Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

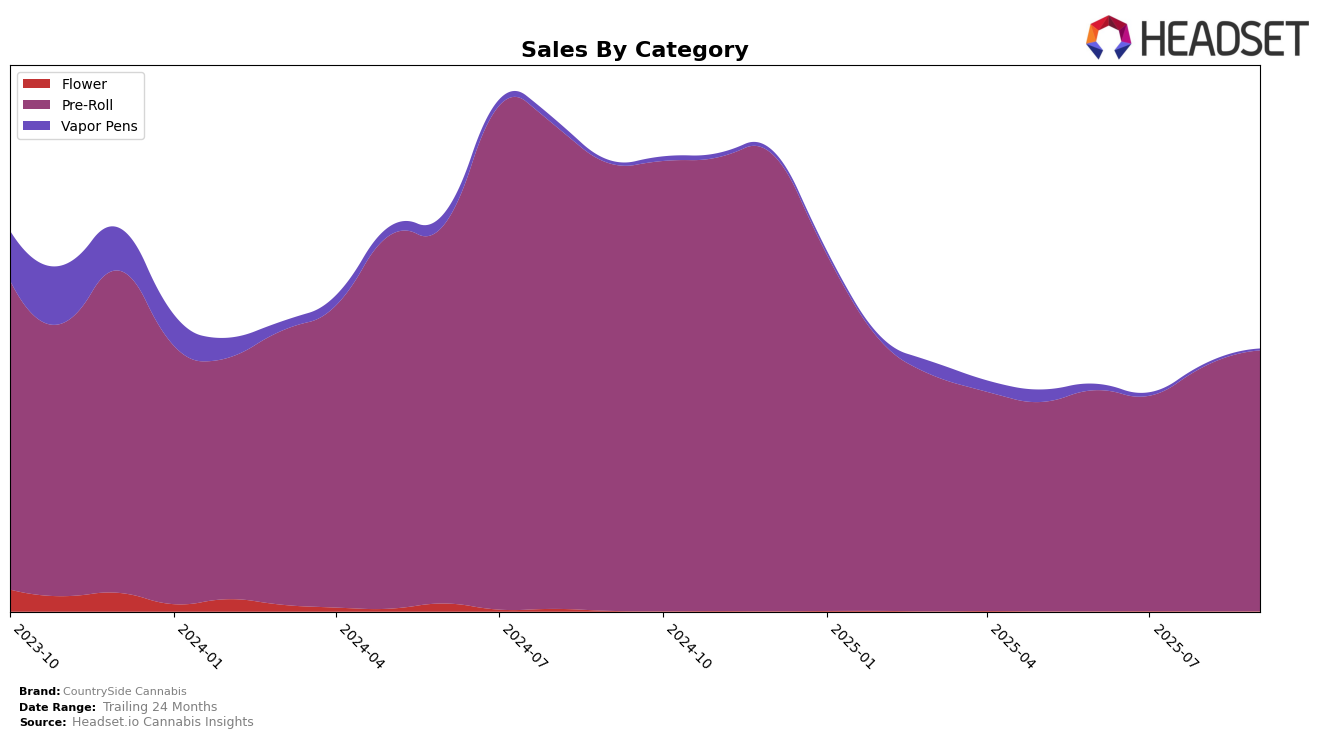

CountrySide Cannabis has shown a noteworthy trajectory in the Pre-Roll category within the province of Ontario. Over the months from June to September 2025, the brand has climbed from a rank of 35 to 28, indicating a positive movement and growing consumer interest. This upward trend is particularly significant given the competitive nature of the Pre-Roll market, where breaking into the top 30 can be challenging. The consistent improvement in their ranking suggests an effective strategy or product offering that resonates well with consumers in Ontario.

Despite their progress in Ontario, it is important to note that CountrySide Cannabis is not ranked within the top 30 brands in other states or provinces, which could be seen as a potential area for growth or a gap in their market penetration. This absence from the top rankings in other regions highlights a significant opportunity for expansion and brand recognition outside of Ontario. The sales figures from Ontario, which have shown a steady increase, provide a strong foundation that could be leveraged to explore and enter new markets. For those interested in the complete performance details across various states and categories, further data exploration would be necessary.

Competitive Landscape

In the competitive landscape of Ontario's Pre-Roll category, CountrySide Cannabis has shown a promising upward trajectory in recent months. Starting from a rank of 35 in June 2025, CountrySide Cannabis improved its position to rank 28 by September 2025, indicating a positive shift in market presence. This improvement is notable when compared to competitors like 3Saints, which also climbed the ranks but remained slightly behind CountrySide Cannabis at rank 30 in September. Meanwhile, 5 Points Cannabis experienced a decline, dropping from rank 27 in June to 29 in September, suggesting a potential opportunity for CountrySide Cannabis to capture more market share. Although Divvy and Rizzlers maintained relatively stable positions, their sales figures did not exhibit the same growth momentum as CountrySide Cannabis, which saw a consistent increase in sales from July to September. This trend positions CountrySide Cannabis as a rising contender in the Ontario Pre-Roll market, with potential to further enhance its competitive standing.

Notable Products

In September 2025, CountrySide Cannabis saw Strawberry OG Pre-Roll 10-Pack (5g) maintain its top position as the best-selling product, with sales reaching 9,941 units. The 10th Planet Pre-Roll 10-Pack (5g) held steady at the second spot, showing a significant increase in sales compared to previous months. Harvest Reserve - Grape Diamonds Pre-Roll (1g) remained in third place, recovering slightly after a dip in August. Ethos Glue Pre-Roll 10-Pack (5g) consistently ranked fourth, despite a continual decline in sales figures over the months. Mandarin Cookies Infused Pre-Roll 5-Pack (2.5g) retained its fifth-place ranking from August, although it experienced a slight drop in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.