Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

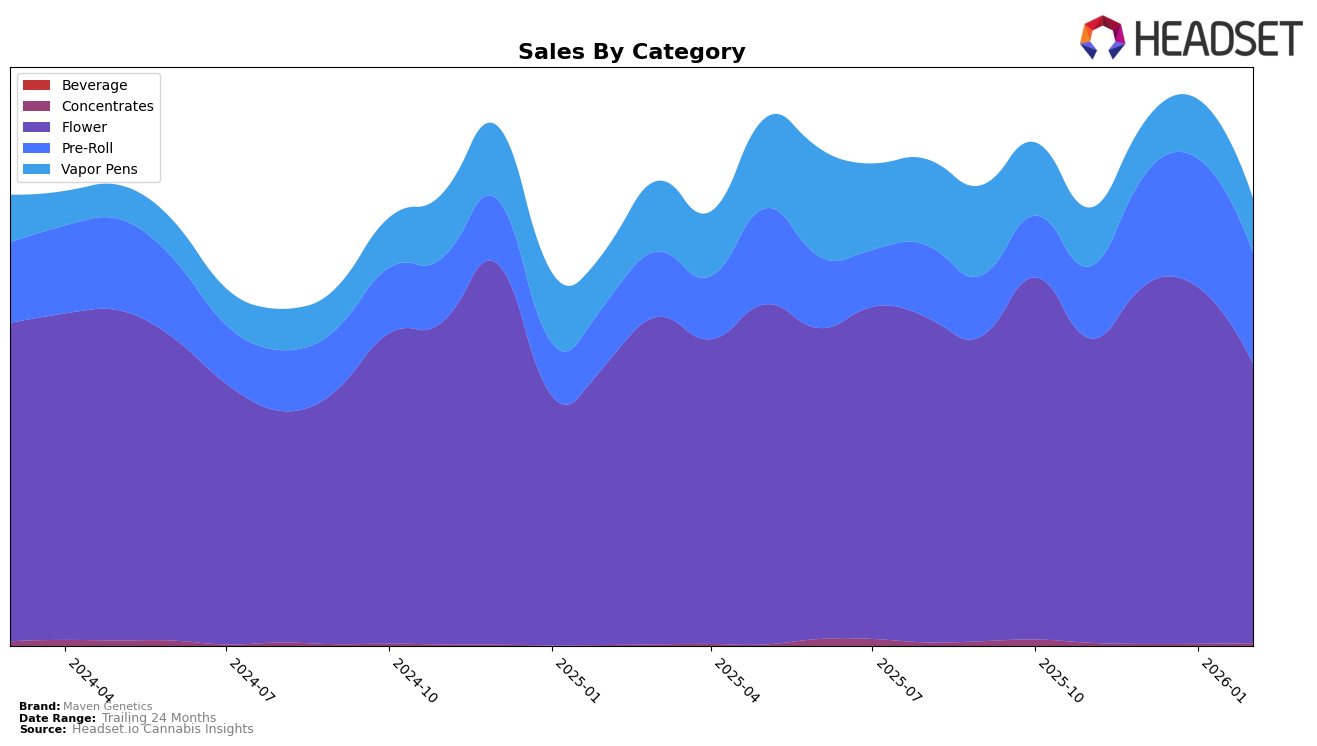

Maven Genetics has demonstrated a notable performance in the California market, particularly in the Flower category. Over the span from November 2025 to February 2026, the brand showed a slight improvement in rankings, moving from 24th to 19th place by January, before settling at 22nd in February. This fluctuation in rankings, despite a decrease in sales from January to February, indicates a competitive landscape where Maven Genetics is maintaining a strong presence. However, in the Vapor Pens category, Maven Genetics has not managed to break into the top 30, which suggests potential areas for growth or reevaluation of strategy in this product line.

In the Pre-Roll category, Maven Genetics has shown a promising upward trend, moving from 50th place in November to 32nd by January, though it slightly dipped to 34th in February. This positive movement in rankings, despite not being in the top 30, reflects a growing consumer interest and potential for further market penetration. The brand's ability to climb the ranks in such a competitive category within California suggests that their offerings are resonating with consumers, but there remains room for improvement to solidify their standing. The data highlights the dynamic nature of the cannabis market and the importance of strategic positioning for Maven Genetics to continue its upward trajectory.

