Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

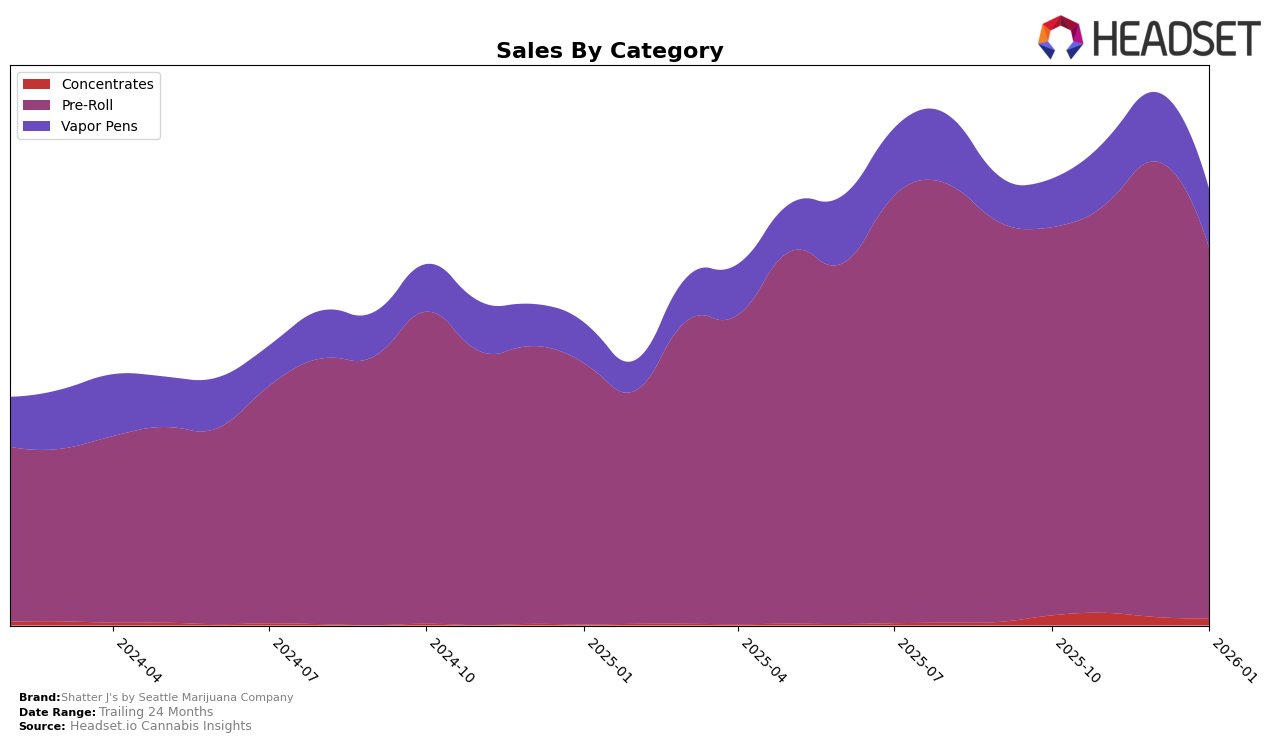

Shatter J's by Seattle Marijuana Company has shown a consistent performance in the Pre-Roll category within Washington. From October 2025 to January 2026, the brand's ranking fluctuated slightly, moving from 19th to 16th place before settling back at 19th. This indicates a stable presence in the top 20, with a noticeable peak in December 2025 when sales reached their highest. Such performance suggests a solid consumer base and effective market strategies in the Pre-Roll category, despite the slight dip in January 2026. However, the brand's absence from the top 30 in other states during this period could imply a more regionally concentrated market focus.

In contrast, Shatter J's performance in the Vapor Pens category within Washington shows a different trend. The brand was not ranked in the top 30 in October 2025 but made its way into the rankings by November 2025, starting at 100th place and improving to 97th by January 2026. This upward trajectory, though outside the top 30, suggests a growing presence in the Vapor Pens market. The increase in sales from November to December indicates positive momentum, but the brand still faces significant competition to break into higher rankings. This movement in the Vapor Pens category could hint at potential growth opportunities if strategic adjustments are made to capitalize on emerging consumer preferences.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll category, Shatter J's by Seattle Marijuana Company has demonstrated notable fluctuations in rank and sales over the recent months. Starting at 19th place in October 2025, Shatter J's improved to 18th in November and reached a peak of 16th in December, before slipping back to 19th in January 2026. This fluctuation indicates a dynamic competitive environment, with Shatter J's showing potential for growth but also facing challenges in maintaining its position. Competitors like 1988 consistently held a higher rank at 17th, while Agro Couture and Seattle's Private Reserve also posed significant competition, with Agro Couture maintaining a rank of 18th or better throughout the period. The sales trends reflect these rankings, with Shatter J's experiencing a peak in December, suggesting a potential seasonal boost or successful marketing effort, but the subsequent decline in January highlights the need for sustained strategic initiatives to maintain upward momentum.

Notable Products

In January 2026, the top-performing product for Shatter J's by Seattle Marijuana Company was the Melon Guava Infused Pre-Roll (1g), which rose to first place with sales of 1907 units. This marks an improvement from its consistent second-place ranking from October to December 2025. The Blackberry Pie Shatter & Distillate Infused Pre-Roll (1g) dropped to second place after holding the top spot for the previous three months. The Blueberry Shatter & Distillate Infused Pre-Roll (1g) maintained its third-place ranking, while the Creme Brulee Flavored Infused Pre-Roll (1g) remained stable at fourth. Notably, the Banana Cream Pie Infused Pre-Roll (1g) entered the rankings in fifth place, showing a new entry in the competitive lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.