Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

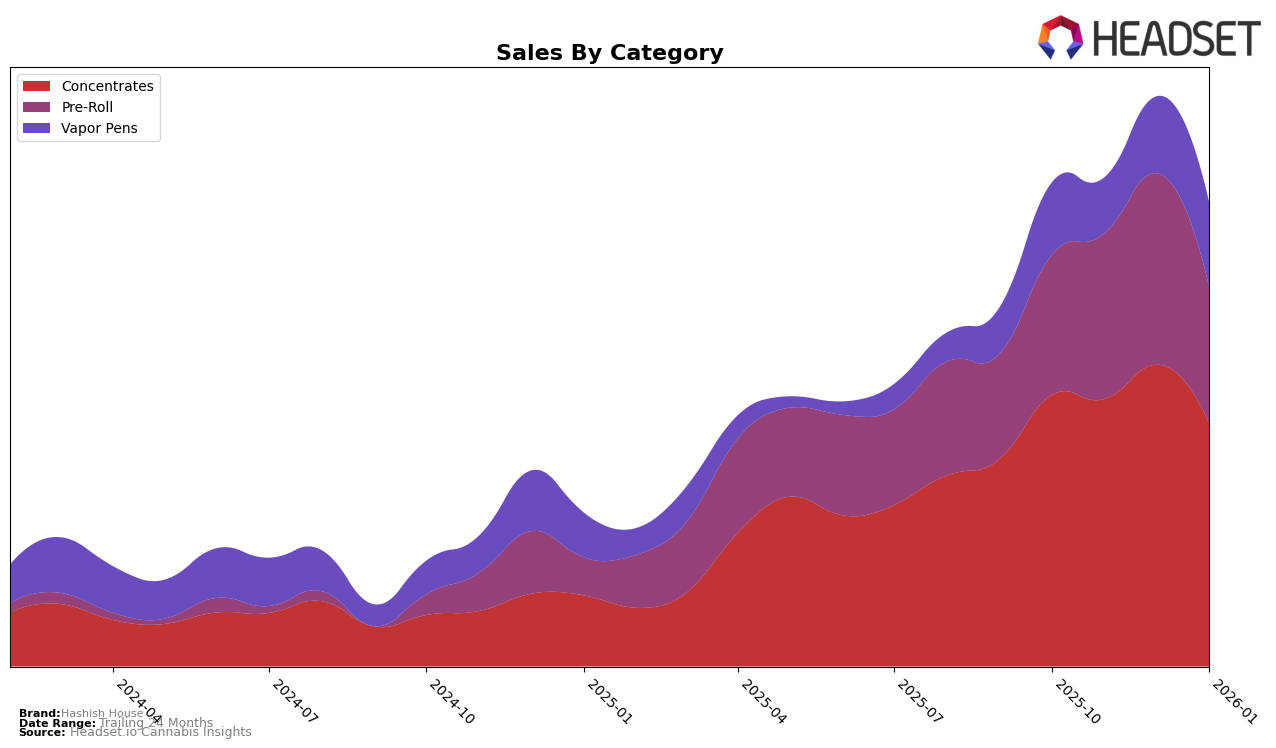

Hashish House has shown a consistent presence in the Concentrates category within California, maintaining a stable ranking at 7th place from October to December 2025, before slipping slightly to 8th in January 2026. This minor decline in ranking coincides with a noticeable dip in sales from December to January, suggesting potential seasonal influences or increased competition. In contrast, their performance in the Pre-Roll category reflects a more dynamic movement, climbing from outside the top 30 to 37th place by December, only to drop back to 43rd in January. This fluctuation could indicate varying consumer preferences or promotional strategies impacting their market position.

In the Vapor Pens category, Hashish House has experienced a positive trend in California, improving their rank from 75th in November to 63rd by January, with corresponding sales figures showing a steady increase. This upward trajectory is a promising sign of growth in a competitive market segment, highlighting the brand's potential to capture a larger market share. The absence of Hashish House in the top 30 for Pre-Rolls during October and November, however, underscores challenges in penetrating this category compared to their stronger performance in Concentrates and Vapor Pens.

Competitive Landscape

In the competitive landscape of the California concentrates market, Hashish House has experienced some fluctuations in its ranking and sales performance over the past few months. While maintaining a steady rank of 7th place from October to December 2025, Hashish House saw a slight dip to 8th place in January 2026. This shift coincides with a notable decrease in sales from December to January, suggesting potential challenges in maintaining its market position. In contrast, WVY has shown a consistent upward trend, moving from 8th place in October to a solid 6th place by January, with sales figures indicating a strong growth trajectory. Similarly, ABX / AbsoluteXtracts has maintained a stable presence within the top 10, with a slight improvement in rank from 10th to 9th, reflecting a steady increase in sales. Meanwhile, West Coast Cure experienced a minor rank fluctuation but remains a formidable competitor with consistently high sales figures. These dynamics highlight the competitive pressures Hashish House faces, emphasizing the need for strategic initiatives to regain momentum and enhance its market share.

Notable Products

In January 2026, the top-performing product for Hashish House was the Wedding Pie Rosin Infused Pre-Roll (1g), which secured the number one spot with notable sales of 7727 units. The Snowball Rosin Infused Pre-Roll (1g) maintained its second position from the previous month, showing consistent demand with sales increasing from 6228 to 6972 units. Triangle Mintz Rosin Infused Pre-Roll (1g) entered the rankings at third place, followed by Blackberry Champagne Rosin Infused Pre-Roll (1g) at fourth, both making their debut in the top rankings. Gelonade Rosin Infused Pre-Roll (1g) experienced a drop from first place in December 2025 to fifth in January 2026, indicating a shift in consumer preference. Overall, the Pre-Roll category dominated the top spots, showcasing its popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.