Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

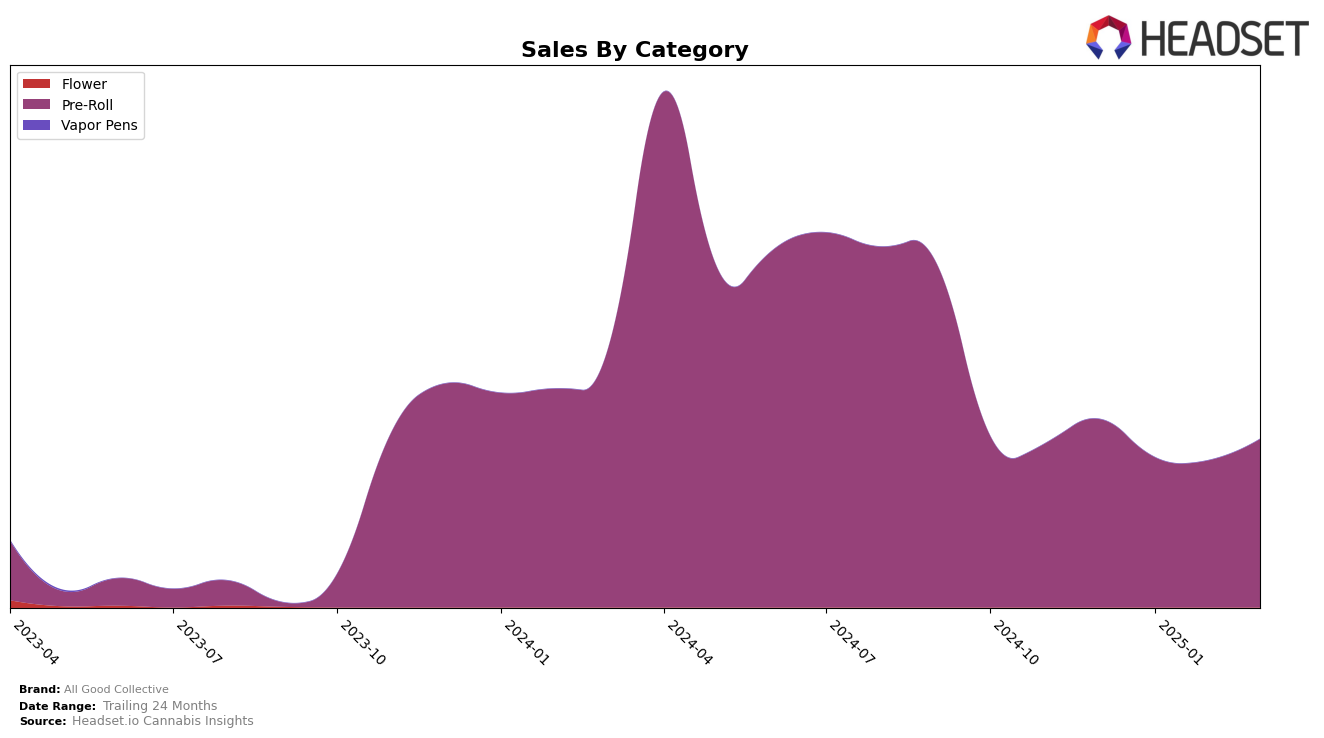

All Good Collective has shown notable performance in the Colorado market, especially within the Pre-Roll category. In December 2024, they were just outside the top 30, ranking 32nd. Despite a dip in January 2025 to 36th place, they managed a recovery by February 2025, returning to their December position and eventually breaking into the top 30 by March 2025, achieving a rank of 29th. This upward trajectory in the rankings suggests a positive trend in consumer reception and market penetration for their Pre-Roll products in Colorado, even though they were not consistently in the top 30 earlier in the period.

The sales figures for All Good Collective in Colorado's Pre-Roll category reveal some interesting dynamics. While there was a decrease in sales from December 2024 to February 2025, with a low point in January, the brand experienced a rebound in March 2025, reflecting a recovery in consumer demand or possibly a successful strategic adjustment. The ability to climb into the top 30 by March indicates that despite earlier challenges, the brand has managed to strengthen its presence in the market. However, the absence of rankings in other states or categories suggests areas where the brand might not yet have a significant foothold or visibility, indicating potential opportunities for future growth.

Competitive Landscape

In the competitive landscape of the pre-roll category in Colorado, All Good Collective has shown a promising upward trend in rank, moving from 32nd in December 2024 to 29th by March 2025. This improvement is significant when compared to competitors like The Colorado Cannabis Co., which dropped from 19th to 30th in the same period, and Binske, which fluctuated but ultimately remained below All Good Collective in March 2025. Notably, Qrious made a remarkable leap from 76th to 28th, surpassing All Good Collective in March, indicating a potential new threat. Despite these dynamics, All Good Collective's sales have shown resilience, with a notable increase from February to March, suggesting effective strategies in maintaining customer loyalty and market presence amidst fluctuating competition.

Notable Products

In March 2025, Blackberry Infused Pre-Roll 10-Pack (3.5g) maintained its position as the top-performing product for All Good Collective, consistently holding the number one rank since December 2024 with sales of 538 units. Watermelon Infused Pre-Roll 10-Pack (5g) showed significant growth, climbing from fifth place in January to second place by March, with a notable increase in sales to 356 units. Grape Infused Pre-Roll 10-Pack (3.5g) experienced a slight drop, moving from second to third place from February to March. Vanilla Infused Pre-Roll 10-Pack (5g) remained stable in fourth place, showing a slight recovery in sales figures. Pineapple Infused Pre-Roll 10-Pack (5g) saw a decline in ranking from second in December to fifth in March, though it showed a slight increase in sales from February to March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.