Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

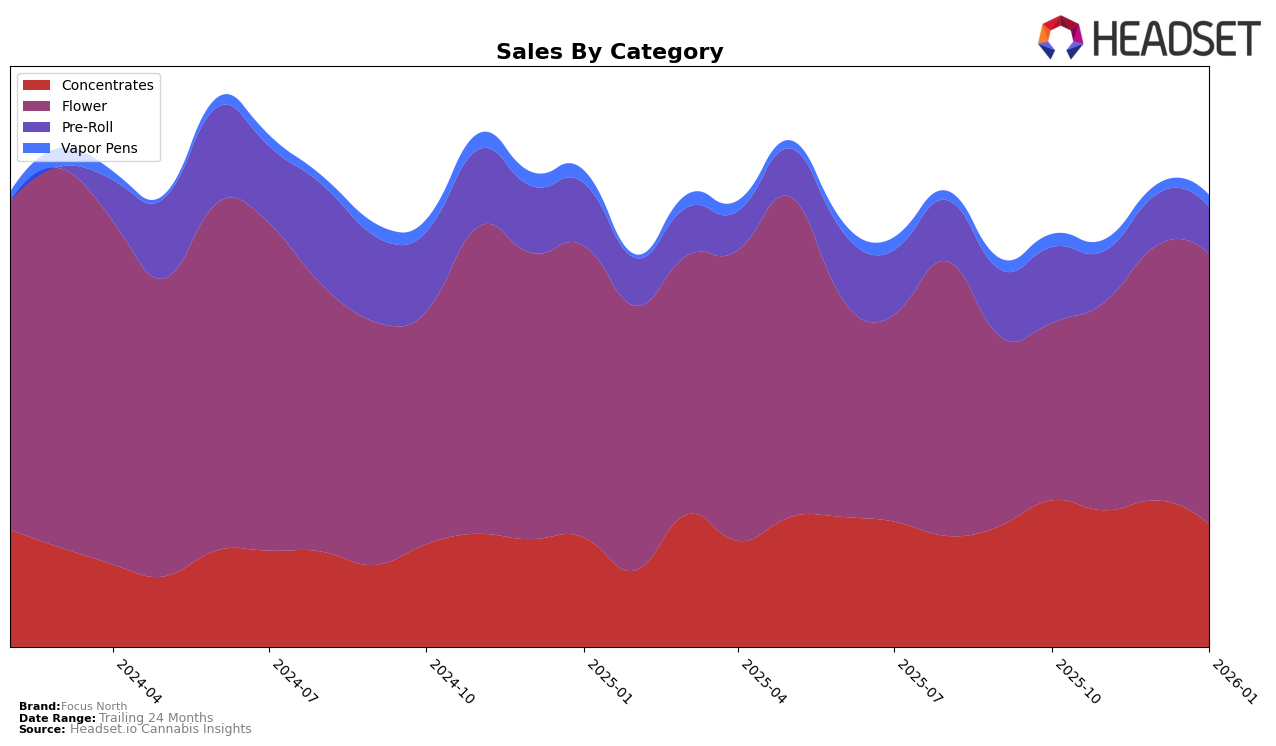

Focus North has demonstrated a varied performance across different product categories in Oregon. In the Concentrates category, the brand experienced a slight decline in rankings from October 2025 to January 2026, moving from 10th to 13th position. Despite this, their sales figures remained relatively robust, indicating a stable customer base. On the other hand, Focus North's presence in the Flower category has been significantly positive, with an impressive upward trajectory from 29th place in October 2025 to 13th place by January 2026, accompanied by a steady increase in sales. This suggests a growing preference among consumers for their Flower products.

However, the performance in other categories paints a different picture. In the Pre-Roll category, Focus North failed to break into the top 30 rankings, peaking at 36th place in October 2025 and dropping further in subsequent months. This indicates a potential area for improvement or increased competition within this segment. Similarly, the brand's Vapor Pens category did not make it into the top 30, with rankings fluctuating between 70th and 78th place. The sales figures for Vapor Pens saw minor variations, reflecting a relatively stagnant market presence. These trends highlight the brand's need to focus on strategic enhancements in these categories to bolster their overall market performance in Oregon.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Focus North has demonstrated a notable upward trajectory in rankings from October 2025 to January 2026, moving from 29th to 13th place. This improvement is indicative of a strategic positioning that has allowed Focus North to gain ground against competitors such as Eugreen Farms, which experienced a slight decline from 7th to 12th place over the same period. Meanwhile, Deep Creek Gardens maintained a steady presence, hovering around the 11th position, suggesting a stable market share. The most dramatic rise was seen by Mother Magnolia Medicinals, which surged from 67th to 15th, indicating a significant increase in sales momentum. Focus North's consistent climb in rank, coupled with its sales growth, positions it as a formidable player in the market, with potential to challenge the leading brands if the trend continues.

Notable Products

In January 2026, the top-performing product from Focus North was Colorado Sunshine (Bulk) in the Flower category, maintaining its number one rank from December 2025 with sales reaching 1,595 units. Wedding Pie (Bulk) emerged as the second top seller, a new entry in the rankings with notable sales of 1,012 units. Pot Roast (Bulk) climbed to the third position from fourth in December, showing a consistent upward trend. Trop Fire Breath (Bulk) also made its debut in the rankings at fourth place, followed by Canal St. Runtz (Bulk) at fifth. The rankings indicate a strong performance for bulk Flower products, with Colorado Sunshine sustaining its lead over consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.