Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

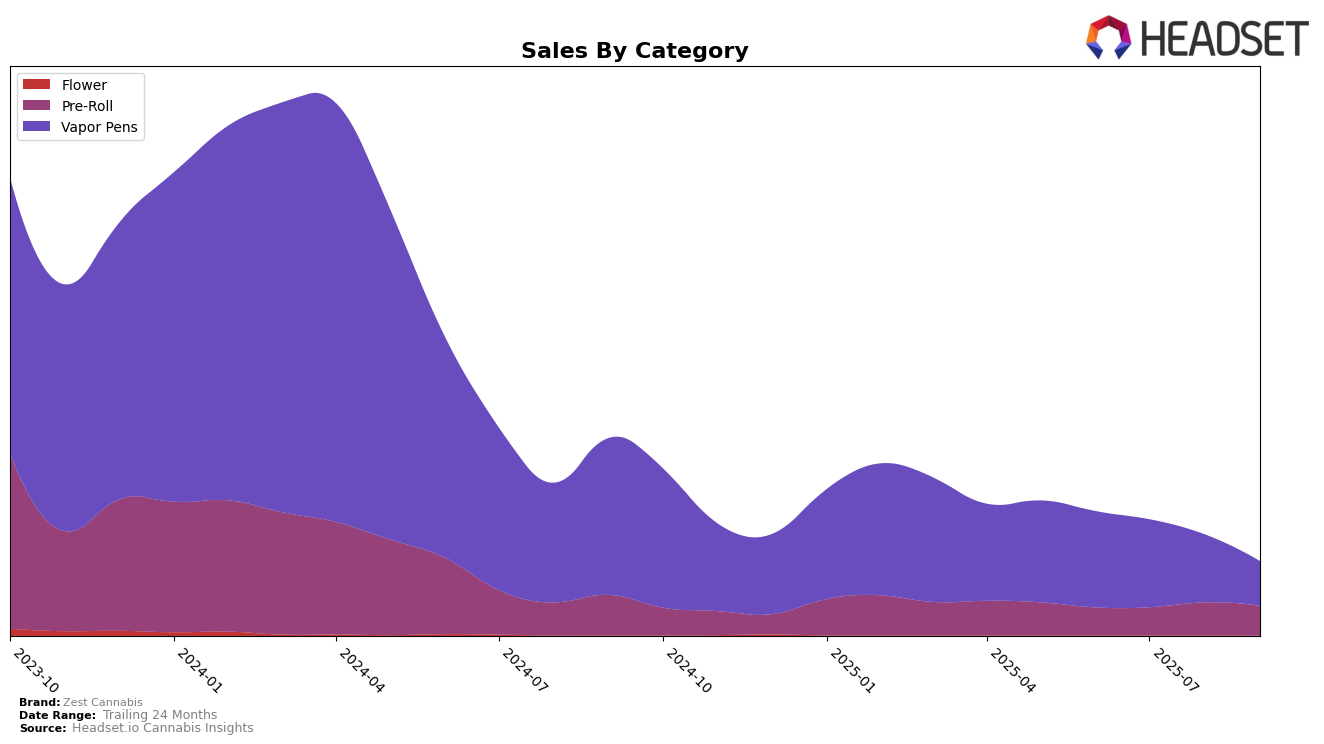

Zest Cannabis has shown varied performance across different states and categories in recent months. In Alberta, the brand's presence in the Vapor Pens category has seen a downward trend, moving from the 47th position in June 2025 to the 55th position by September 2025. This decline in ranking is accompanied by a decrease in sales, which could indicate increasing competition or changing consumer preferences within the region. Meanwhile, in Ontario, Zest Cannabis has struggled to break into the top 30 for Vapor Pens, with its rank falling to 93rd by September 2025. This suggests that the brand faces significant challenges in penetrating the Ontario market effectively.

In Saskatchewan, Zest Cannabis has experienced a more dynamic performance across categories. The brand has maintained a steady presence in the Pre-Roll category, hovering around the 50s in rankings, indicating a stable consumer base. However, in the Vapor Pens category, there has been a noticeable fluctuation, with rankings moving from 22nd in June to 30th in September 2025. Despite the drop, Zest Cannabis remains within the top 30, highlighting its competitive edge in this category in Saskatchewan. This varied performance across categories and states suggests that while Zest Cannabis has established a foothold in certain areas, there are opportunities for growth and improvement in others.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Zest Cannabis has experienced fluctuating rankings over the past few months, with its position shifting from 47th in June 2025 to 55th by September 2025. This decline in rank is notable when compared to competitors such as Western Cannabis and Roilty Concentrates, both of which also saw a downward trend, but started from higher ranks. For instance, Western Cannabis, despite a drop, maintained a higher rank than Zest Cannabis throughout the period, while Roilty Concentrates fell from 39th to 60th, indicating a more significant decline. Meanwhile, Potluck showed a recovery by September, moving back into the top 50. These dynamics suggest that while Zest Cannabis faces challenges in maintaining its competitive position, there is room for strategic adjustments to regain market share, especially as other brands also navigate similar fluctuations.

Notable Products

In September 2025, the top-performing product for Zest Cannabis was Cherry Blast Shatter Liquid Diamond Cartridge in the Vapor Pens category, maintaining its first-place ranking from August, with a notable sales figure of 788 units. The Pink Lemon Shatter Infused Pre-Roll 5-Pack climbed to second place, improving from its third-place position in August. Pink Lemon Liquid Diamond Cartridge experienced a drop, moving from second to third place in the Vapor Pens category. Blue Sour Berry Liquid Diamond Cartridge held steady in fourth place, showing consistent performance despite a significant drop in sales since July. Lastly, Pomegranate Kush Infused Pre-Roll 6-Pack re-entered the rankings at fifth place, marking its first appearance since July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.