Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

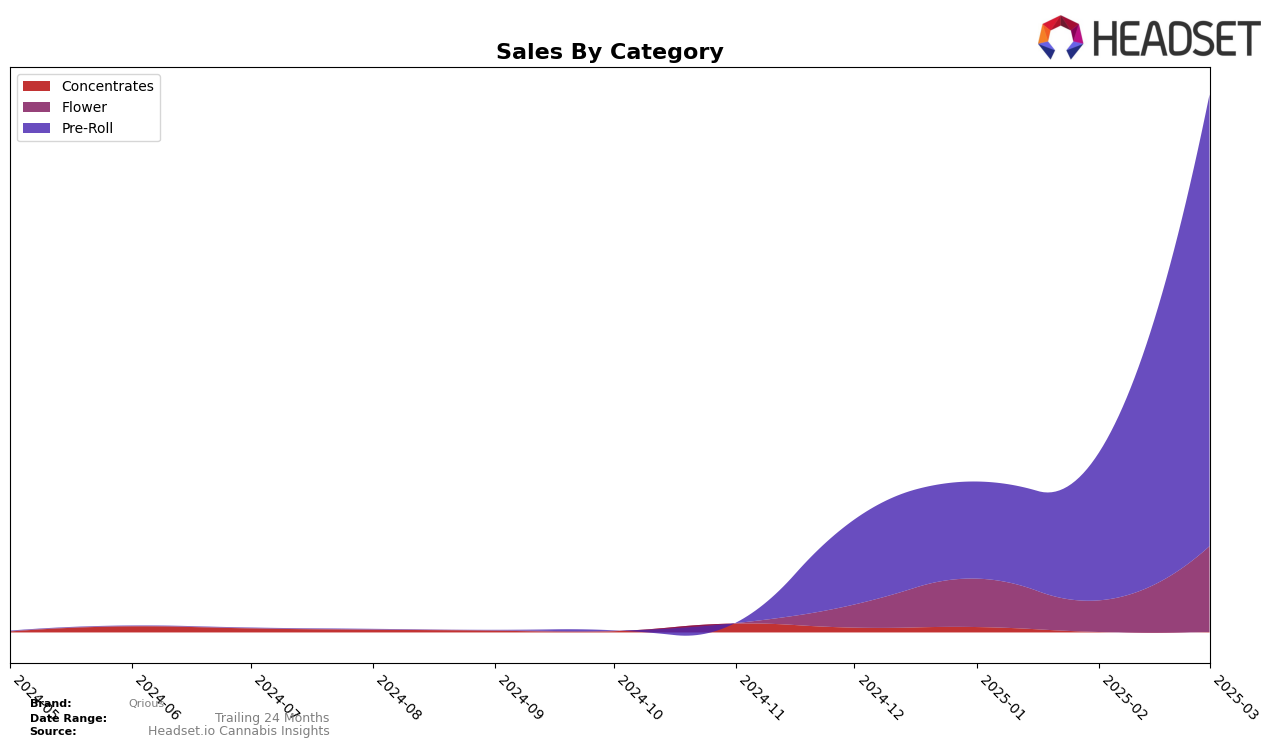

In the state of Colorado, the cannabis brand Qrious has shown significant upward movement within the Pre-Roll category over the first quarter of 2025. Starting from a position outside the top 30 in December 2024, Qrious climbed to rank 28 by March 2025. This impressive ascent indicates a strong market response and increasing consumer demand for their products. The notable jump in rankings suggests that Qrious is successfully capturing market share and enhancing its presence within the competitive Colorado Pre-Roll market.

Analyzing the sales trajectory of Qrious in Colorado, there is a clear trend of growth from December 2024 to March 2025. While specific sales figures are limited, the brand's rank improvement is indicative of a substantial increase in sales volume. This upward trend is a positive indicator of Qrious's strategic positioning and product appeal. However, it is worth noting that Qrious's presence in other states or categories remains to be explored, as the data does not indicate their ranking in any other state or category, which could imply either a focused strategy in Colorado or potential areas for expansion.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Qrious has demonstrated a remarkable upward trajectory in recent months. Starting from a rank of 76 in December 2024, Qrious made a significant leap to rank 28 by March 2025. This dramatic improvement in rank is indicative of a strong growth trend, suggesting that Qrious is rapidly gaining market share. In contrast, The Colorado Cannabis Co. experienced a decline, dropping out of the top 20 by February 2025 and showing a downward sales trend. Meanwhile, Binske and Packs (fka Packwoods) have maintained relatively stable positions, with Packs showing a slight improvement to rank 26 in March 2025. All Good Collective also saw some fluctuations but remained outside the top 20. The rapid ascent of Qrious in rank and sales suggests a growing consumer preference, positioning it as a formidable competitor in the Colorado Pre-Roll market.

Notable Products

In March 2025, the top-performing product for Qrious was the Black Cherry Fuego Pre-Roll (1g) in the Pre-Roll category, securing the first rank with a notable sales figure of 4,654 units. Following closely, the Lemon Crank Pre-Roll (1g) and Lemonade Cherry Blast Pre-Roll (1g) took the second and third spots, respectively. Lavender Skies Pre-Roll (1g) and Cherry Dynamite Pre-Roll (1g) occupied the fourth and fifth positions. Compared to previous months, Black Cherry Fuego Pre-Roll (1g) maintained its top position, while the Lemon Crank Pre-Roll (1g) consistently held the second spot. The product rankings have shown stability, with no significant changes from the prior months, indicating a steady consumer preference for these top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.