Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

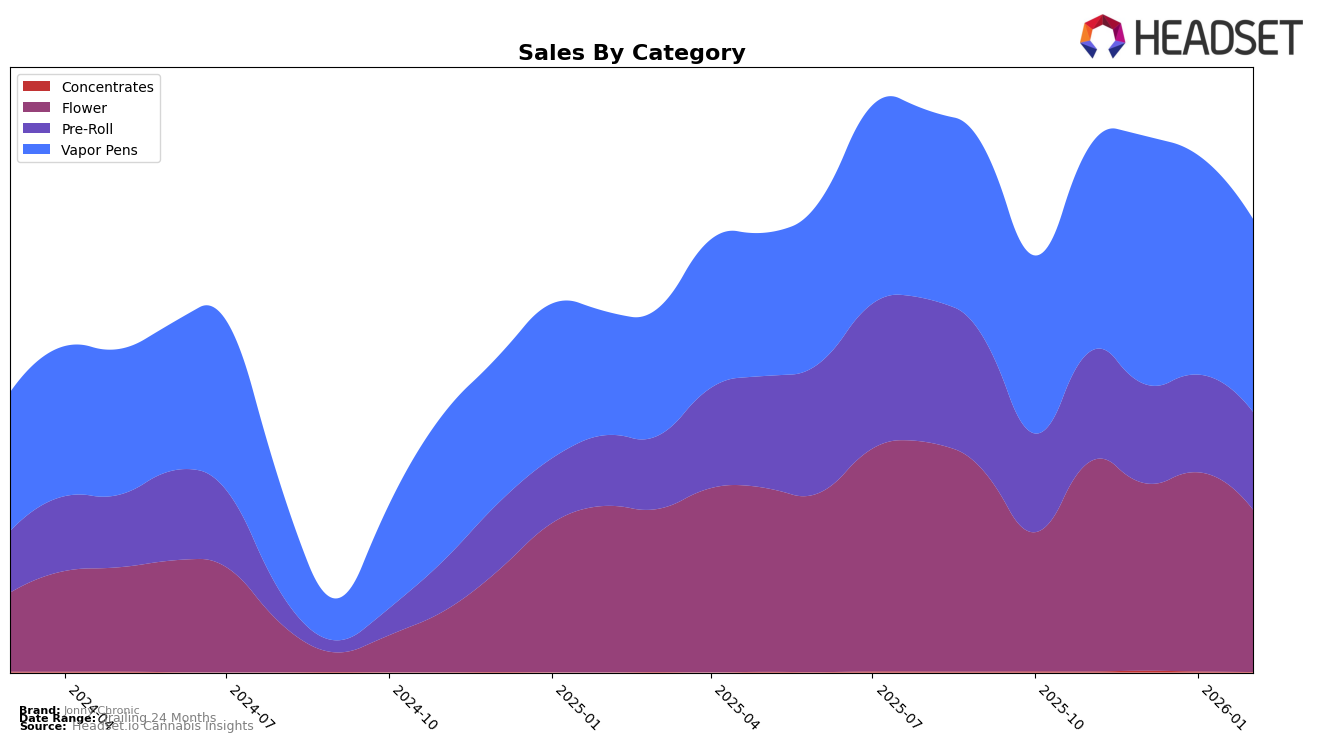

Jonny Chronic's performance across various provinces in Canada reveals a mixed bag of results, particularly in the Flower category. In Alberta, Jonny Chronic's Flower products fell out of the top 30 rankings by January 2026, a notable decline considering they were ranked 34th in December 2025. However, in British Columbia, the Flower category maintained a solid performance, consistently ranking around the 12th to 14th positions over the months. Meanwhile, in Ontario, the Flower products saw a slight dip in rankings, dropping from 22nd to 26th by February 2026, indicating potential challenges in maintaining market share.

The Pre-Roll and Vapor Pen categories present a different narrative for Jonny Chronic. In the Pre-Roll category, the brand experienced fluctuations but generally remained outside the top 30 in British Columbia, with rankings hovering around the mid-40s. Contrastingly, their Vapor Pen products showed strong performance, particularly in Ontario, where they improved to 12th place by February 2026. However, in Saskatchewan, Vapor Pens dropped out of the top 30 by February 2026, indicating a loss in momentum. These trends suggest that while Jonny Chronic has pockets of strength, particularly in Vapor Pens, there are areas that require strategic attention to regain competitive positioning, especially in the Pre-Roll category across certain provinces.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Jonny Chronic has shown a promising upward trend in its rankings over the past few months. Starting from the 13th position in November 2025, Jonny Chronic experienced a slight dip to 15th in December, but quickly rebounded to 14th in January 2026, and further climbed to 12th by February. This upward trajectory is noteworthy, especially in comparison to competitors like Purple Hills, which consistently trailed behind Jonny Chronic, peaking at 14th in February. Meanwhile, Weed Me and Versus maintained stronger positions, with Versus consistently ranking in the top 10, indicating a competitive edge in sales volume. Despite this, Jonny Chronic's ability to improve its rank amidst such strong competition suggests a growing consumer preference and potential for increased market share in the Ontario vapor pen category.

Notable Products

In February 2026, the top-performing product for Jonny Chronic was the Blue Dream Liquid Diamonds Cartridge (1g) in the Vapor Pens category, securing the first rank with sales of 7720 units. The Northern Lights Pre-Roll 3-Pack (1.5g) climbed to the second position, showing a notable improvement from its consistent fifth-place ranking in the preceding months. Cherry Bomb Reefers Pre-Roll 3-Pack (1.5g), which had maintained the top rank from November 2025 to January 2026, slipped to third place. The Acapulco Gold Live Resin Cartridge (1g) held its position within the top five, ranking fourth in February. Lastly, the Cherry Bomb Pre-Roll 10-Pack (5g) reentered the rankings at fifth place, maintaining its presence in the competitive pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.