Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

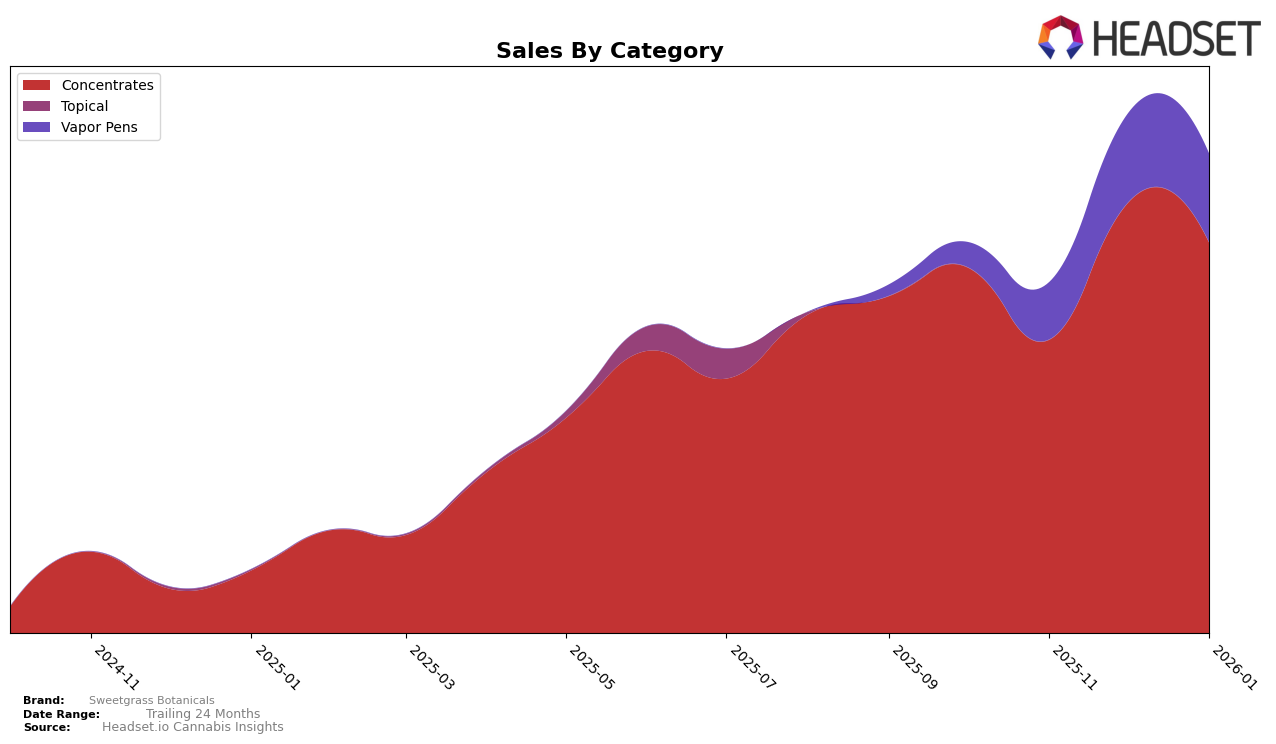

Sweetgrass Botanicals has experienced notable fluctuations in its performance across different product categories in Massachusetts. In the Concentrates category, the brand showed a dynamic presence, with rankings shifting from 15th in October 2025 to 18th in November 2025, and then climbing to 12th in December 2025, before settling back to 15th in January 2026. This movement suggests a competitive market landscape where Sweetgrass Botanicals is able to regain ground after a slight dip. The sales figures reflect this volatility, with a noticeable peak in December, indicating a successful month for the brand despite the overall fluctuations in ranking.

In contrast, the Vapor Pens category presents a different story for Sweetgrass Botanicals. The brand was not ranked in the top 30 from October to December 2025, which could be seen as a challenge in gaining traction in this category. However, by January 2026, the brand made a significant leap, achieving a rank of 98th. This movement, while still outside the top 30, indicates a potential upward trajectory or a strategic shift that may have begun to pay off. The sales data for January 2026 in Vapor Pens, although modest, suggests initial success in penetrating this competitive segment. Such insights highlight the brand's varied performance across categories and underline the importance of strategic adjustments in different markets.

