Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

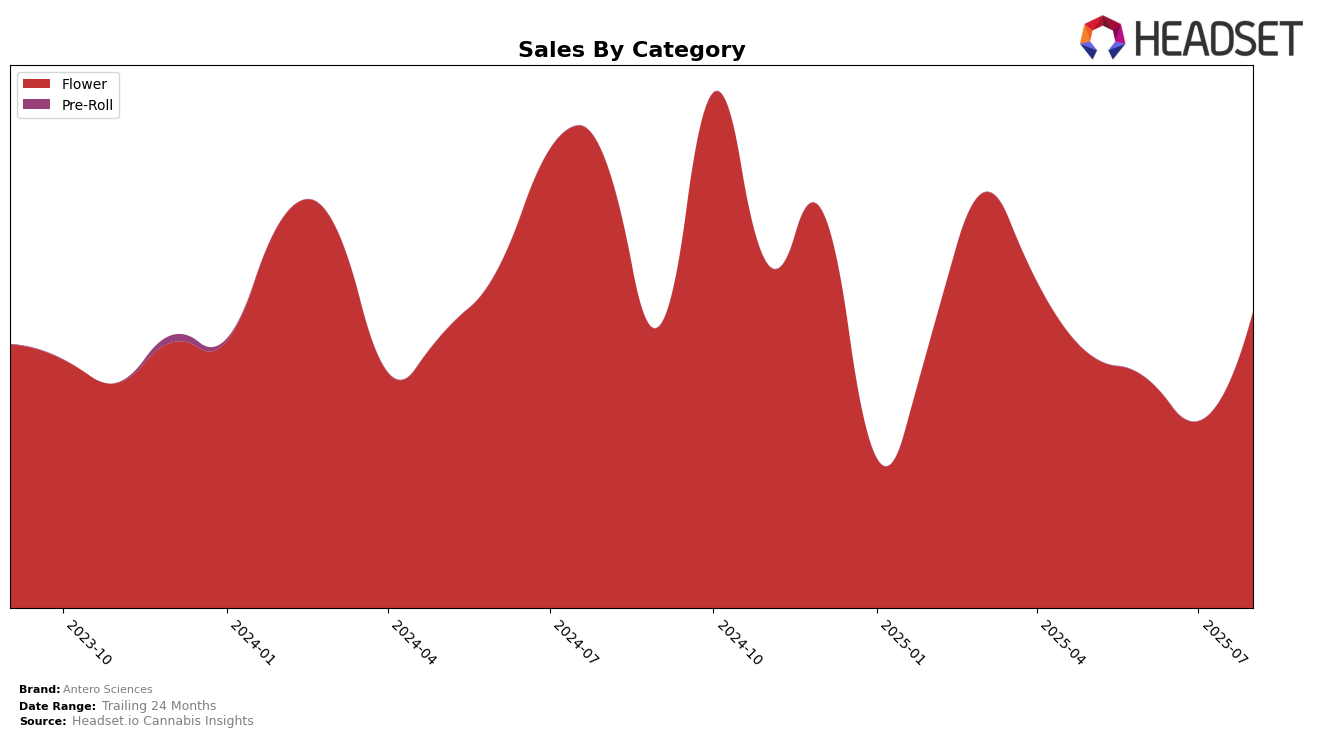

In the Colorado market, Antero Sciences has experienced notable fluctuations in the Flower category rankings over the summer of 2025. Starting in May at rank 33, the brand improved slightly to rank 32 in June. However, July saw a drop to rank 44, indicating a challenging month for the brand. This setback was followed by a significant recovery in August, as Antero Sciences climbed to rank 24, suggesting a strong rebound in performance. The August sales figures reflect this upward trend, with sales reaching $337,183, marking a substantial increase from the previous months.

While the rankings in Colorado show a promising recovery for Antero Sciences by August, the absence of rankings in the top 30 for certain months highlights areas for potential improvement. The brand's performance outside of the Flower category and in other states remains an area of interest, as further insights into these segments could provide a more comprehensive understanding of their market dynamics. Observing how Antero Sciences navigates these challenges and opportunities in the future will be crucial for assessing their long-term growth and stability in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Antero Sciences has experienced a dynamic shift in its rankings over the summer months of 2025. Notably, Antero Sciences improved its rank from 44th in July to 24th in August, demonstrating a significant upward trend in sales performance. This improvement is particularly impressive given that competitors like Bloom County and Green Farms have fluctuated in their rankings, with Bloom County dropping out of the top 20 in July and Green Farms making a notable leap from 45th in June to 17th in July. Meanwhile, Hi-Fuel and Fresh Cannabis have maintained relatively stable positions, with Fresh Cannabis consistently improving its rank each month. Antero Sciences' ability to climb the ranks amidst such volatility indicates a strengthening market presence and suggests potential for continued growth in the competitive Colorado flower category.

Notable Products

In August 2025, the top-performing product from Antero Sciences was Pez Sour Popcorn (Bulk) in the Flower category, achieving the highest sales rank. Truffle Monkey Popcorn (Bulk) followed closely, securing the second position in the same category. Doggy Style Popcorn (Bulk) made a notable climb, moving from fifth place in May to third in August, with sales figures increasing to 6,115 units. Caps Frozen Lemons (14g) debuted in the rankings at fourth place, showcasing a strong entrance. Black Velvet (3.5g), previously ranked third in July, dropped to fifth place in August, despite maintaining robust sales at 4,738 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.