Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

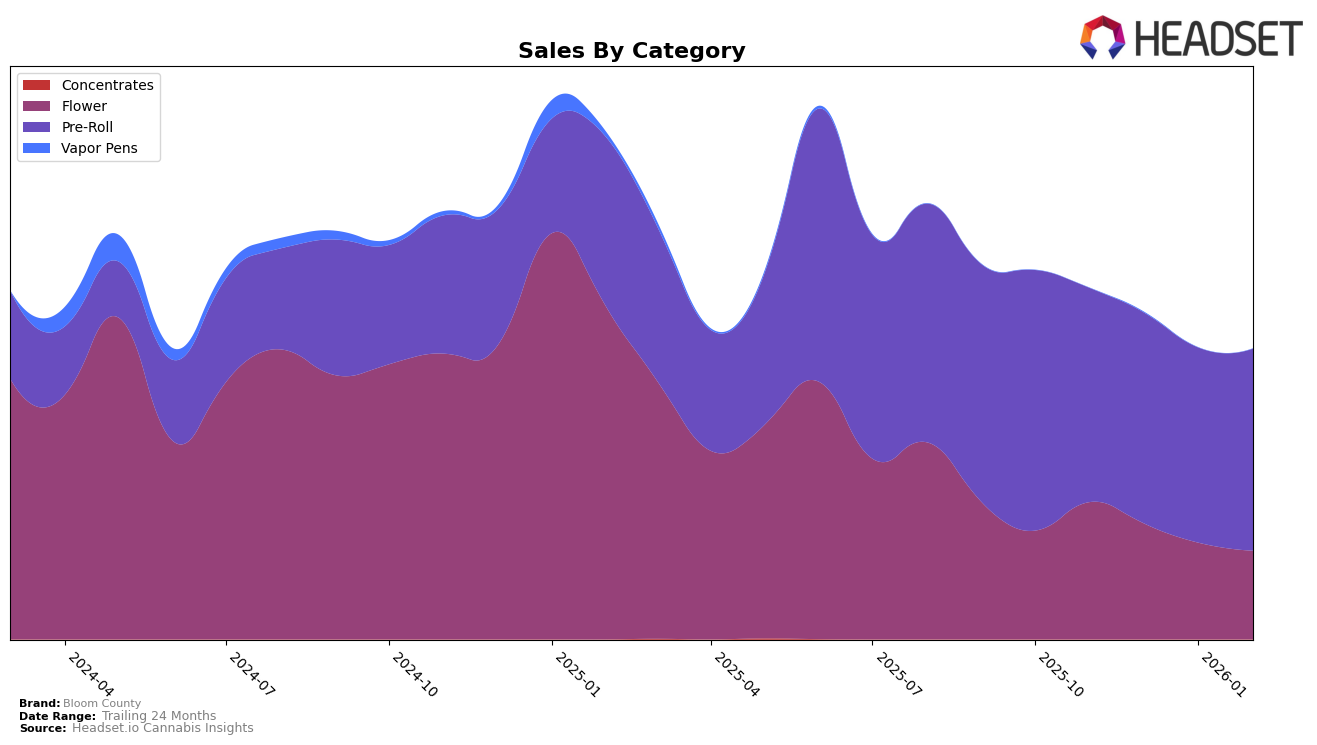

Bloom County's performance in the cannabis market has shown varied results across different categories and states. In the Colorado market, their Flower category has experienced some fluctuations in rankings. Starting at 36th place in November 2025, they dropped out of the top 30 entirely by January 2026, before recovering to 34th place by February. This suggests a challenging period for Bloom County in maintaining a competitive edge within the Flower category. On the other hand, their Pre-Roll category has demonstrated more stability, maintaining a consistent top 10 position, ranking 4th in November and holding steady at 6th place from December through February. This indicates a strong foothold in the Pre-Roll market segment in Colorado, contrasting with the Flower category's volatility.

While Bloom County's overall sales figures provide some insight, it is the shifts in rankings that tell a more compelling story of their market performance. The decline in Flower sales from November to February, from $241,193 to $155,448, reflects the challenges faced in this category, potentially due to increased competition or changing consumer preferences. Conversely, the Pre-Roll category's relatively stable sales figures suggest a loyal customer base or effective market strategy, despite a slight dip in December. The absence of Bloom County in the top 30 for Flower in January highlights the competitive nature of the market and the need for strategic adjustments to regain and maintain higher rankings. This analysis underscores the importance of category-specific strategies and the dynamic nature of the cannabis industry across different states and product segments.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll category, Bloom County has maintained a relatively stable position, ranking 6th from December 2025 through February 2026, after a slight drop from 4th place in November 2025. This consistency in rank suggests a steady performance despite fluctuations in sales figures. Notably, Seed & Strain Cannabis Co. has shown a strong presence, climbing from 6th to 4th place in December 2025 and maintaining a top 5 position, which may indicate a competitive threat to Bloom County. Meanwhile, TWAX has demonstrated significant upward mobility, moving from 7th to 4th place by February 2026, potentially challenging Bloom County's market share. Conversely, Bonsai Cultivation experienced a decline from 5th to 8th place, which could provide an opportunity for Bloom County to capitalize on shifting consumer preferences. Additionally, Spectra has shown a gradual improvement, moving from 9th to 7th place, suggesting a strengthening position in the market. These dynamics highlight the competitive pressures and opportunities for Bloom County to strategize and potentially regain a higher rank in the coming months.

Notable Products

In February 2026, Head Hunter Pre-Roll (1g) emerged as the top-performing product for Bloom County with sales reaching 13,983 units. Super Silver Haze Pre-Roll (1g) followed closely, securing the second position. Super Boof Pre-Roll (1g) dropped to third place after leading in January 2026. Apple Mints Pre-Roll (1g) entered the rankings at fourth position, while Brain Crasher Pre-Roll (1g) rounded out the top five, having been ranked third back in November 2025. Notably, Super Boof Pre-Roll (1g) experienced fluctuating rankings, moving from fifth in December 2025 to first in January 2026 before settling at third in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.