Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

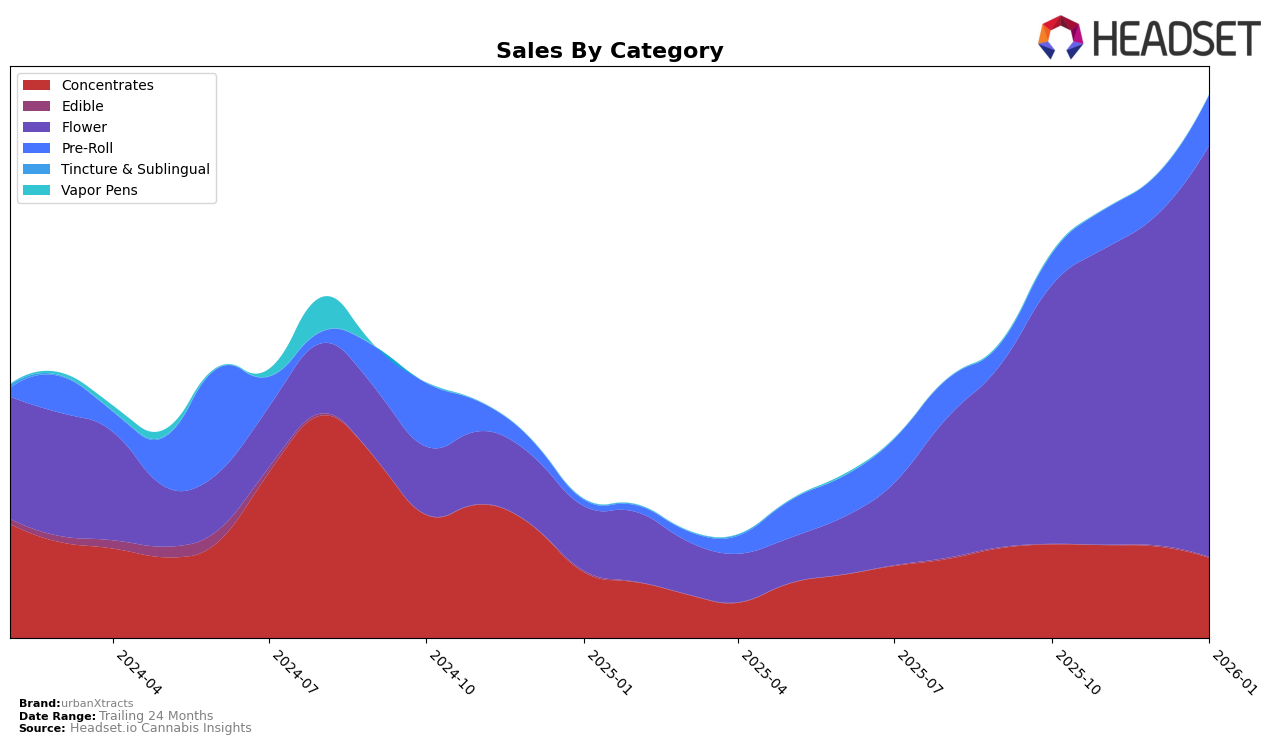

UrbanXtracts has shown a steady presence in the New York concentrates market, maintaining a consistent rank of 21st in October and November 2025, before slightly dropping to 23rd in December 2025 and January 2026. This indicates a minor decrease in their standing within this category, which could be attributed to various market dynamics or increased competition. Despite this, urbanXtracts has managed to sustain a stable sales volume, with only a modest decline over the months. This stability in sales, despite the drop in ranking, suggests that their customer base remains loyal, albeit with a need for strategies to enhance their market position.

