Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

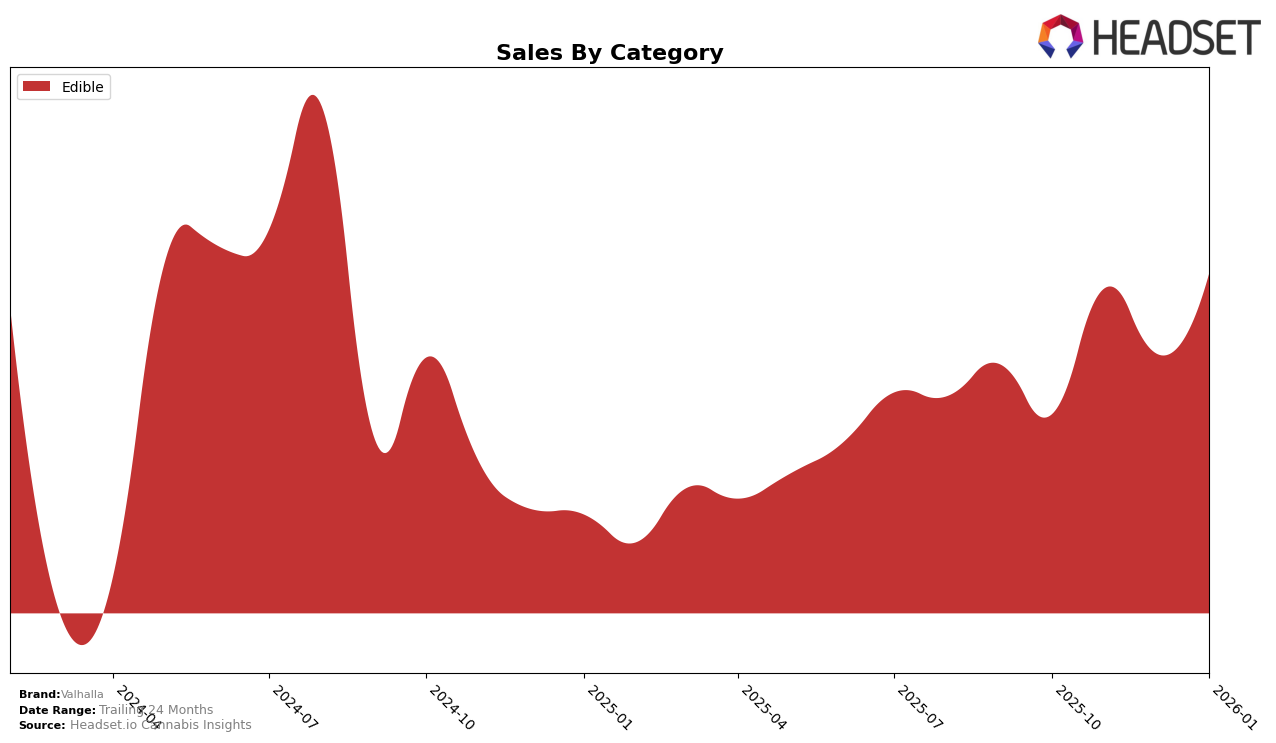

Valhalla's performance in the edibles category across different states has shown varied results, highlighting both strengths and areas for improvement. In Maryland, Valhalla maintained a consistent presence in the top 30 rankings, but experienced some fluctuations. Starting at rank 26 in October 2025, they improved slightly to rank 23 in November, only to see a dip back to rank 27 by January 2026. This suggests a volatile market presence in Maryland, potentially indicating challenges in maintaining consumer interest or facing stiff competition. The sales figures reflect this inconsistency, with a significant drop from December 2025 to January 2026, which could be a point of concern for the brand's strategy in this state.

