Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

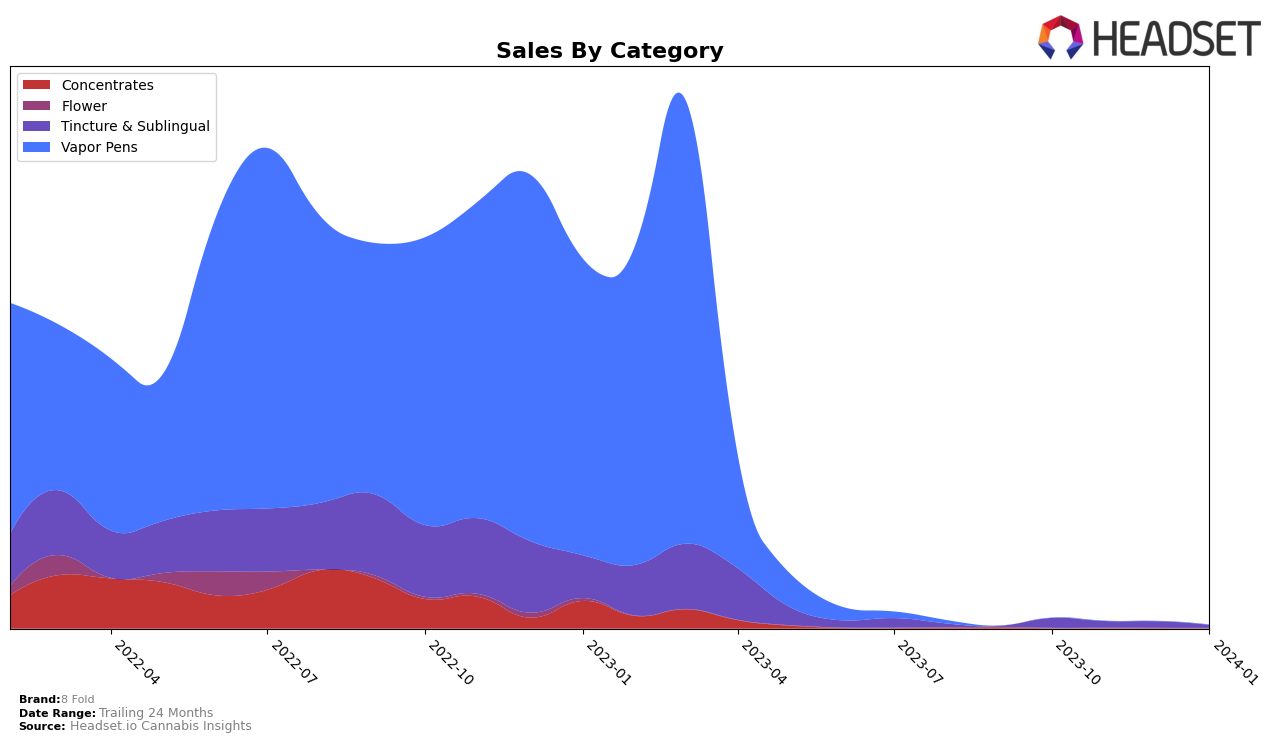

In the Nevada market, the cannabis brand 8 Fold has shown a notable presence across different product categories, albeit with mixed results in terms of rankings. In the Tincture & Sublingual category, 8 Fold maintained a strong position within the top 20 brands from October 2023 to January 2024, starting at rank 8 in October and experiencing a slight decline to rank 15 by January 2024. This consistent presence in the rankings, despite a downward shift, suggests a stable consumer base and ongoing demand for their Tincture & Sublingual products. However, the sales figures indicate a decreasing trend, with October 2023 sales at 11,180 dropping significantly by January 2024. This could reflect a range of factors from increased competition, changes in consumer preferences, or other market dynamics affecting 8 Fold's performance in this category.

Contrastingly, in the Concentrates category within the same Nevada market, 8 Fold faced challenges in maintaining a top 20 ranking. The brand did not appear in the top 20 for October 2023 but managed to secure a spot at rank 66 in November 2023. The absence of 8 Fold from the top 20 rankings in October and the subsequent low ranking in November could be interpreted as either a lack of market penetration or perhaps strategic shifts in focus towards other categories. It's important for stakeholders to consider these fluctuations as potential indicators of where the brand might need to reinforce its market strategies or possibly capitalize on the categories where it holds a stronger presence. The appearance in November, albeit at a lower rank, suggests there is still an opportunity for 8 Fold to climb the ranks in the Concentrates category, provided they address the underlying factors contributing to their initial absence and later low ranking.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Nevada, 8 Fold has experienced notable fluctuations in its market position over the recent months. Initially ranked 8th in October 2023, it saw a slight dip to 10th in November and December, before a more significant drop to 15th in January 2024. This trend indicates a challenging period for 8 Fold, especially when compared to its competitors. For instance, TRYKE showed an improvement in rank from 18th to 14th before slightly dropping to 16th, demonstrating a more volatile performance but ending slightly above its starting point. Meanwhile, Nour and The Real McCoy (NV) have shown resilience, with Nour moving from 13th to 13th again, after a dip to 17th, and The Real McCoy (NV) navigating from 12th to 14th, indicating a relatively stable market presence. Levia, on the other hand, has seen a decline from 14th to 17th. These shifts highlight the competitive dynamics within the category, with 8 Fold needing to address its recent downward trend in rank and sales to regain its footing against these competitors.

Notable Products

In January 2024, 8 Fold's top-performing product was the Peppermint Tincture (800mg) within the Tincture & Sublingual category, maintaining its number one rank consistently from October 2023 through January 2024, with January sales hitting 98 units. Notably, the Blood Orange Tincture (800mg) and Blueberry Tincture (800mg), both also in the Tincture & Sublingual category, showed strong performances in previous months but did not make the sales list in January 2024. The CBD RSO Syringe (1g) from the Concentrates category, which had a presence in November 2023 with a rank of 4, also disappeared from the January 2024 sales data. This indicates a shift in consumer preference or availability issues for products other than the top seller. The consistent performance of the Peppermint Tincture (800mg) highlights its dominant position in 8 Fold's product lineup, despite the fluctuating presence of other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.