Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

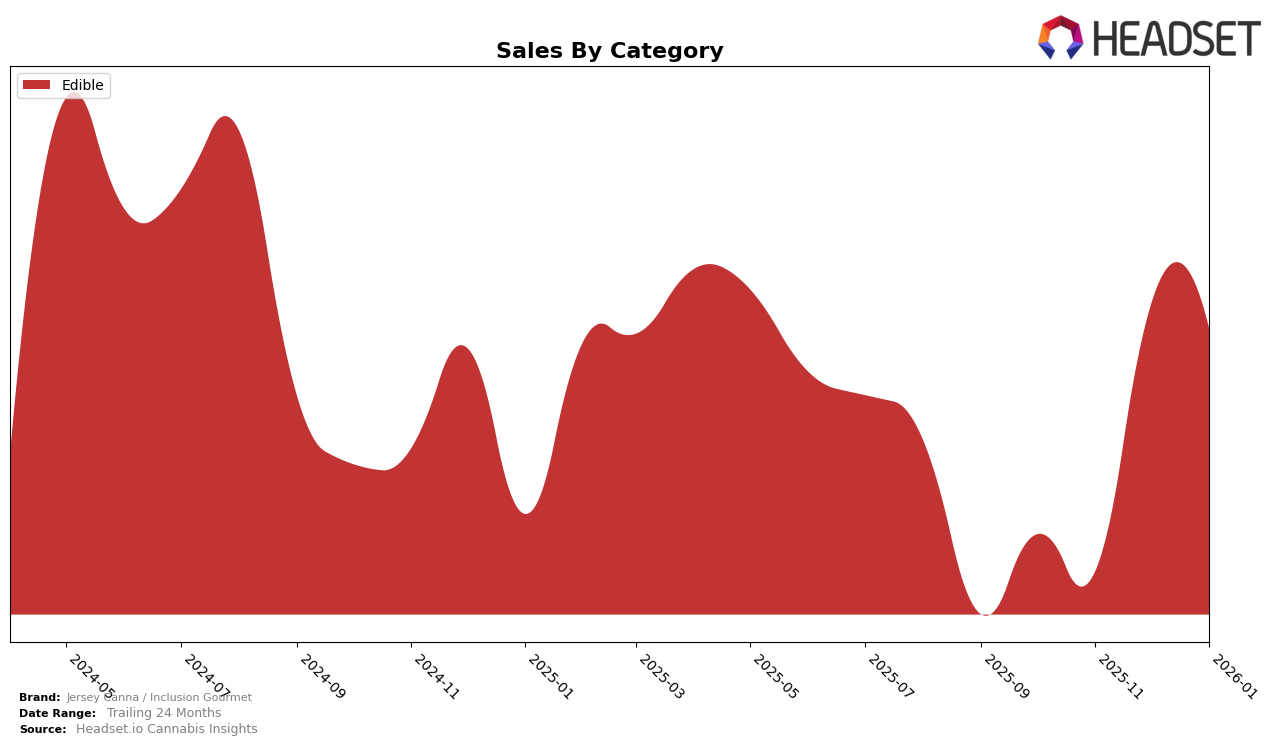

Jersey Canna / Inclusion Gourmet has shown notable performance in the Edible category in New Jersey over the past few months. After not making it into the top 30 brands in October and November 2025, the brand made a significant leap to rank 25th in December 2025 and maintained this position in January 2026. This upward movement in the rankings coincides with a substantial increase in sales from November to December, indicating a successful strategy in capturing consumer interest during this period. The consistency in maintaining their position in January suggests they have managed to hold onto their market share effectively.

Despite not being in the top 30 in earlier months, the brand's ability to break into the rankings in December highlights a positive trend and potential for further growth. The increase in sales from November to December was quite remarkable, and while specific figures are not disclosed here, this trend suggests that Jersey Canna / Inclusion Gourmet is gaining traction in the New Jersey market. The brand's performance in the Edible category in New Jersey could serve as a foundation for future expansion and improvement in other states or categories. However, it remains to be seen if they can continue this momentum and climb even higher in the rankings or replicate this success in other regions.

Competitive Landscape

In the competitive landscape of the New Jersey edible cannabis market, Jersey Canna / Inclusion Gourmet has shown a notable upward trend in rankings, moving from 35th place in October 2025 to 25th place by December 2025, where it maintained its position into January 2026. This improvement in rank suggests a positive reception and growing consumer preference for their products. In comparison, Verano experienced a decline, dropping from 21st in November 2025 to 27th in January 2026, potentially indicating challenges in maintaining market share. Meanwhile, Zzzonked consistently outperformed Jersey Canna / Inclusion Gourmet, holding a higher rank throughout the period, despite a slight dip from 18th in December 2025 to 24th in January 2026. Breakwater also showed resilience, improving its rank from 38th in October 2025 to 23rd by January 2026, suggesting a competitive edge in the market. These dynamics highlight the competitive pressures and opportunities for Jersey Canna / Inclusion Gourmet to further capitalize on its upward momentum and potentially capture more market share from its competitors.

Notable Products

In January 2026, the top-performing product for Jersey Canna / Inclusion Gourmet was the Cannacubes - Belgian Milk Chocolate Bites 10-Pack (100mg), which climbed to the first position with notable sales of 312 units. The Cannabar - Belgian Milk Chocolate Bar 10-Pack (100mg) held steady in the second position, showing a slight decrease in sales compared to December. The Cannabar - Cookies & Cream Dark Chocolate Bar 10-Pack (100mg) made its debut in the rankings at third place, indicating strong consumer interest. Meanwhile, the Cannabar - Belgium Dark Chocolate Bar 10-Pack (100mg) dropped to fourth place despite a consistent sales pattern over the previous months. Lastly, the Cannabars - Smores Milk Chocolate 10-Pack (100mg) entered the rankings at fifth, showcasing a diverse consumer preference for different chocolate flavors within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.