Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

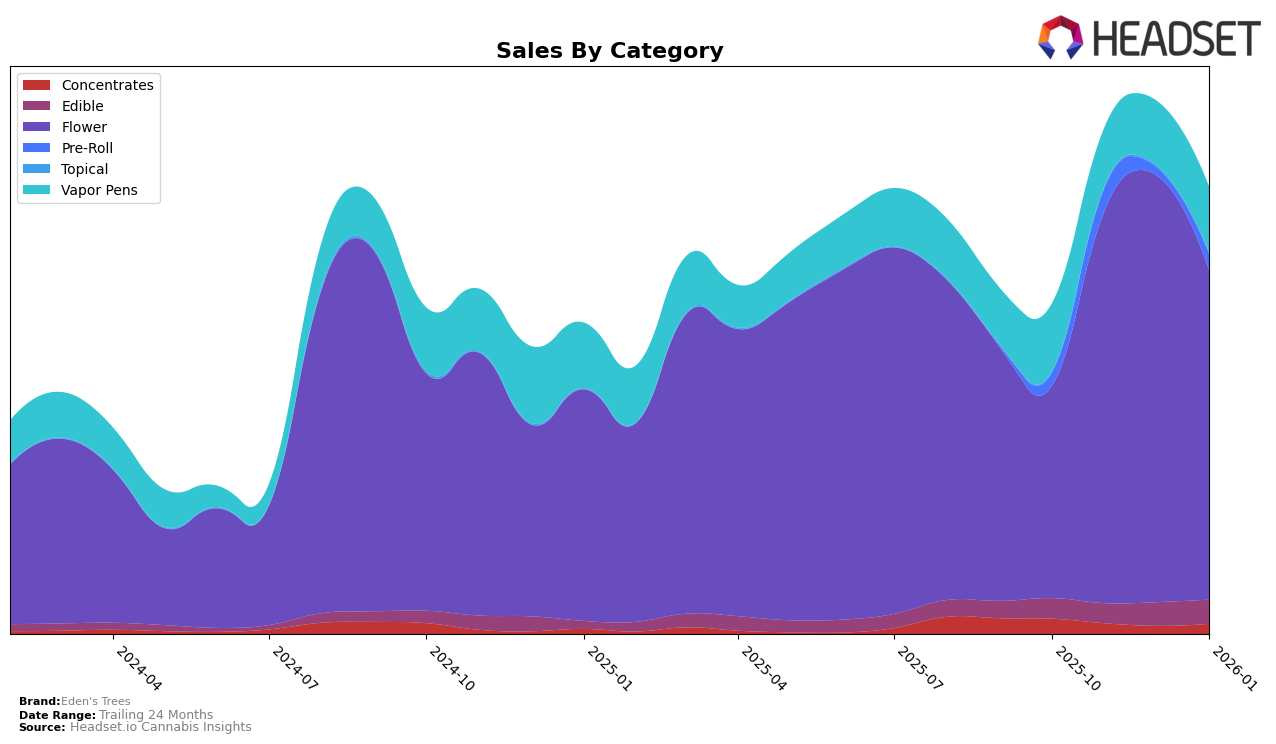

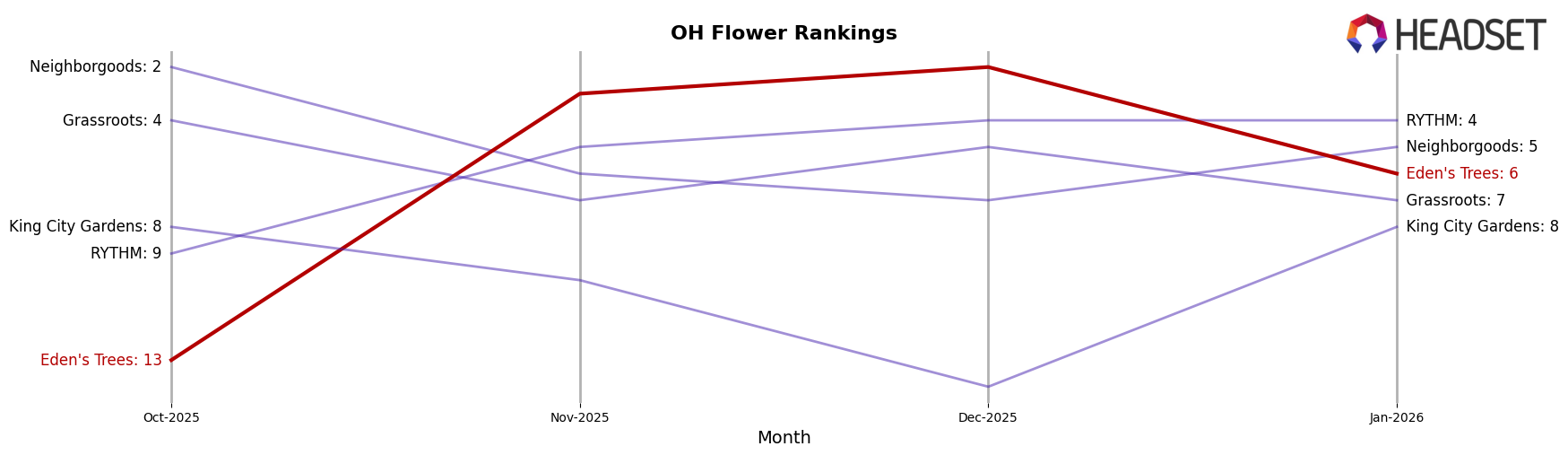

Eden's Trees has shown a varied performance across different product categories in Ohio. In the Concentrates category, the brand experienced a dip in rankings, moving from 10th in October 2025 to 15th in November, disappearing from the top 30 in December, and then climbing back to 12th in January 2026. This fluctuation indicates potential challenges in maintaining stable market presence in this category. Conversely, in the Flower category, Eden's Trees demonstrated impressive growth, rising from 13th place in October to an impressive 2nd place by December, before settling at 6th in January. This upward trend in Flower sales is a notable achievement, suggesting strong consumer demand and effective market strategies in this segment.

In the Edible category, Eden's Trees maintained a relatively stable position, hovering around the 17th and 18th spots throughout the analyzed months. This consistency might point to a loyal customer base or steady product performance. Meanwhile, in the Pre-Roll category, the brand's performance was less stable, with rankings fluctuating and the brand not appearing in the top 30 for December. Finally, in the Vapor Pens category, Eden's Trees consistently ranked between 15th and 17th, indicating a stable yet moderately competitive position. This stability could be a sign of consistent product quality or brand loyalty within this category, though there is room for growth to break into higher ranks.