Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

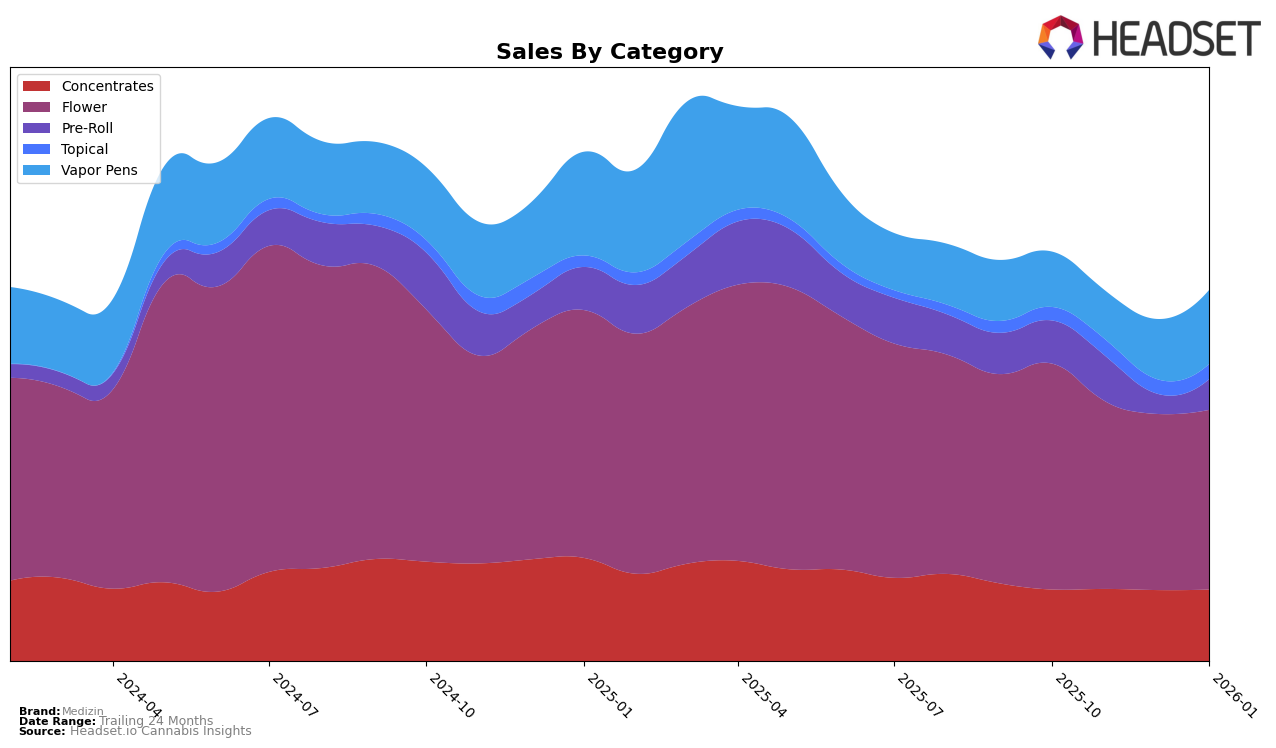

Medizin has shown a consistent performance across various categories in Nevada, with notable strengths in Concentrates and Topicals. The brand has maintained the top position in the Concentrates category from October 2025 to January 2026, indicating a strong market presence and consumer preference. Additionally, in the Topical category, Medizin has climbed to the number one spot by November 2025 and maintained it through January 2026. This stability in rankings suggests a well-established product line and effective market strategy in these categories. However, the Flower category has seen a gradual decline in ranking from third in October 2025 to fifth by January 2026, which could be a point of concern for the brand as competition intensifies.

In the Pre-Roll category, Medizin experienced fluctuations, starting at the seventh position in October 2025 and ending at ninth in January 2026, with a notable dip to the tenth position in December 2025. This suggests some volatility in this segment, possibly due to changing consumer preferences or increased competition. Conversely, the brand's performance in the Vapor Pens category has shown improvement, moving up from the fourteenth position in October 2025 to ninth by January 2026. This upward trend in Vapor Pens indicates a successful strategy in capturing market share within this growing segment. Despite not being in the top 30 in some categories in other states, the brand's robust presence in Nevada across several categories highlights its regional strength and potential for growth.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Medizin has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially holding the third position in October 2025, Medizin saw a decline to the fifth position by December 2025, where it remained through January 2026. This downward trend in rank coincided with a decrease in sales, contrasting with the upward trajectory of Alternative Medicine Association / AMA, which climbed from the fifth to the second position, and Grassroots, which improved its rank from twelfth to sixth over the same period. Meanwhile, Find. maintained a relatively stable performance, moving from sixth to fourth place, indicating a competitive pressure on Medizin to adapt its strategies to regain its lost ground. The shifting dynamics highlight the need for Medizin to innovate and potentially reevaluate its market approach to enhance its competitive edge in this evolving market.

Notable Products

In January 2026, Cap Junky 3.5g maintained its position as the top-performing product for Medizin, with sales reaching 4052 units. Silver Reserve Infused Pre-Roll 1g climbed to the second spot, showing a significant presence despite not being ranked in December 2025. Chloe 3.5g emerged as a new entrant in the rankings, securing the third position. Piescream Pre-Roll 1g, which was second in November 2025, has seen a decline, now ranking fourth. Face on Fire #9 3.5g made its debut in the rankings at the fifth position, indicating a growing interest in flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.