Competitive Landscape

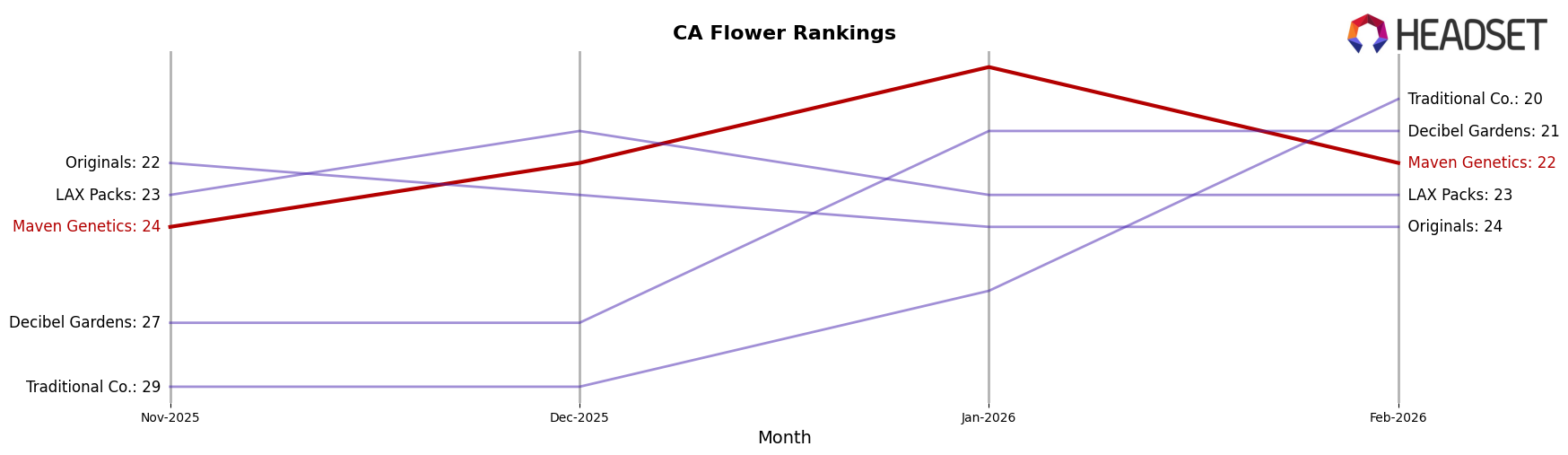

In the competitive landscape of the California Flower category, Maven Genetics experienced notable fluctuations in its ranking from November 2025 to February 2026. Initially ranked 24th in November, Maven Genetics improved to 19th in January before slipping back to 22nd in February. This fluctuation suggests a dynamic market environment where Maven Genetics is actively competing for market share. Notably, LAX Packs maintained a relatively stable position, peaking at 21st in December, while Decibel Gardens showed a consistent upward trend, reaching 21st by February. Meanwhile, Traditional Co. demonstrated significant improvement, climbing from 29th to 20th over the same period. These movements indicate a competitive pressure on Maven Genetics to maintain its market position amidst rivals that are either stabilizing or improving their standings. Despite these challenges, Maven Genetics' ability to reach 19th place in January highlights its potential to capitalize on market opportunities and suggests a need for strategic initiatives to sustain and enhance its ranking in the California Flower market.

Notable Products

In February 2026, Key Lime Jack (3.5g) emerged as the top-performing product for Maven Genetics, climbing to the number one spot with sales reaching 2,491 units. Following closely, Shangri La (3.5g) held the second position, showing a significant rise from its absence in January's rankings. Chroma (3.5g) debuted in the third position, indicating a strong market entry. Prizm (3.5g) and 98K Pre-Roll (1g) secured the fourth and fifth spots, respectively, both appearing in the rankings for the first time. Notably, Key Lime Jack (3.5g) demonstrated consistent growth, advancing from the fourth position in November 2025 to its current leading status.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.