Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

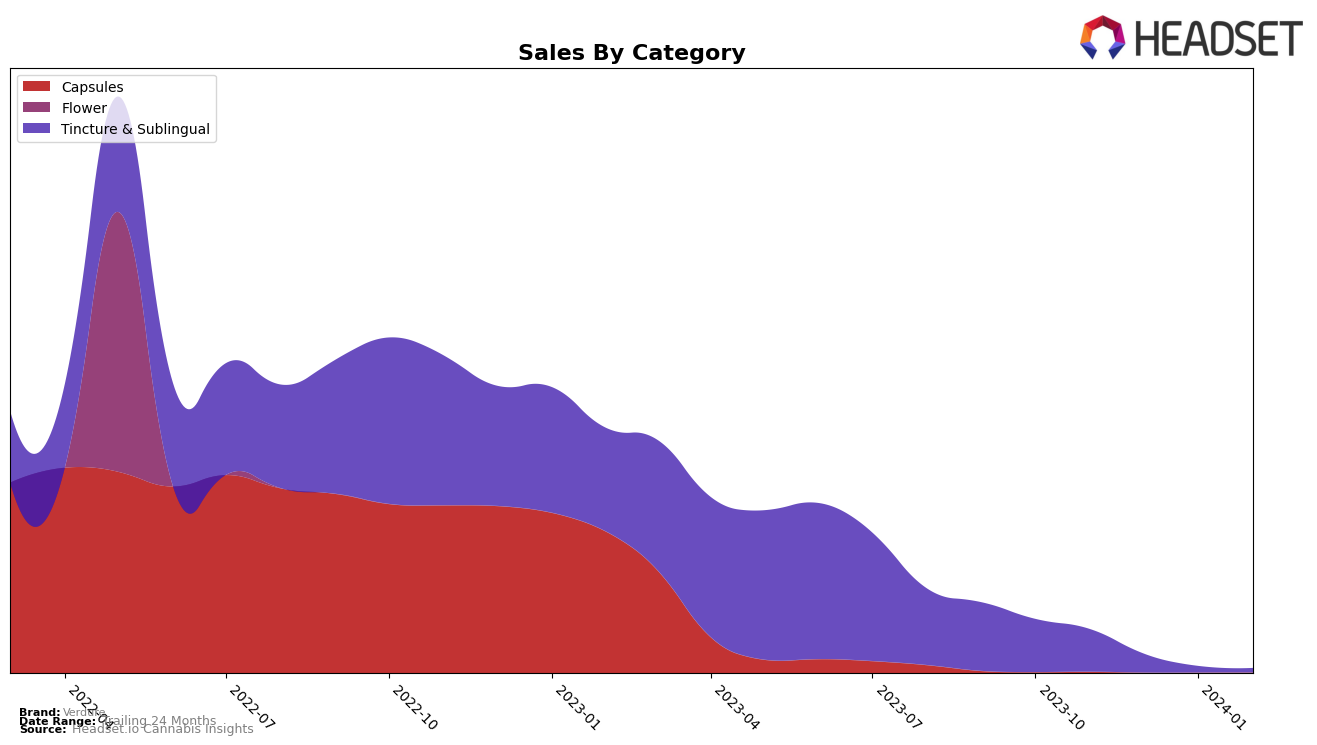

In the competitive landscape of cannabis brands, Verdure has shown varied performance across different states and product categories. For instance, in California, Verdure's Tincture & Sublingual category has seen a significant drop in rankings from November 2023 to February 2024, moving from 23rd to 46th position, coupled with a sharp decline in sales from 13,151 to 836. This trend indicates a challenging market environment for Verdure in California, possibly due to increased competition or changing consumer preferences. Conversely, in Washington, Verdure has maintained a strong presence in the Tincture & Sublingual category, consistently ranking in the top 10 from November 2023 to February 2024, and even improving its position in February. This stability, highlighted by an increase in sales from 450 in November 2023 to 601 in February 2024, suggests a solid foothold and a positive reception amongst Washington consumers.

Looking at other states, Verdure's performance in Massachusetts and again in Washington, but within the Capsules category, paints a picture of a brand with varying degrees of market penetration and consumer acceptance. In Massachusetts, Verdure's Tincture & Sublingual products were ranked 18th in November 2023, with no further rankings available for the subsequent months, indicating a potential exit or significant decrease in visibility within this market segment. This absence from the top 20 rankings could signal a need for strategic reevaluation in Massachusetts. On the other hand, in Washington, Verdure's Capsules category managed to secure a 12th rank in November 2023, showing promise, although no further data is provided to assess whether this position has been maintained or improved. This snapshot suggests that while Verdure faces challenges in some areas, there are clear opportunities for growth and consolidation in others, particularly in categories and states where they have established a strong initial presence.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Verdure has experienced a notable shift in its market position over the recent months. Initially ranked 23rd in November 2023, Verdure saw a gradual decline to 46th by February 2024, indicating a challenging period in terms of rank and sales within this competitive market. Competitors such as Heavy Hitters and Seed & Strain Cannabis Co. have shown significant fluctuations in their rankings as well, with Heavy Hitters peaking at 20th in December 2023 before dropping out of the top 20 rankings, and Seed & Strain Cannabis Co. maintaining a more stable yet lower position. Notably, Heavy Hitters experienced a substantial increase in sales in December 2023, which contrasts with Verdure's sales trajectory that has not mirrored such peaks. This analysis suggests that while Verdure faces stiff competition, the dynamic nature of the market and the varying performance of competitors like Autumn Brands and Opi-Not, who also fluctuate outside the top rankings, presents an opportunity for Verdure to strategize and potentially improve its market standing and sales performance in the evolving Tincture & Sublingual sector in California.

Notable Products

In February 2024, Verdure's top-performing product was the CBD/THC 1:1 Sativa Honey Lemon Tincture, which led the sales chart with a total of 18 units sold. Following closely were the CBD/THC 1:1 Relief Honey Lemon Tincture and the Indica Honey Lemon Tincture, both tying for second place with 14 units sold, but the former maintaining a higher ranking due to its consistent performance in previous months. Notably, the Orange & Lemon Tincture and the Sativa Orange Lemon Tincture also shared the second-place position, indicating a strong preference among consumers for tinctures within the Verdure lineup. The CBD/THC 1:1 Relief Honey Lemon Tincture, which was the top seller in December 2023, saw a slight decrease in its ranking over the months, yet it remained a popular choice. This shift in consumer preference highlights the competitive nature of the tincture category and the variability in product popularity over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.