Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

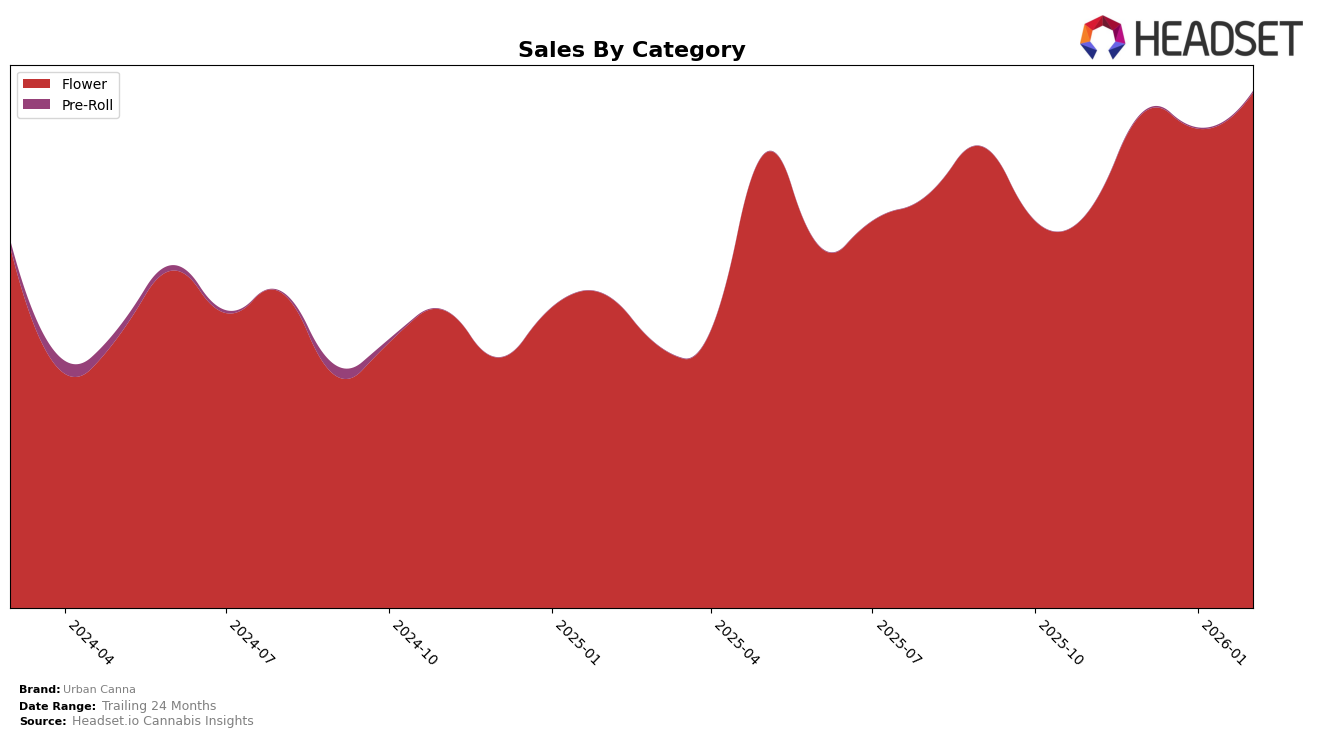

Urban Canna has shown a consistent performance in the Flower category in Oregon. Over the past few months, the brand has maintained a strong presence, with rankings fluctuating slightly between the 4th and 6th positions. Notably, December 2025 saw Urban Canna climb to the 4th position, indicating a significant uptick in consumer preference during the holiday season. Despite a slight dip in January 2026 to the 5th position, the brand rebounded with increased sales in February 2026, suggesting a resilient market strategy and customer loyalty.

While Urban Canna's consistent ranking in Oregon's Flower category is commendable, the absence of the brand in the top 30 across other states or provinces could be seen as a limitation to their market reach. This highlights an opportunity for Urban Canna to potentially expand its footprint beyond Oregon, tapping into new markets to boost its overall brand presence. The brand's ability to maintain a top position in a single state suggests strong local brand equity, but diversification could be key to future growth. This regional focus might be a strategic decision, or it could indicate untapped potential in other markets.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Urban Canna has demonstrated resilience and adaptability, maintaining a strong presence despite fluctuations in the market. Over the past few months, Urban Canna's rank has varied, peaking at 4th place in December 2025 and settling at 6th in February 2026. This performance is noteworthy given the competitive pressure from brands like Bald Peak, which consistently held a top position, albeit dropping from 2nd to 4th in February 2026. Meanwhile, Otis Garden has seen a more volatile trajectory, dropping to 8th in January 2026 before recovering to 5th in February. Urban Canna's sales have shown a positive trend, increasing from December 2025 to February 2026, which contrasts with the sales dip experienced by High Tech in December. The steady improvement in Urban Canna's sales suggests a robust market strategy that could further solidify its position amidst fierce competition.

Notable Products

In February 2026, Blue Inferno (Bulk) emerged as the top-performing product for Urban Canna, securing the number one rank with sales reaching 3293 units. Gelato Cake (1g) followed closely in second place, experiencing a notable rise from its fourth position in December 2025. Dirty Bananas (1g), which was previously ranked first in November 2025, settled into the third spot. Motor OG (Bulk) dropped from its top position in December 2025 to fourth place. Flavor Flav OG (1g) entered the top five rankings for the first time, coming in at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.