Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

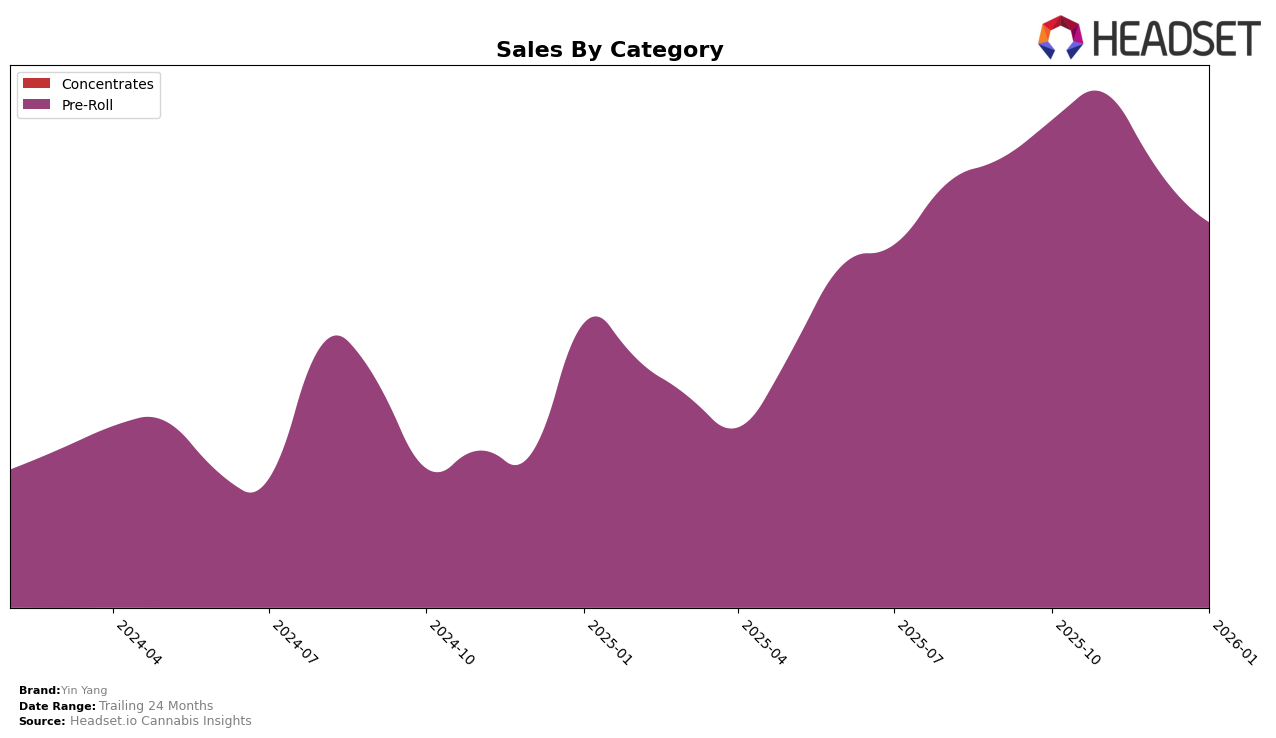

Yin Yang has demonstrated consistent performance in the Pre-Roll category across Oregon. Despite a slight dip in December 2025, where the brand moved from the 8th to the 9th position, it quickly regained its standing by January 2026, returning to the 8th rank. This resilience in ranking suggests a stable consumer base and effective market strategies that help maintain its position within the top 10 brands. Notably, the brand experienced a decrease in sales from November 2025 to January 2026, which might indicate seasonal fluctuations or shifts in consumer preferences. However, maintaining a top 10 ranking despite these sales changes points to strong brand loyalty or effective promotional efforts.

In terms of broader market presence, Yin Yang's absence from the top 30 in other states or categories could be seen as a potential area for growth or a missed opportunity. The brand's consistent ranking in Oregon might suggest that their strategies are particularly well-suited to this market, but it also highlights the need for expansion and adaptation to other regions or categories. The lack of presence in other states could be interpreted as a limitation in brand reach or market penetration, which might be an area for strategic development in the future. Understanding the dynamics that contribute to their success in Oregon could be key to replicating this performance elsewhere.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Yin Yang has experienced notable fluctuations in its rank and sales performance over recent months. While Yin Yang maintained a steady position at rank 8 in October and November 2025, it slipped to rank 9 in December 2025 before recovering slightly to rank 8 in January 2026. This fluctuation coincides with a decline in sales from November to January, suggesting a potential challenge in maintaining market share. In contrast, Meraki Gardens consistently improved its rank from 9 to 7, indicating a strengthening market presence despite a slight dip in sales. Meanwhile, Oregrown made a significant leap from rank 18 in December to rank 10 in January, reflecting a substantial increase in sales. Fire Dept. Cannabis and Killa Beez also demonstrated varying performances, with Fire Dept. Cannabis maintaining a stable rank of 6, while Killa Beez experienced a decline from rank 6 to 9. These dynamics highlight the competitive pressure Yin Yang faces in retaining its market position amidst evolving consumer preferences and competitor strategies.

Notable Products

In January 2026, Yin Yang's top-performing product was the I've Got a Fever x Need More Cowbell Pre-Roll 10-Pack (5g), which secured the number one rank with sales reaching 954 units. Following closely was the Domo Arigato x Mr Roboto Pre-Roll 10-Pack (5g) at the second position. The Money for Nothing x Chicks for Free Pre-Roll 56-Pack (28g) and Smoke x Mirrors Pre-Roll 10-Pack (5g) tied for third place, both demonstrating strong sales figures. The F*ck Around x Find Out Pre-Roll 56-Pack (28g) rounded out the top four. Notably, these products did not have rankings in the previous months, indicating a significant surge in popularity for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.