Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

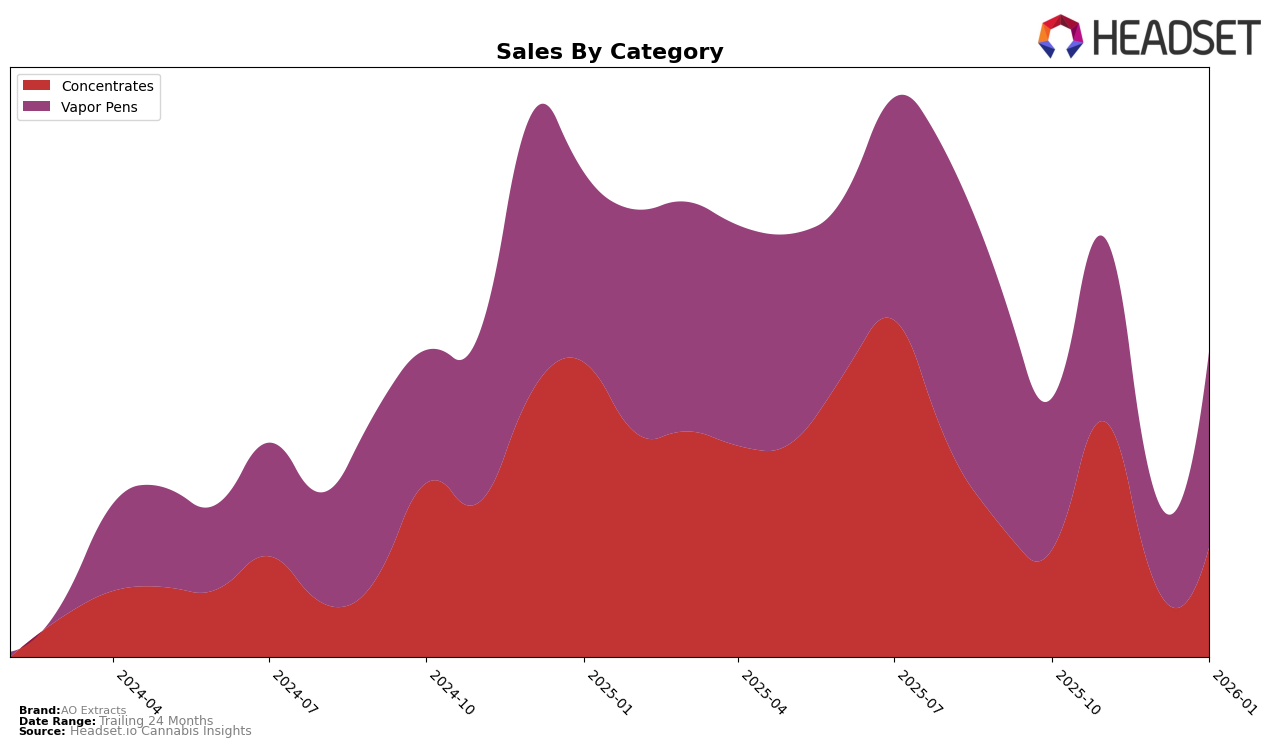

In examining the performance of AO Extracts across different categories and states, we observe some notable trends and shifts. In the Colorado market, AO Extracts has shown a fluctuating presence in the Concentrates category. The brand climbed from a rank of 21 in October 2025 to 13 in November 2025, which signals a significant improvement in market penetration. However, the subsequent drop to 26 in December 2025 indicates potential challenges in maintaining that momentum, before recovering to a rank of 20 by January 2026. Such volatility may suggest underlying competitive pressures or seasonal demand variations that the brand is navigating.

