Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

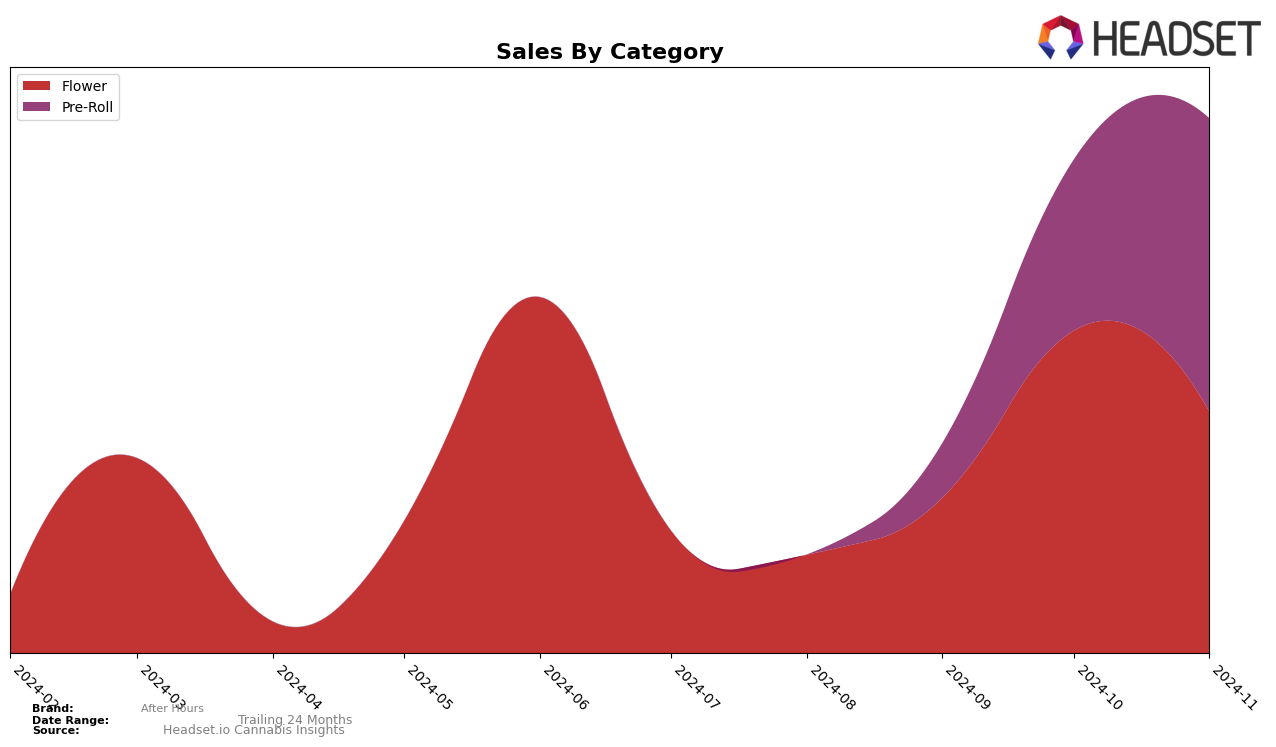

In the province of Saskatchewan, After Hours has shown a notable upward trajectory in the Flower category. The brand rose from a rank of 63 in August 2024 to breaking into the top 30 by October, and it maintained a position at rank 30 in November. This consistent climb suggests a strengthening market presence, potentially driven by strategic product offerings or increased consumer interest. Notably, After Hours did not make it into the top 30 ranks in August and September, which highlights the significance of their recent progress. The brand's sales in this category have also seen a substantial increase, reflecting this upward trend.

In contrast, After Hours' performance in the Pre-Roll category within Saskatchewan is a tale of a late entry into the rankings. The brand was not in the top 30 until October, where it debuted at rank 54 and improved to rank 36 by November. This indicates a promising growth trajectory, albeit from a lower starting point compared to their Flower category performance. The absence from the top 30 in earlier months could suggest either a recent market entry or a strategic pivot to enhance their offerings in this category. The sales figures in November show a positive trend, reinforcing the brand's potential in expanding its market share in Pre-Rolls.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, After Hours has demonstrated a remarkable upward trajectory in recent months, significantly impacting its rank and sales performance. From August to October 2024, After Hours surged from a rank outside the top 20 to an impressive 28th position, before settling at 30th in November. This upward momentum is mirrored in its sales, which saw a substantial increase from August to October, before slightly declining in November. In contrast, Battle River Bud consistently maintained a higher rank, peaking at 28th in November, while Bold and Catch Me Outside experienced more fluctuations, with Bold achieving a stable rank around 30th. Despite these competitors having higher sales figures, After Hours' rapid climb in rank suggests a growing market presence and consumer interest, positioning it as a brand to watch in the Flower category in Saskatchewan.

Notable Products

In November 2024, the top-performing product from After Hours was the Indica Pre-Roll 10-Pack (5g) in the Pre-Roll category, maintaining its position at rank 1 with notable sales of 1524 units. The Sativa Pre-Roll 10-Pack (5g) held steady at rank 2, showing consistent performance across the months. The Indica Premium Milled (28g) in the Flower category climbed to rank 3, an improvement from rank 5 in October. The Sativa Premium Milled (28g) dropped one position to rank 4, while the Sativa Premium Milled (14g) fell to rank 5 from its previous fourth position. Overall, the Pre-Roll category products continue to dominate the sales rankings for After Hours.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.