Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

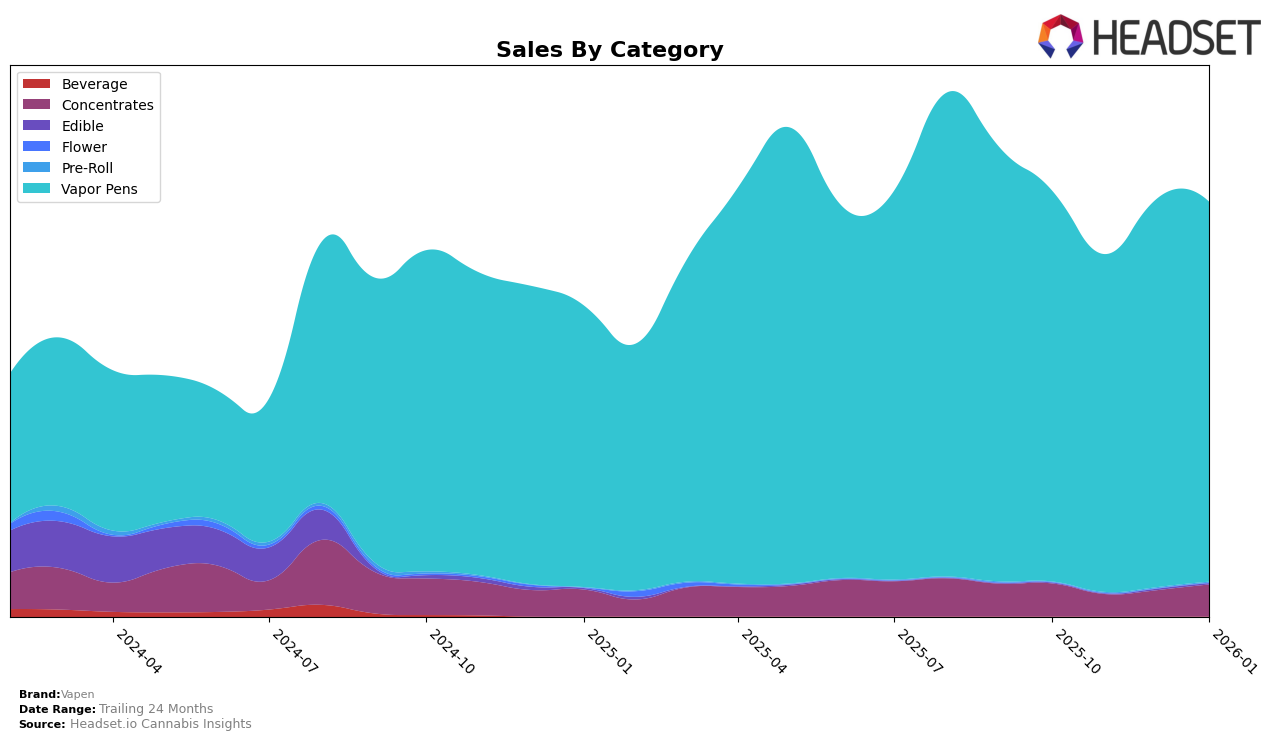

Vapen's performance in the Ohio market shows a notable presence in both the Concentrates and Vapor Pens categories. In the Concentrates category, Vapen experienced fluctuations, moving from a rank of 14 in October 2025 to 19 in November, then improving to 16 in December, and finally climbing to 13 in January 2026. This upward trend towards the end of the period suggests a recovery and potential growing demand in this category. The absence of rankings outside the top 30 in any month indicates consistent performance relative to other brands in the Ohio market.

In the Vapor Pens category, Vapen maintained a strong presence, consistently ranking within the top 11 throughout the months observed, with a peak at rank 8 in January 2026. This stability in ranking suggests a solid foothold in the Vapor Pens market in Ohio. The brand's ability to maintain and improve its position highlights its competitive edge and appeal in this particular category. The data implies that Vapen's strategic efforts in Ohio have been effective, particularly in the Vapor Pens segment, where they have sustained high rankings consistently.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, Vapen has shown a fluctuating yet promising trajectory in terms of rank and sales. Over the four-month period from October 2025 to January 2026, Vapen improved its rank from 10th to 8th, indicating a positive trend despite facing stiff competition. Notably, Rove consistently maintained a higher rank, moving from 8th to 6th, while Select experienced a decline from 5th to 7th, which might have contributed to Vapen's improved standing. Meanwhile, Seed & Strain Cannabis Co. and Buckeye Relief remained close competitors, with ranks fluctuating around Vapen's position. Despite a dip in sales in November 2025, Vapen's recovery in December and January suggests resilience and potential for growth in Ohio's vapor pen market.

Notable Products

In January 2026, the top-performing product for Vapen was the Maui Wowie Distillate Cartridge (1g) in the Vapor Pens category, reclaiming its number one position from October 2025 with sales reaching 2456 units. The newly introduced Grape Galaxy Distillate Cartridge (0.5g) made a significant impact by securing the second rank in its debut month. Granddaddy Purple Distillate Cartridge (1g) maintained a strong presence, ranking third, albeit dropping from its second-place position in November 2025. Peach Rings Distillate Cartridge (1g), which was the top product in December 2025, fell to fourth place. The OG Kush Distillate Cartridge (0.5g) remained steady at fifth place for two consecutive months, indicating stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.