Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

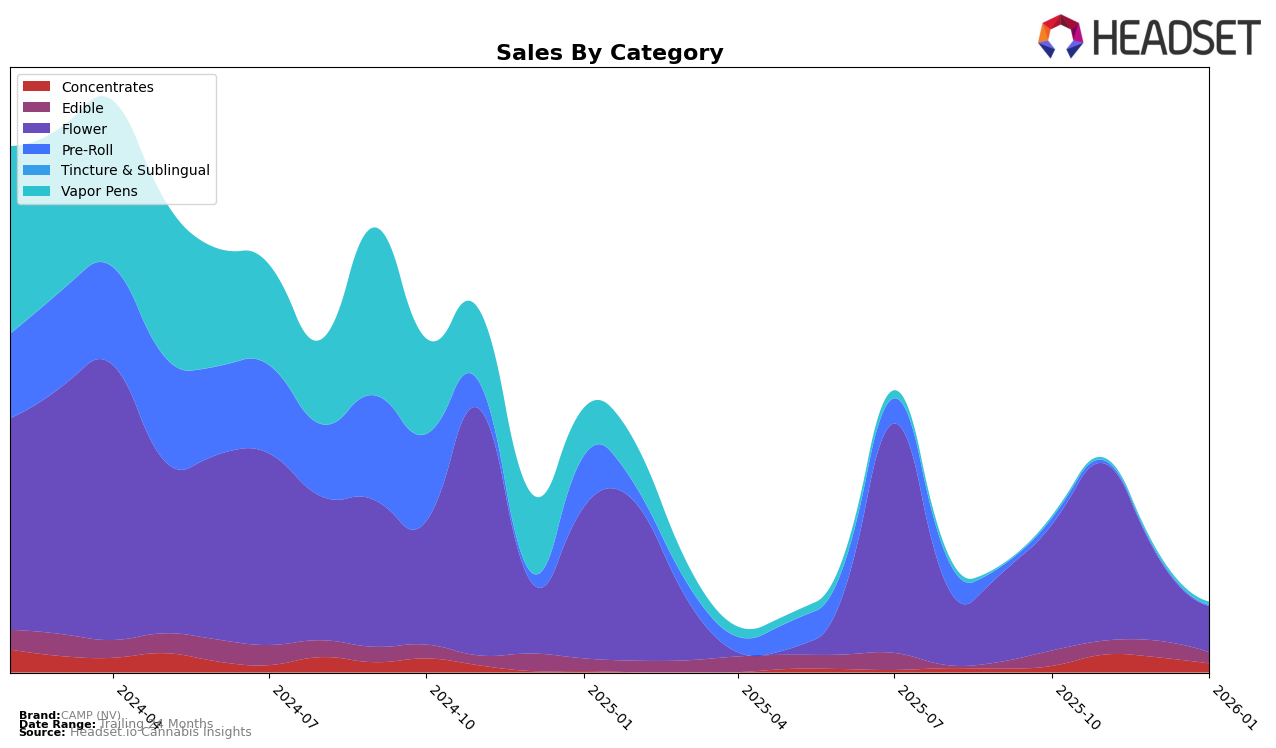

CAMP (NV) has demonstrated a dynamic performance across various product categories in the state of Nevada. In the Concentrates category, the brand saw a significant improvement, moving from the 23rd position in October 2025 to 10th in November, before stabilizing around the 12th and 17th positions in subsequent months. This upward trajectory indicates a growing consumer interest in their concentrate offerings. However, the Flower category presented a more volatile pattern with a peak at the 8th position in November, followed by a drop to the 29th position by January 2026. This fluctuation could suggest competitive pressures or shifts in consumer preferences within the state.

In the Edible category, CAMP (NV) maintained a relatively stable presence, ranking between 16th and 20th over the observed months, which suggests consistent consumer demand. On the other hand, their performance in the Pre-Roll and Vapor Pens categories was less remarkable, with the brand not making it into the top 30 in recent months. Specifically, for Vapor Pens, the brand was ranked 55th in January 2026, indicating room for growth in this segment. The absence of rankings in certain months for these categories highlights potential areas for strategic focus to enhance market penetration and consumer engagement in Nevada.

Competitive Landscape

In the Nevada flower category, CAMP (NV) has experienced notable fluctuations in its ranking and sales over the past few months. While it held a strong position in November 2025, ranking 8th, it saw a decline to 29th by January 2026. This drop in rank correlates with a significant decrease in sales, suggesting a potential loss of market share to competitors. Brands like Prime Cannabis and The Grower Circle have shown more consistent performance, with Prime Cannabis improving its rank from 41st in October 2025 to 27th by January 2026, and The Grower Circle maintaining a top 30 position throughout. Additionally, Reina, although not ranked in the earlier months, emerged strong in December 2025 and January 2026. These competitors' steady or improving ranks and sales highlight the competitive pressure on CAMP (NV), indicating a need for strategic adjustments to regain its previous market standing.

Notable Products

In January 2026, CAMP (NV) saw Double Solo Burger #5 (3.5g) maintain its top position in the Flower category, despite a decrease in sales to 3588 units. Following closely, Double Solo Burger (3.5g) climbed to second place, improving from its third position in December 2025. Peach Rosin Gummies 10-Pack (100mg) emerged as the third best-selling product, moving up one rank from December 2025. Meanwhile, Blackberry Rosin Gummies 10-Pack (100mg) entered the rankings at fourth place, while Melonade (3.5g) debuted in fifth. These shifts highlight a growing consumer preference for edibles, as indicated by the strong performance of the gummies.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.