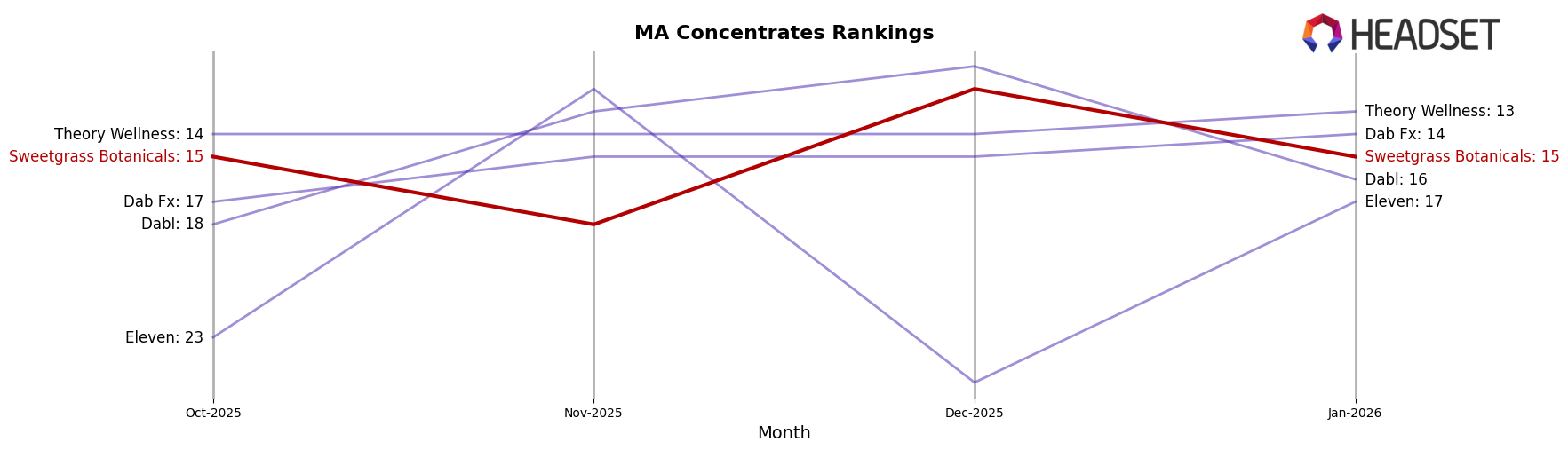

Competitive Landscape

In the Massachusetts concentrates market, Sweetgrass Botanicals has experienced fluctuating rankings over the past few months, indicating a competitive landscape. In October 2025, Sweetgrass Botanicals held a rank of 15, but saw a decline to 18 in November, before rebounding to 12 in December, and then dropping back to 15 in January 2026. This volatility highlights the competitive pressure from brands like Theory Wellness, which consistently maintained a rank around 14, and Dabl, which showed significant improvement, moving from 18 in October to 11 in December, although it slipped to 16 in January. Additionally, Dab Fx displayed steady performance, hovering around the 14-15 rank range. The sales trends reflect these rankings, with Sweetgrass Botanicals experiencing a notable sales increase in December, aligning with its peak rank of 12, but facing a decline in January. This competitive environment suggests that Sweetgrass Botanicals needs to strategize effectively to maintain and improve its market position amidst strong contenders.

Notable Products

In January 2026, Gelato Punch Live Rosin (1g) emerged as the top-performing product for Sweetgrass Botanicals, reclaiming its number one rank from October 2025, with notable sales of 162 units. Alien Marker Live Hash Rosin (1g) slipped to second place after previously holding the top spot in December 2025. Lions Breath Live Hash Rosin (1g) maintained its third-place position from December, indicating consistent performance. Superboof Live Rosin (1g) re-entered the rankings at third place, showing a resurgence from its absence in December 2025. Super Papaya Splash Live Rosin Cartridge (0.5g) debuted in the rankings at fourth place, highlighting its growing popularity in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.