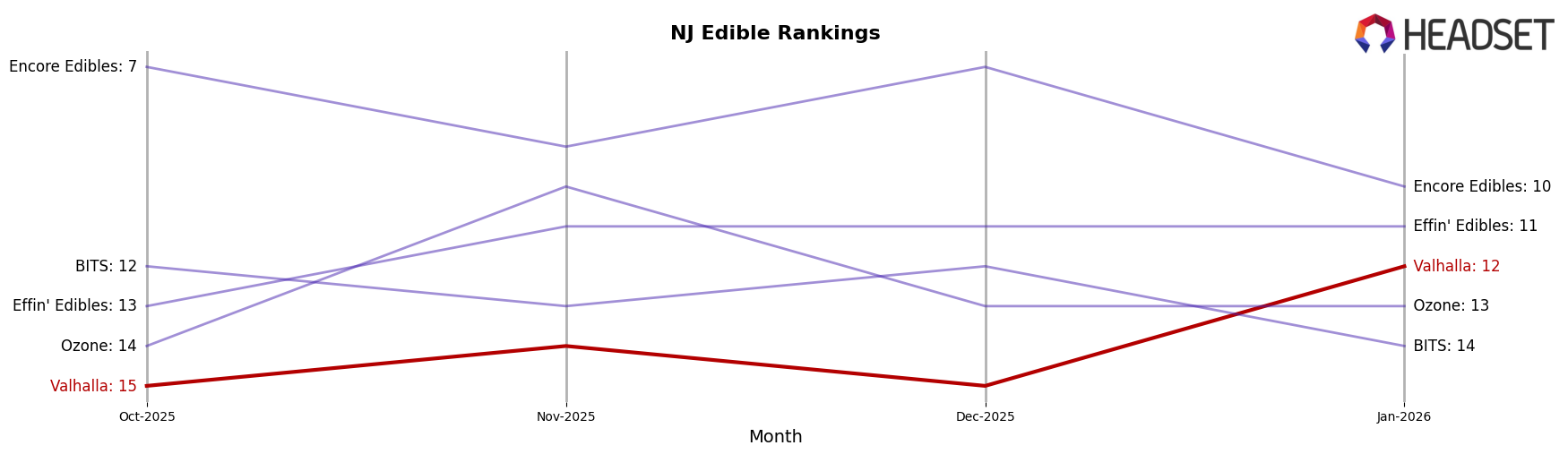

Meanwhile, in New Jersey, Valhalla demonstrated more stable and promising performance. The brand consistently ranked within the top 15, showing a notable improvement by reaching rank 12 in January 2026. This upward trend in New Jersey is complemented by a substantial increase in sales during the same period, suggesting a successful market penetration and possibly effective marketing strategies that resonated with consumers. The contrasting performances in Maryland and New Jersey highlight the importance of state-specific strategies and the potential for growth in markets where Valhalla is able to strengthen its brand presence and consumer engagement.

Competitive Landscape

In the competitive landscape of the New Jersey edible cannabis market, Valhalla has shown a promising upward trend in its ranking, climbing from 15th place in October 2025 to 12th place by January 2026. This improvement in rank is indicative of a significant increase in sales, particularly noticeable in January 2026, where Valhalla's sales surged compared to previous months. Despite this positive trajectory, Valhalla faces stiff competition from brands like Encore Edibles, which, although experiencing fluctuations, consistently ranks higher, peaking at 7th place in both October and December 2025. Meanwhile, Ozone and BITS have shown varying performances, with Ozone maintaining a relatively stable position close to Valhalla's, and BITS slightly trailing. Effin' Edibles has consistently outperformed Valhalla, holding a steady 11th rank by January 2026. These dynamics suggest that while Valhalla is gaining momentum, strategic efforts are necessary to surpass its competitors and secure a stronger foothold in the market.

Notable Products

In January 2026, Valhalla's top-performing product was the Indica Blue Raspberry Soft Lozenges 10-Pack (100mg), maintaining its number one rank consistently from October 2025 with a notable sales figure of 3933 units. Following closely, the Sweet Orange Soft Lozenges 10-Pack (100mg) held steady at the second position, having climbed from the fifth rank in the previous months. The Strawberry Lemonade Soft Lozenges 10-Pack (100mg) secured the third position, re-entering the rankings since October 2025. Green Apple Soft Lozenges 10-Pack (100mg) consistently ranked fourth, showing a stable performance. Sour Watermelon Soft Lozenges 10-Pack (100mg) rounded out the top five, having fluctuated between the third and fifth positions over the prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.