Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

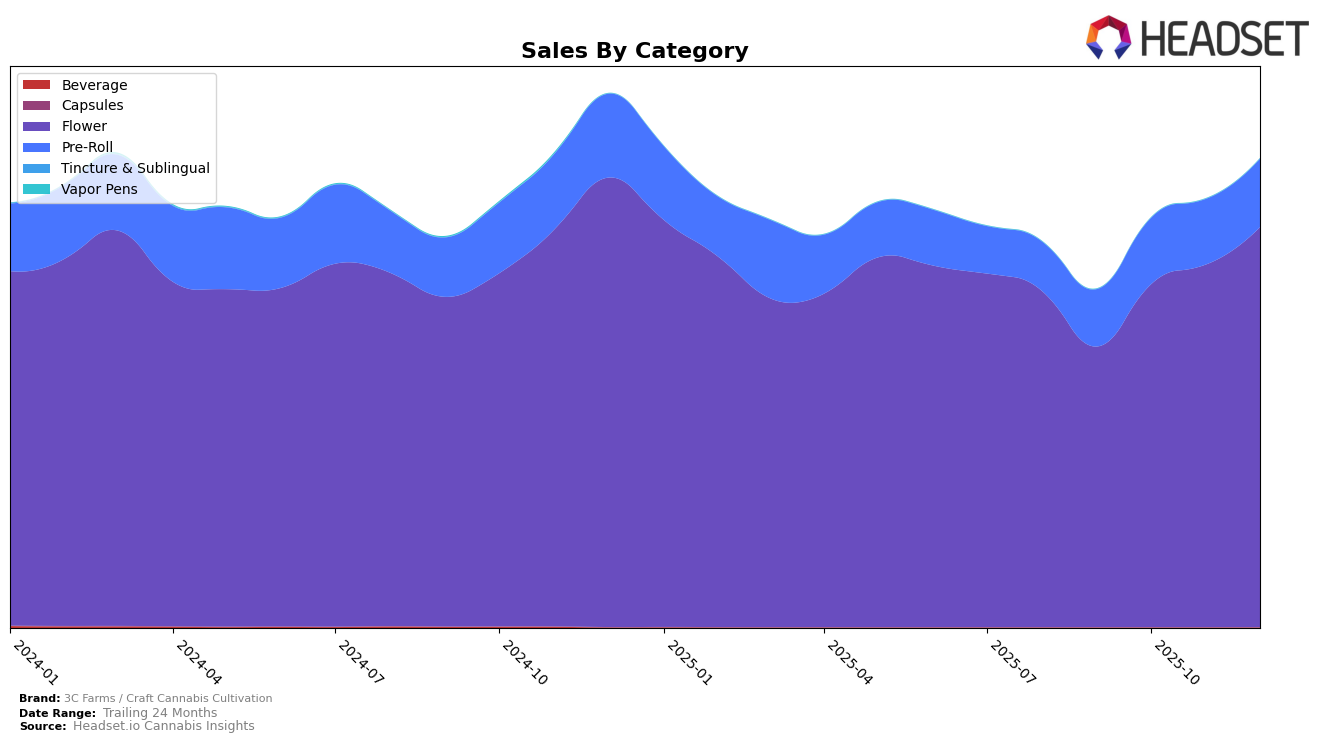

In the competitive landscape of cannabis brands, 3C Farms / Craft Cannabis Cultivation has shown notable progress in the California market, particularly in the Flower category. Over the last four months of 2025, the brand climbed from a rank of 37 in September to 28 by December. This upward trajectory is underscored by a steady increase in sales, culminating in a noteworthy December performance. Such a rise in rankings within a short period indicates a successful strategy in capturing market share and possibly enhancing product offerings or distribution channels. Notably, the brand managed to break into the top 30 by November, a significant achievement that highlights its growing prominence in the California cannabis scene.

In contrast, the Pre-Roll category tells a slightly different story for 3C Farms / Craft Cannabis Cultivation. Despite not breaking into the top 30, the brand improved its ranking from 79 in September to 71 in December in California. While the rankings in this category remain outside the top tier, the consistent upward movement suggests that the brand is making incremental gains in this segment as well. The sales figures reflect a modest but steady increase, indicating that while Pre-Rolls may not be their strongest category, there is potential for growth. This gradual improvement could point to effective marketing strategies or product improvements that are slowly resonating with consumers.

Competitive Landscape

In the competitive landscape of the California flower category, 3C Farms / Craft Cannabis Cultivation has shown a promising upward trajectory in rankings from September to December 2025, moving from 37th to 28th place. This improvement is notable as it reflects a consistent increase in sales, culminating in a significant rise by December. In contrast, Decibel Gardens maintained a relatively stable position, slightly ahead of 3C Farms, but with a less pronounced sales growth. Meanwhile, Soma Rosa Farms experienced fluctuations, ending December just below 3C Farms despite initially higher rankings. Traditional Co. also saw minor rank changes, indicating a stable market presence but not matching the sales momentum of 3C Farms. Interestingly, Smoken Promises experienced a significant drop in rank from 19th in September to 27th in December, suggesting potential challenges despite higher sales figures than 3C Farms. These dynamics highlight 3C Farms' strategic growth in a competitive market, emphasizing its potential to continue climbing the ranks with sustained sales efforts.

Notable Products

In December 2025, Anunnaki OG (3.5g) emerged as the top-performing product for 3C Farms / Craft Cannabis Cultivation, maintaining its first-place rank from November with sales reaching 4988 units. Tahoe OG (3.5g) held steady in the second position, improving from a previous dip in November. Sasquatch Sap (3.5g) climbed to third place, marking a consistent rise in rank over the past months. Tahoe OG Pre-Roll (1g) dropped to fourth place, while Jack Kraken Pre-Roll (1g) entered the rankings in fifth place for the first time. The Flower category dominated the top three positions, reflecting a strong consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.