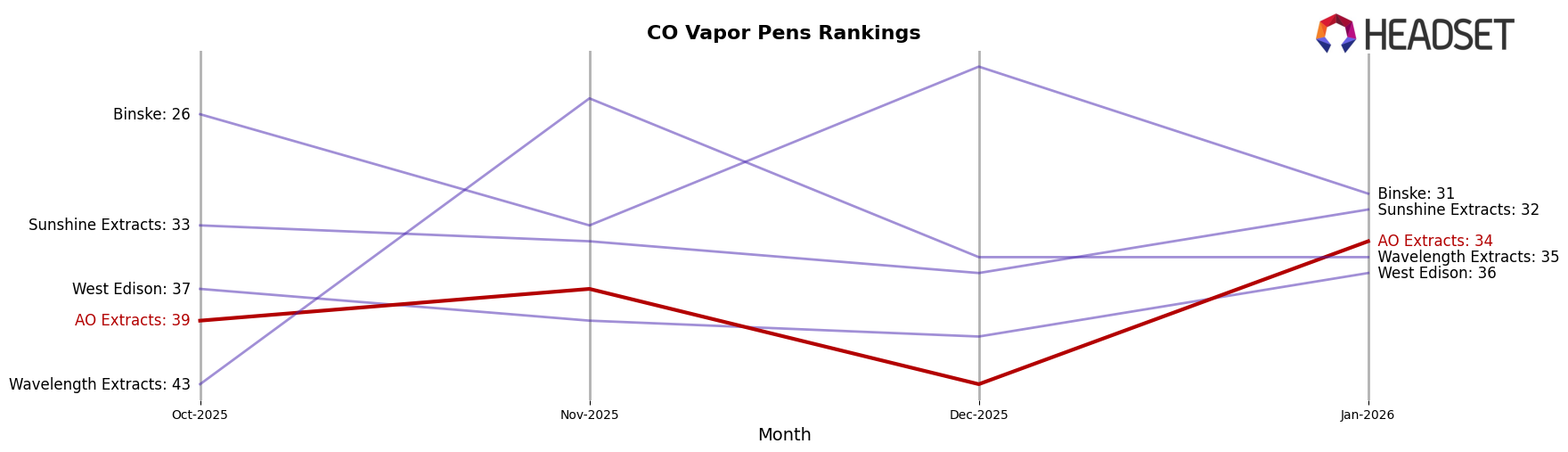

In the Vapor Pens category, AO Extracts has not yet secured a consistent top 30 position in Colorado. Despite being ranked 39th in October 2025 and improving slightly to 37th in November, the brand fell out of the top 30 by December, ranking 43rd. It is noteworthy, however, that by January 2026, AO Extracts had managed to climb back to the 34th spot, indicating a potential recovery or strategic adjustment. These movements highlight the competitive nature of the Vapor Pens market and suggest that while AO Extracts is making strides, there is still considerable room for growth and stabilization.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, AO Extracts has been navigating a dynamic market with fluctuating ranks over the past few months. Notably, AO Extracts improved its rank from 39th in October 2025 to 34th by January 2026, indicating a positive trend in market positioning. This improvement is significant when compared to competitors like Binske, which saw a drop from 26th to 31st in the same period, and West Edison, which remained relatively stable but lower in rank. Meanwhile, Sunshine Extracts and Wavelength Extracts have shown varied performances, with Wavelength Extracts experiencing a notable leap to 25th in November before settling at 35th in January. Despite a dip in December, AO Extracts' sales rebounded in January, suggesting resilience and potential for further growth, especially as it outpaces some competitors in sales recovery.

Notable Products

In January 2026, the top-performing product for AO Extracts was Mango Money Distillate Cartridge 1g, which secured the first rank with notable sales of 947 units. Following closely, Blue Raz Distillate Cartridge 1g ranked second, although it saw a decline from its previous first position in October 2025. Apples and Bananas Distillate Cartridge 1g moved up to third place, showing a consistent presence in the top ranks since November 2025. Banana Runtz Distillate Cartridge 1g maintained its position in the top five, ranking fourth, while Grape Runtz Distillate Cartridge 1g entered the top ranks at fourth place for the first time. The Vapor Pens category continues to dominate the sales landscape for AO Extracts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.