Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

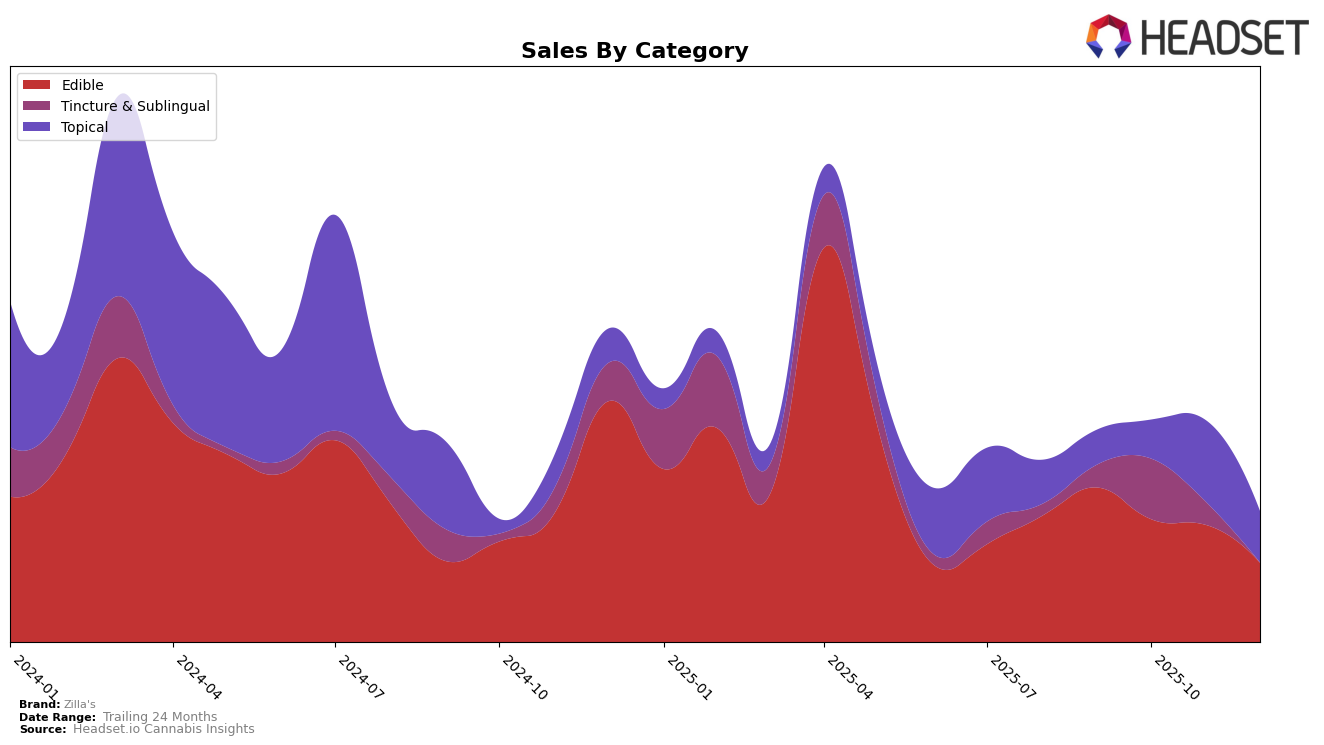

In the state of Michigan, Zilla's has shown a notable presence in the Edible category. However, their performance has been quite volatile over the last few months. In September 2025, Zilla's did not rank within the top 30 brands, sitting at the 98th position. This indicates a challenge in gaining traction in a competitive market. Unfortunately, the subsequent months did not see Zilla's make any significant breakthrough, as they failed to appear in the top 30 rankings from October through December 2025. This absence from the top 30 suggests that while there may be slight improvements or stability in sales, it is not enough to compete with the leading brands in Michigan's edible market.

Despite these challenges in Michigan, Zilla's recorded sales of $11,071 in September 2025, which provides a glimpse into their market presence. However, without a position in the top 30 rankings in the following months, it is evident that Zilla's needs to strategize effectively to improve their market position. The lack of continued ranking data implies that either sales have plateaued or increased competition has overshadowed their performance. Observing trends and strategic movements in states like Michigan will be crucial for Zilla's as they aim to enhance their brand visibility and market share in the edible category.

Competitive Landscape

In the Michigan edible market, Zilla's has faced significant challenges in maintaining a competitive position, as evidenced by its absence from the top 20 rankings since September 2025. Despite this, Zilla's initial rank of 98 in September indicates a foothold that could be leveraged with strategic marketing efforts. In contrast, brands like Smokiez Edibles and Sauce Essentials have consistently maintained higher rankings, with Smokiez Edibles improving from 42 to 41 and Sauce Essentials dropping from 56 to 65 over the same period. Meanwhile, Vlasic Labs has experienced fluctuations, ending the year at rank 99, which suggests potential volatility that Zilla's could exploit. Additionally, Zoobies shares a similar trajectory to Zilla's, with both brands not appearing in the top rankings after September. For Zilla's, understanding these dynamics and the sales trends of competitors could inform strategic decisions to enhance market presence and sales performance.

Notable Products

In December 2025, the top-performing product for Zilla's was CBG/CBD 1:1 Relief For Mind Gummy Bears 20-Pack, which climbed to the number one spot with notable sales of 113 units. The CBD/CBG 1:1 Calm & Sleep Gummy Bears 10-Pack maintained a strong position, ranking second with consistent sales performance throughout the past months. Watermelon Taffy 10-Pack showed significant improvement, moving up to tie for second place, illustrating a resurgence in popularity. Grape Jelly Taffy 10-Pack and Orange Cream Taffy 2-Pack both secured the third position, indicating a stable demand for these flavors. Overall, December saw a reshuffling in rankings, with the Relief For Mind Gummy Bears making a notable leap from third to first, showcasing its growing consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.