve Twelve has slipped to 22nd by September 2024, indicating a downward trend in both rank and sales. This decline is contrasted by the performance of competitors such as Hustler's Ambition, which, despite a dip in September, maintained a stronger presence with a peak rank of 13th in August. Meanwhile, Flower House showed volatility but managed to outperform Twelve Twelve in July with a rank of 12th. Interestingly, BLVD has shown a significant upward trajectory, improving from 74th in June to 24th in September, suggesting a potential emerging threat. These shifts highlight the competitive pressures Twelve Twelve faces, emphasizing the need for strategic adjustments to regain its footing in the Nevada Flower market.

Notable Products

In September 2024, the top-performing product for Twelve Twelve was Mango Milk (3.5g) in the Flower category, reclaiming its number one position with sales of 1916 units. White Lemons Pre-Roll (1g) emerged as a strong contender, securing the second rank with notable sales figures. Jenny Kush Pre-Roll (1g) climbed to the third position, showing a significant increase from its previous rank of fourth in August. Jenny Kush (3.5g) experienced a drop, falling to fourth place after leading in previous months. Hasta Manana (3.5g) rounded out the top five, showing a steady decline in rank since July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.