Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

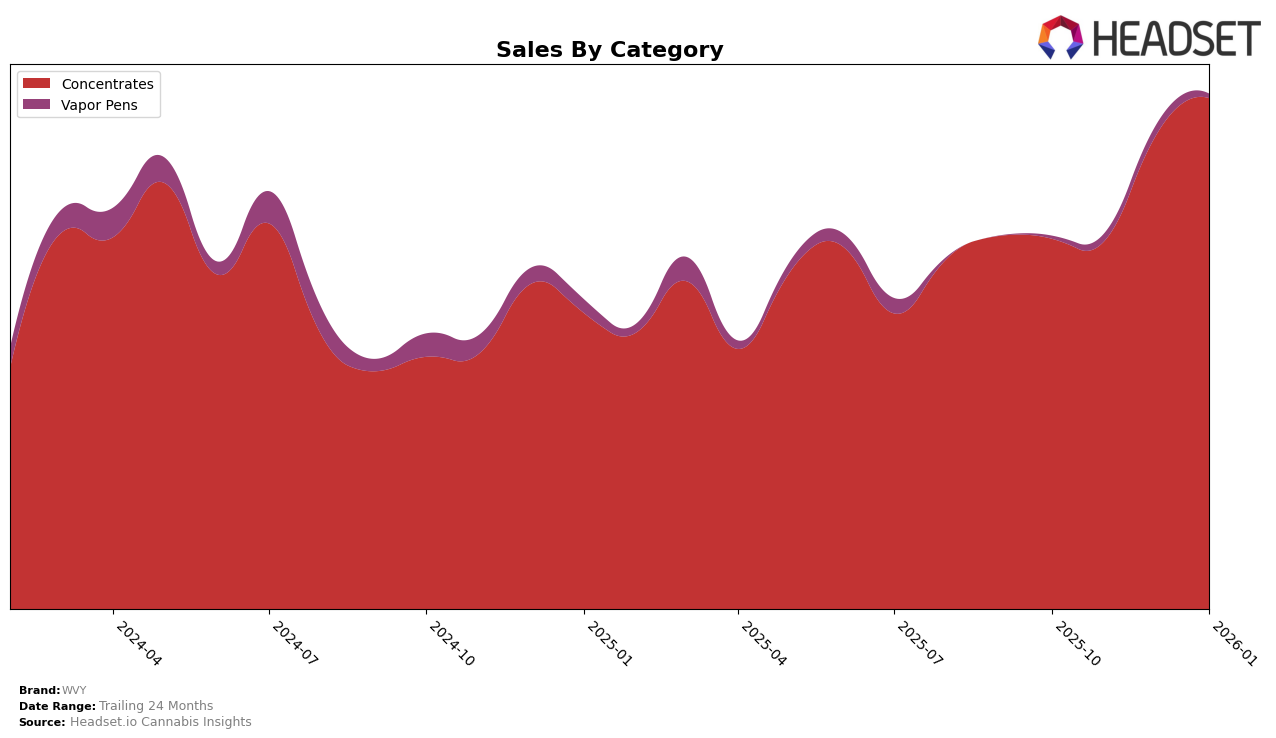

In the California market, WVY has demonstrated a consistent performance in the Concentrates category. Over the last few months, the brand maintained its position at rank 8 in October and November 2025, before climbing to rank 6 in December 2025 and January 2026. This upward trend is indicative of a strengthening presence and possibly an increase in consumer preference or market share. The sales data corroborates this improvement, with a notable increase from $470,689 in October 2025 to $647,857 by January 2026, suggesting effective strategies in product placement or consumer engagement.

While WVY's performance in California is commendable, the absence of rankings in other states or provinces suggests that the brand is either not present or not competitive enough to break into the top 30 in those regions. This could be a strategic decision to focus on markets where they have a stronger foothold, or it might indicate potential areas for future growth and expansion. Understanding the dynamics in these unranked regions could provide valuable insights into WVY's broader market strategy and potential opportunities for diversification and increased market penetration.

Competitive Landscape

In the competitive landscape of the California concentrates market, WVY has demonstrated a notable upward trajectory in brand ranking over the recent months. Starting from the 8th position in October 2025, WVY climbed to the 6th position by December 2025 and maintained this rank into January 2026. This improvement in rank is significant, especially when compared to other brands such as West Coast Cure, which fluctuated between 5th and 8th positions, and Hashish House, which dropped from 7th to 8th place. WVY's sales have shown a positive trend, with a noticeable increase from November to January, contrasting with the declining sales of Punch Extracts / Punch Edibles, which consistently held the 4th rank but experienced a downward sales trend. This suggests that WVY's strategic initiatives may be effectively capturing market share and consumer interest, positioning it as a rising competitor in the California concentrates category.

Notable Products

In January 2026, Cherry Burger Budder (1g) emerged as the top-performing product for WVY, leading the sales with 3,597 units sold. Jet Fuel OG Budder (1g) followed closely in second place, while White Widow Budder (1g) secured the third position. Notably, Tahoe Brunch Budder (1g) maintained its fourth-place ranking from December 2025 to January 2026. White Apricot Budder (1g) rounded out the top five, showcasing strong performance in the Concentrates category. Compared to previous months, these products demonstrated consistent sales growth, with Cherry Burger Budder (1g) making a particularly significant leap to the top rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.