Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

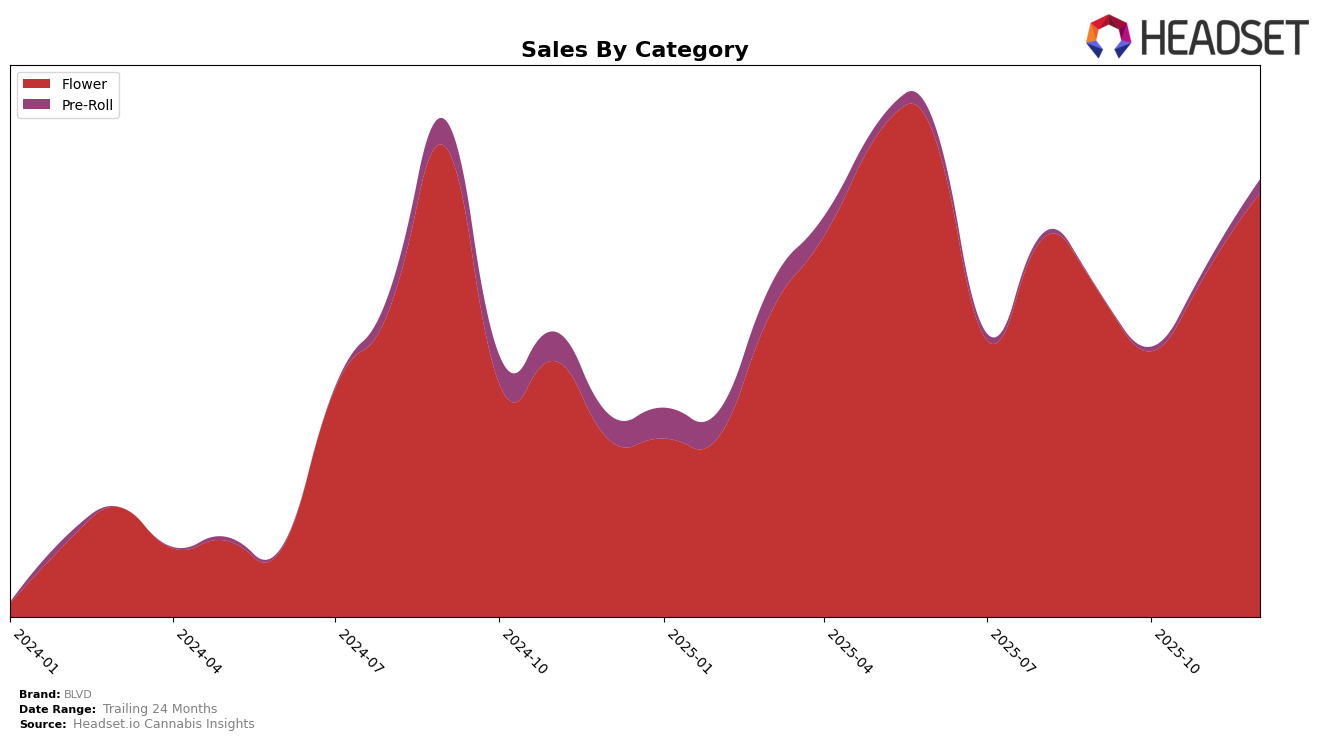

BLVD's performance in the Nevada market shows a fluctuating but generally positive trend in the Flower category. Despite dropping to 31st place in October 2025, the brand managed to climb back to 27th by December 2025, indicating a recovery in their market position. This rebound is supported by a notable increase in sales from October to December, suggesting a successful strategy to regain consumer interest. However, the Pre-Roll category tells a different story, as BLVD did not appear in the top 30 rankings for most of the year, only surfacing in 58th place by December. This absence from the top rankings could be a point of concern as it highlights potential challenges in gaining traction in this category.

While the Flower category in Nevada shows promise with a positive trajectory, BLVD's struggle to break into the top 30 in the Pre-Roll category could imply a need for strategic adjustments. The brand's ability to reverse a downward trend in Flower sales and climb back in the rankings is a testament to their resilience and adaptability in a competitive market. However, the contrasting performance in Pre-Rolls suggests that BLVD might need to reassess their product offerings or marketing strategies to capture a larger share of this segment. The data indicates potential areas for growth and improvement, offering a nuanced view of BLVD's market dynamics in Nevada.

Competitive Landscape

In the competitive landscape of the Nevada flower category, BLVD has experienced a fluctuating rank trajectory from September to December 2025. Starting at rank 26 in September, BLVD saw a dip to 31 in October, before recovering slightly to 29 in November and improving further to 27 by December. This period of volatility is set against the backdrop of competitors like GB Sciences, which showed a more consistent upward trend, moving from rank 33 in September to 29 in December, and Super Good, which made significant gains from rank 36 in September to 25 in December. Meanwhile, Lavi experienced a notable decline from rank 8 in September to 26 in December, indicating potential market share opportunities for BLVD. Despite these fluctuations, BLVD's sales showed a positive trend, particularly in December, suggesting a potential for further rank improvement if this momentum continues.

Notable Products

In December 2025, the top-performing product for BLVD was 702 Headband (3.5g) in the Flower category, maintaining its number one ranking from the previous months with a notable sales figure of 3603 units. Cap Junkie (3.5g), also in the Flower category, held steady at the second position, although its sales saw a decrease compared to September 2025. Naked City Gushers (3.5g) retained its third position in the Flower category, showing consistent improvement in sales over the months. Greyhound (3.5g) remained at fourth place, with sales stabilizing in December. A new entry, Greyhound Pre-Roll (1g), debuted at fifth place in the Pre-Roll category, indicating a positive reception in its initial month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.