Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

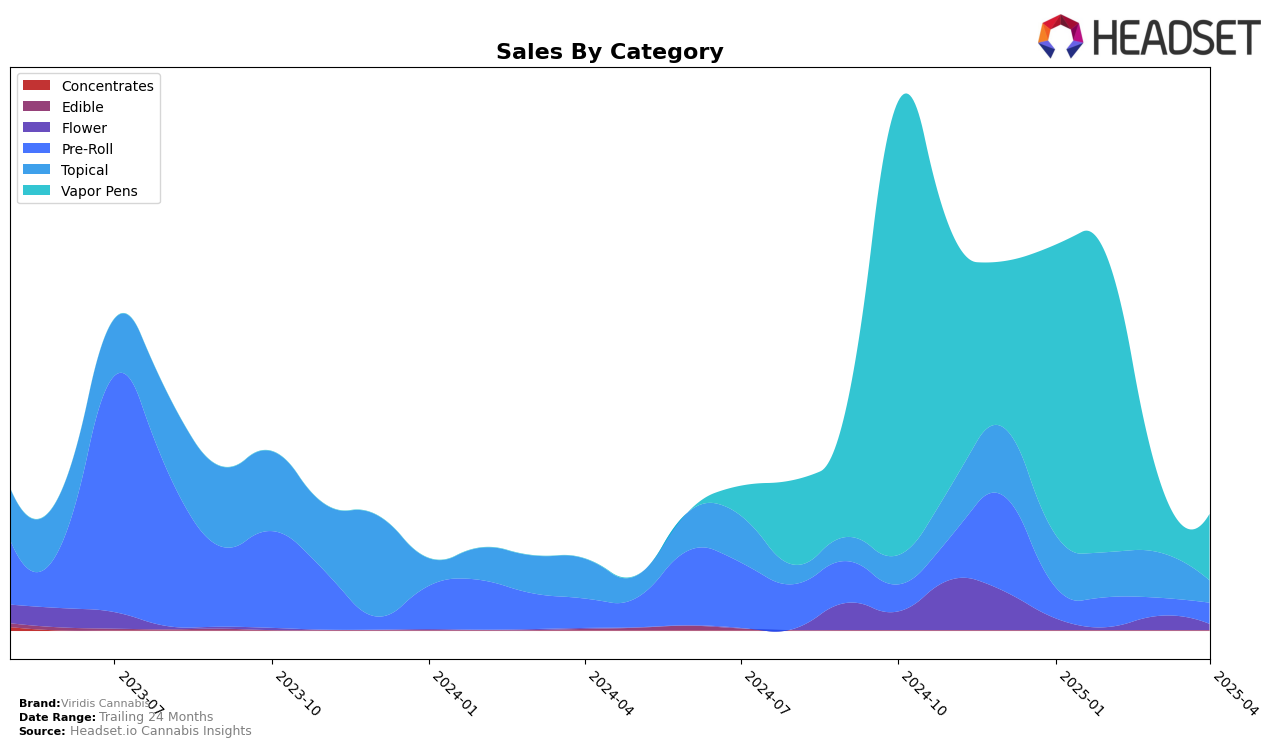

Viridis Cannabis has shown a steady presence in the Vapor Pens category within the Alberta market. Despite not breaking into the top 30 rankings from January to April 2025, the brand has maintained consistent sales figures, with a minor increase from January to February. This stability suggests a loyal customer base, though the absence from the top 30 indicates room for growth in brand visibility and market penetration within the province.

The lack of rankings for March and April could suggest a plateau or potential challenges in maintaining momentum against competitors in the Vapor Pens category in Alberta. While the brand's sales figures in the early months of 2025 show a positive trend, the absence from the top rankings highlights the competitive nature of the market. This scenario presents an opportunity for Viridis Cannabis to strategize on enhancing its market share and potentially explore other categories or states for expansion.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Viridis Cannabis has shown a modest improvement in its market position, moving from 64th to 62nd rank between January and February 2025. This upward trend, albeit slight, indicates a positive reception in a competitive market. Notably, Tweed and FIGR are key competitors, with ranks of 43rd and 46th respectively, suggesting they hold a stronger market presence. Meanwhile, Dab Bods leads with a 38th rank, indicating a significant gap that Viridis Cannabis needs to bridge to compete more effectively. On the other hand, Zest Cannabis trails behind Viridis Cannabis, consistently ranking lower, which might offer a comparative advantage for Viridis if they can capitalize on this momentum. The absence of ranks for March and April suggests Viridis Cannabis did not make it to the top 20, highlighting an opportunity for strategic marketing efforts to boost their visibility and sales in the coming months.

Notable Products

In April 2025, the top-performing product for Viridis Cannabis was the FSE Terpene Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent first-place ranking from January through April, though its sales decreased to 280 units. The Cool Pre-Roll 5-Pack (2.5g) climbed to the second position, showing a steady increase in rank and sales since January. The CBD Zen Citrus Cannabomb Bath Bomb (100mg CBD, 150g) dropped to third place, reflecting a decline in sales compared to previous months. The CBD MoveMint Balm (200mg CBD, 16.2mg THC, 60g) held steady in fourth place, with sales figures remaining relatively low. Lastly, the Grape Pie (14g) in the Flower category entered the rankings in March at fifth place, maintaining this position in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.