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Eden's Trees has demonstrated significant fluctuations in its market position over recent months. Starting from a rank of 13 in October 2025, Eden's Trees made a remarkable leap to rank 3 in November, and further ascended to rank 2 in December, before dropping to rank 6 in January 2026. This volatility highlights a dynamic competitive environment where brands like RYTHM, which consistently improved its rank from 9 to 4, and Neighborgoods, which maintained a strong presence within the top 7, are formidable contenders. Despite the drop in January, Eden's Trees' peak performance in November and December suggests a potential for regaining momentum, especially as it outpaced Grassroots, which saw a decline from rank 4 to 7 over the same period. The shifts in rank and sales figures indicate that while Eden's Trees has experienced a temporary setback, its previous upward trajectory could be a positive indicator for future growth in the Ohio market.

Notable Products

In January 2026, Alien Mints 2.83g emerged as the top-performing product for Eden's Trees, reclaiming its number one position after being second in the previous months, with notable sales of 19,430 units. Sunny Blossom 2.83g made a significant leap to second place from fifth in December 2025, showing a strong upward trend in popularity. Sherb Pop 2.83g entered the rankings for the first time in third place, indicating a fresh interest among consumers. Cadillac Rainbows 2.83g dropped to fourth place from third in December, reflecting a slight decline in its sales momentum. Super Star Pre-Roll 2-Pack 1g maintained a stable presence, ranking fifth, though its sales saw a decrease compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.