Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

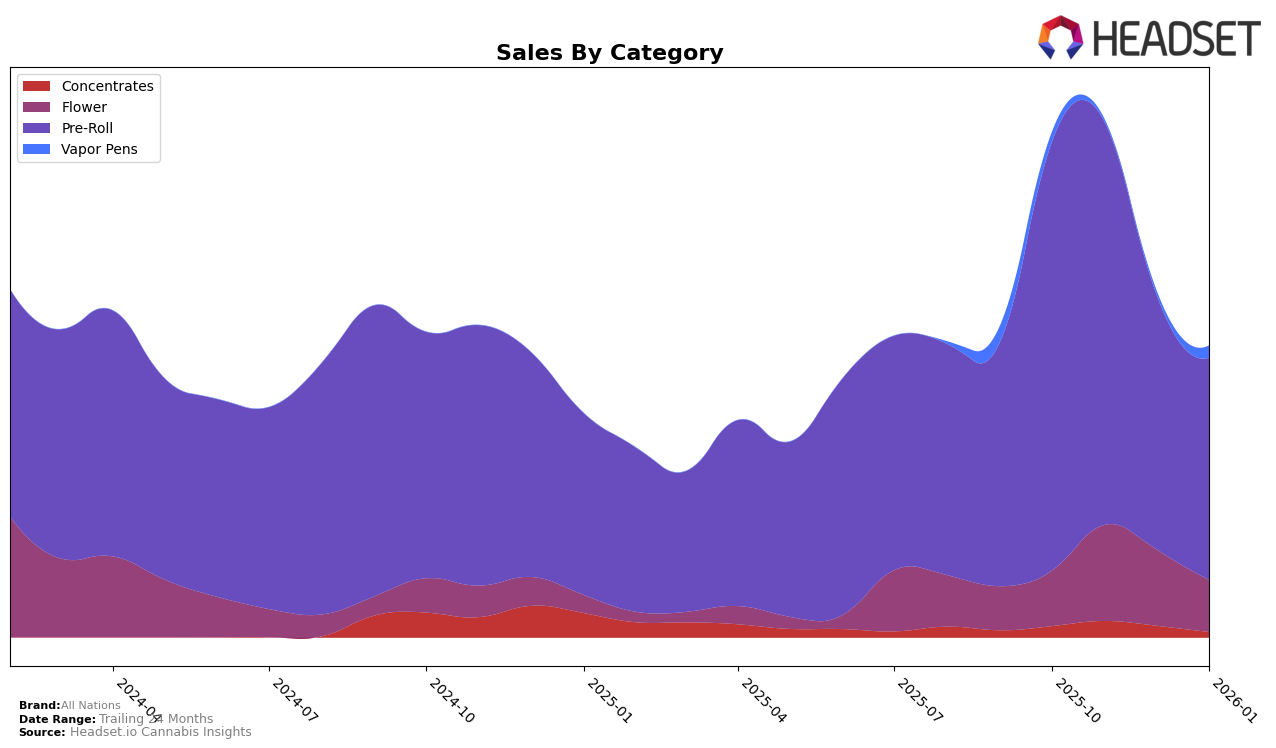

All Nations has shown a varied performance across different product categories in British Columbia. In the Concentrates category, the brand started in the top 30 but then fell out of the top rankings by January 2026, indicating a potential decline in market presence. However, the Flower category tells a different story, where All Nations has seen a consistent presence, albeit with a downward trend from October 2025 to January 2026, moving from 50th to 65th place. This movement suggests a need for strategic adjustments to regain traction in this segment.

The Pre-Roll category has been a stronghold for All Nations in British Columbia, where they maintained a top 5 rank in October 2025. However, the subsequent months saw a decline, stabilizing at 29th by January 2026. This indicates a significant drop but also shows that they have managed to stay within the top 30, which is still a competitive position. In contrast, the Vapor Pens category saw All Nations barely making it into the rankings, with a minor presence in October 2025 and then reappearing in January 2026 at 74th place. This sporadic ranking suggests a niche or fluctuating demand for their Vapor Pens products.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, All Nations has experienced significant fluctuations in its ranking over the past few months, which could impact its market positioning and sales trajectory. Starting strong in October 2025 with a rank of 5, All Nations saw a sharp decline to 24 in November and further slipped to 29 in December and January. This downward trend contrasts with the performance of competitors like BoxHot, which maintained a relatively stable rank around the 26-30 range, and BC Green, which improved its position significantly from 59 in October to a peak of 27 in December before slightly declining to 31 in January. The sales figures reflect these trends, with All Nations experiencing a notable decrease from October to January, while competitors like Common Ground and Vox showed varying degrees of growth and stability. These dynamics suggest that All Nations may need to reassess its strategies to regain its competitive edge and stabilize its sales in the evolving market.

Notable Products

In January 2026, the top-performing product for All Nations was Lemon Tartz Pre-Roll 3-Pack (1.5g), maintaining its number one rank consistently since October 2025, with sales reaching 3363 units. Sto:Lo Haze Pre-Roll 3-Pack (1.5g) also held its second-place position throughout these months. Mac Daddy Pre-Roll 3-Pack (1.5g) secured the third spot in January, climbing from fourth place in November 2025. Tropic Thunder Pre-Roll 3-Pack (1.5g) remained stable in fourth place, while Sour Lemon Tartz Infused Pre-Roll 3-Pack (1.5g) entered the rankings in January at fifth place. These rankings show a stable hierarchy among the top products, with minimal shifts in positions from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.