Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

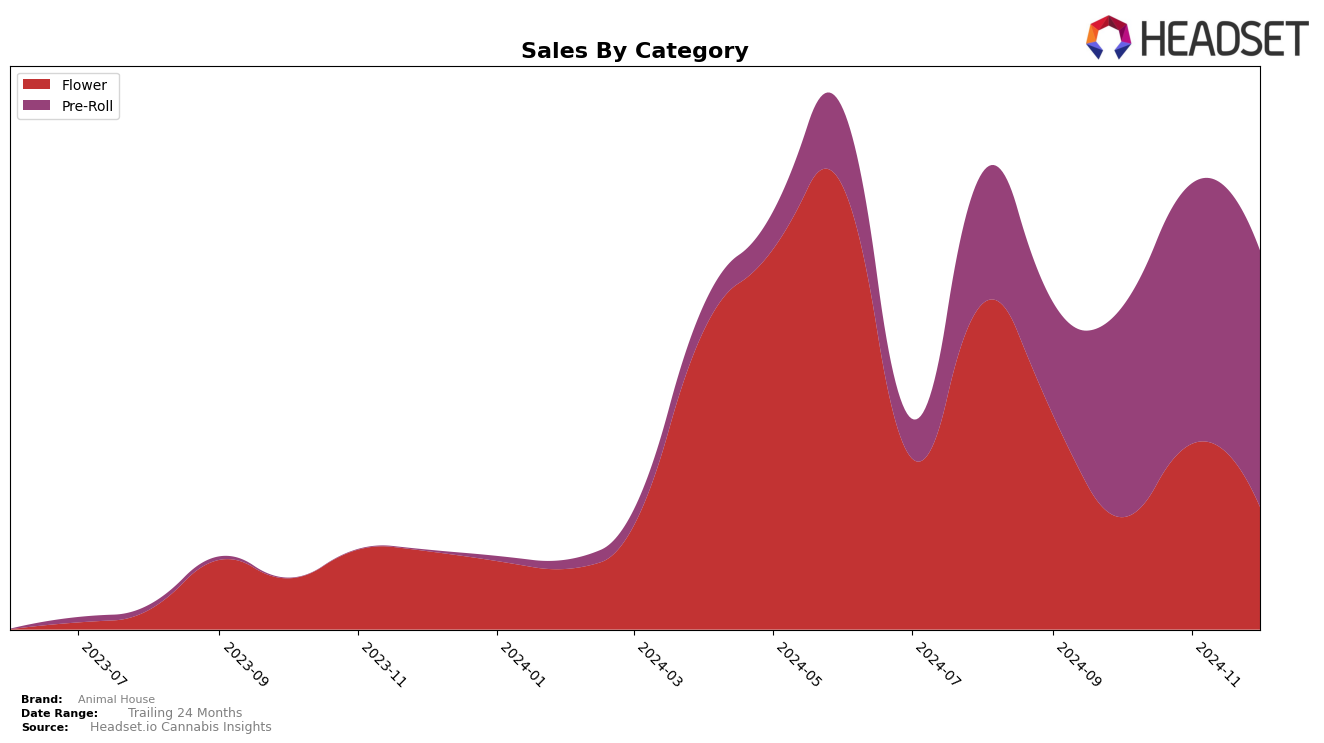

In New York, Animal House has shown a mixed performance across different cannabis categories. In the Flower category, the brand struggled to maintain a top 30 presence, with rankings fluctuating from 37th in September to 67th by December. This indicates a challenge in sustaining competitive positioning in a highly dynamic market. On the other hand, the Pre-Roll category paints a more positive picture for Animal House. The brand managed to climb from 47th in September to consistently remain in the top 30 by December, highlighting a stronger foothold and possibly a more loyal customer base in this segment. These movements suggest that while there are hurdles in some areas, there are also opportunities for growth and stabilization in others.

Animal House's sales figures provide further insight into its market performance. For instance, in the Pre-Roll category in New York, the brand saw a notable increase in sales from October to November, indicating a successful strategy or product offering during this period. However, the Flower category saw a decline in sales from September to October, which might suggest issues such as increased competition or shifts in consumer preferences. The absence of top 30 rankings in certain months for the Flower category underscores the need for strategic adjustments to regain market share. These trends highlight the importance of targeted efforts to enhance brand presence and consumer engagement in specific categories.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Animal House has shown a notable upward trajectory in its rankings from September to December 2024, moving from 47th to 30th place. This improvement is significant when compared to competitors such as Weekenders, which fluctuated between 27th and 34th place, and OHHO, which also saw a rise from 37th to 31st. Despite being absent from the top 20 in September, Animal House's sales have surged, aligning closely with those of FlowerHouse New York, which ranked between 28th and 38th. Meanwhile, Slap That S Exotics (S.T.A. Exotics) maintained a relatively stable position, ranking between 23rd and 29th. The consistent rise in Animal House's rank and sales suggests a strengthening market presence, potentially driven by strategic marketing efforts or product enhancements, positioning it as a formidable contender in the New York pre-roll market.

Notable Products

In December 2024, Animal House's top-performing product was the Lemon Cherry Gelato kief Infused Pre-Roll 3-Pack (1.5g), securing the first rank with notable sales of 1155 units. Following closely, the Gazzurple Infused Pre-Roll 3-Pack (1.5g) achieved the second rank, while Rainbow Runtz Infused Pre-Roll 3-Pack (1.5g) held the third position. Notorious Cherry Kief Infused Pre-Roll 3-Pack (1.5g) experienced a drop from its previous top position in November to fourth place in December. Gazzurple (3.5g) maintained a steady performance, ranking fifth in December, down from fourth in November. These shifts indicate a dynamic change in consumer preferences towards different pre-roll products over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.