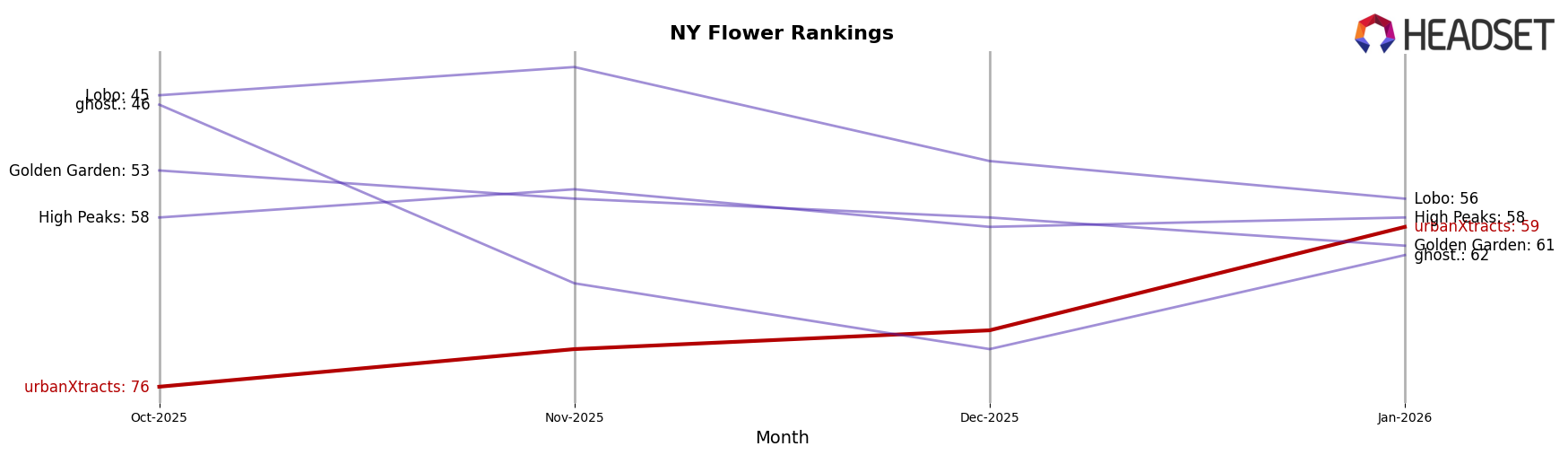

In contrast, urbanXtracts' performance in the New York flower category has been on an upward trajectory. Starting from a 76th place ranking in October 2025, the brand has climbed to 59th by January 2026. This upward movement is accompanied by a notable increase in sales, particularly in January 2026. The improvement in ranking and sales indicates a growing market presence and potentially successful product offerings or marketing strategies in this category. However, it is worth noting that urbanXtracts was not in the top 30 brands in any other states or provinces, highlighting a potential area for growth and expansion beyond New York.

Competitive Landscape

In the competitive landscape of the New York flower category, urbanXtracts has shown a promising upward trajectory in recent months. Starting from a rank of 76 in October 2025, urbanXtracts climbed to 59 by January 2026, reflecting a significant improvement in its market position. This positive trend is underscored by a steady increase in sales, which rose from October's figures to January's, indicating growing consumer preference and brand recognition. In contrast, competitors such as Lobo and ghost. experienced a decline in their rankings, with Lobo dropping from 45 to 56 and ghost. fluctuating but ultimately falling from 46 to 62 over the same period. Meanwhile, High Peaks and Golden Garden maintained relatively stable positions, with minor rank changes. This competitive shift highlights urbanXtracts' growing influence in the New York market, positioning it as a strong contender against established brands.

Notable Products

In January 2026, the top-performing product for urbanXtracts was Singapore Sling Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 1041 units. Nana Glue Pre-Roll (1g) maintained its second-place position from December 2025, showing a consistent performance with 841 units sold. Platinum Kush Breath (14g) in the Flower category climbed to the third rank, marking its debut in the top three. Singapore Sling (14g) dropped one position to fourth, despite a slight decrease in sales to 647 units. Nana Glue (3.5g) remained stable at fifth place, continuing its steady performance from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.