Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

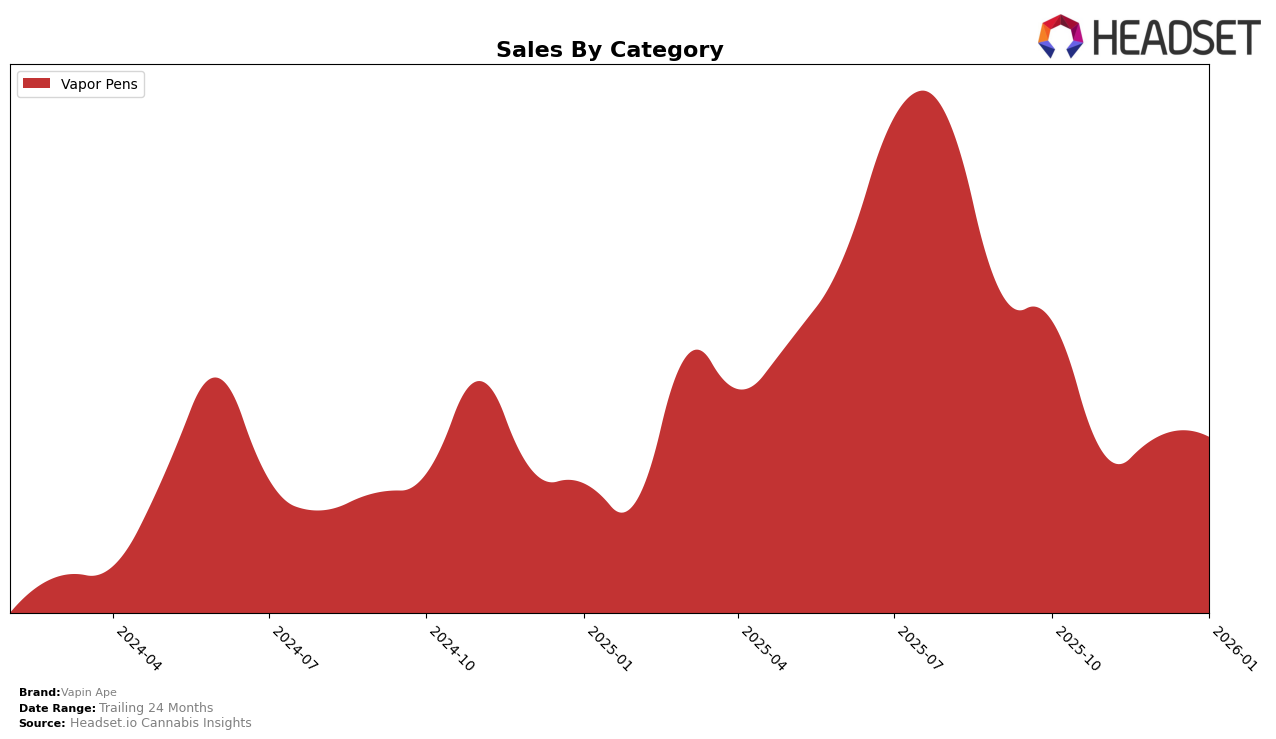

In the Illinois market, Vapin Ape has maintained a consistent presence in the Vapor Pens category, although their performance has seen some fluctuations. Starting in October 2025, the brand held the 20th position, but by November, it had slipped to 23rd, maintaining this rank through December before slightly improving to 22nd in January 2026. This indicates a modest recovery but suggests challenges in maintaining a stable upward trajectory. The sales figures reflect these ranking shifts, with a noticeable dip in November followed by a partial recovery in December and a slight decline in January. This volatility suggests that while Vapin Ape remains a player in the Illinois market, it faces competitive pressures that impact its rankings.

Meanwhile, in the Michigan market, Vapin Ape has shown a more dynamic performance in the same category. The brand started strong in October 2025, securing the 14th spot, a rank it maintained in November. However, December saw a drop to 19th, indicating potential challenges or increased competition. By January 2026, Vapin Ape rebounded to 13th, outperforming its October ranking. This positive trajectory in January suggests strategic adjustments or market conditions that favored the brand. While sales figures dipped in December, they rose again in January, highlighting a resilient comeback. Such movements suggest that Vapin Ape is capitalizing on opportunities in Michigan, although the path is not without its hurdles.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Michigan, Vapin Ape has experienced fluctuations in its market position over the past few months. Starting from October 2025, Vapin Ape maintained a rank of 14, but slipped to 19 by December before recovering to 13 in January 2026. This volatility in rank is mirrored by its sales performance, which saw a dip in December but rebounded in January. Notably, Jeeter consistently outperformed Vapin Ape, maintaining higher ranks and sales figures, although its rank dropped from 8 in December to 11 in January. Meanwhile, Pro Gro and Jungle Juice showed similar fluctuations, with Pro Gro's rank improving from 18 in December to 15 in January, and Jungle Juice climbing from 16 to 14 in the same period. Breeze Canna remained relatively stable, holding the 12th position in both December and January. These dynamics suggest that while Vapin Ape is competitive, it faces strong challenges from brands like Jeeter and Breeze Canna, which consistently capture higher market shares, indicating a need for strategic adjustments to enhance its market presence.

Notable Products

In January 2026, the top-performing product from Vapin Ape was the Grape Runtz Plus HTE Distillate Disposable (1g) in the Vapor Pens category, maintaining its first-place rank from December 2025 with sales of 4163 units. The Pineapple Haze HTE Distillate Disposable (1g) held the second position, consistent with its December ranking, despite a slight decrease in sales to 3900 units. Jack Frost Plus FSE Distillate Disposable (1g) entered the rankings for the first time at third place, marking a notable debut. Gelato Dream Plus HTE Distillate Disposable (1g) saw a drop, maintaining its fourth-place position from December but declining in sales to 2802 units. The Black Cherry Kush Full Spectrum Distillate Disposable (2g) reappeared in the rankings at fifth place, down from its November peak, with sales of 2628 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.