Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

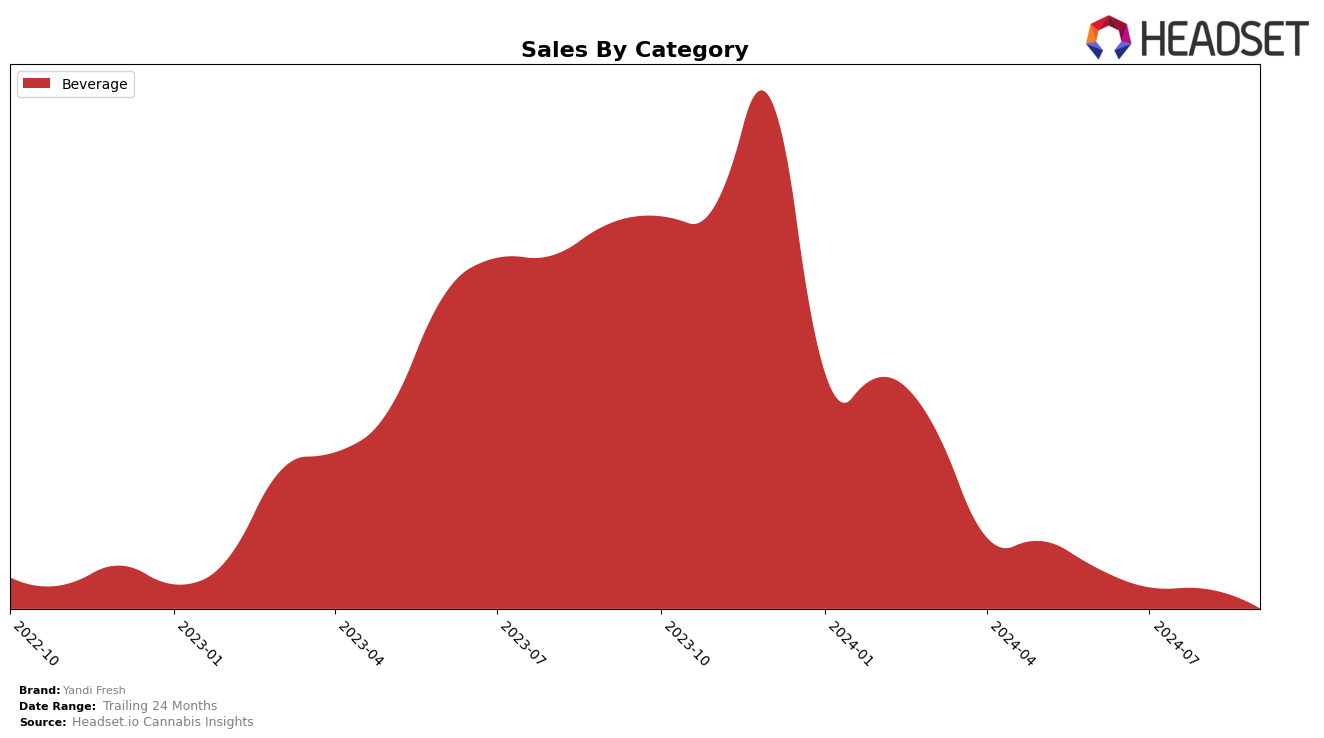

Yandi Fresh has shown a fluctuating performance across different categories and states, with notable movements particularly in the Beverage category. In Ontario, Yandi Fresh managed to secure a spot in the top 30 for the Beverage category in June, with a rank of 29, but slipped out of the top 30 by September. This decline in ranking could be indicative of increased competition or a shift in consumer preferences within the province. Despite this, the brand maintained a fairly consistent sales volume throughout the summer months, suggesting a loyal customer base that continues to support their offerings even when they fall out of the top ranks.

Across the board, Yandi Fresh's performance in other states and categories remains less visible, as the brand did not make it into the top 30 rankings in any other regions or categories during this period. This absence in the rankings could be a point of concern, indicating potential challenges in expanding their market presence beyond Ontario. While this might seem discouraging, it also presents an opportunity for Yandi Fresh to reassess their strategies and explore new avenues for growth. The brand's ability to maintain sales levels in Ontario despite ranking fluctuations highlights a resilience that could be leveraged for future expansion efforts.

```Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Yandi Fresh has shown a consistent presence, albeit outside the top 20 brands, with ranks of 29th in June, 31st in July, and 30th in August 2024. Despite not appearing in the top 20 in September, Yandi Fresh's sales have demonstrated a slight upward trend from July to August, suggesting a potential for growth. In contrast, Tweed emerged in the top 20 in August, indicating a stronger market presence, while Proper Cannabis Company and Aspire have not made it into the top 20, similar to Yandi Fresh. The data suggests that while Yandi Fresh is maintaining its position, there is a competitive opportunity to capitalize on the slight sales increase and aim for a breakthrough into the top 20, especially as other brands like Tweed are gaining traction.

Notable Products

In September 2024, Yandi Fresh's top-performing product was the Peach Apple Cider Beverage (10mg THC, 355ml), maintaining its number one rank since June despite a decline in sales to 655 units. The Raspberry Apple Cider Drink (10mg THC, 355ml) held steady at second place, reflecting consistent demand over the months. Notably, the Spiced Apple Cider Beverage (10mg) climbed to third place, showing a slight increase in sales compared to August. The Cranberry Apple Cider Drink (10mg THC, 355ml) dropped one position to fourth, while the Green Apple Cider Beverages (10mg) remained in fifth place, indicating stable but low sales figures. Overall, the top products exhibited minor shifts in rankings, with the Peach Apple Cider Beverage consistently leading the pack.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.