Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

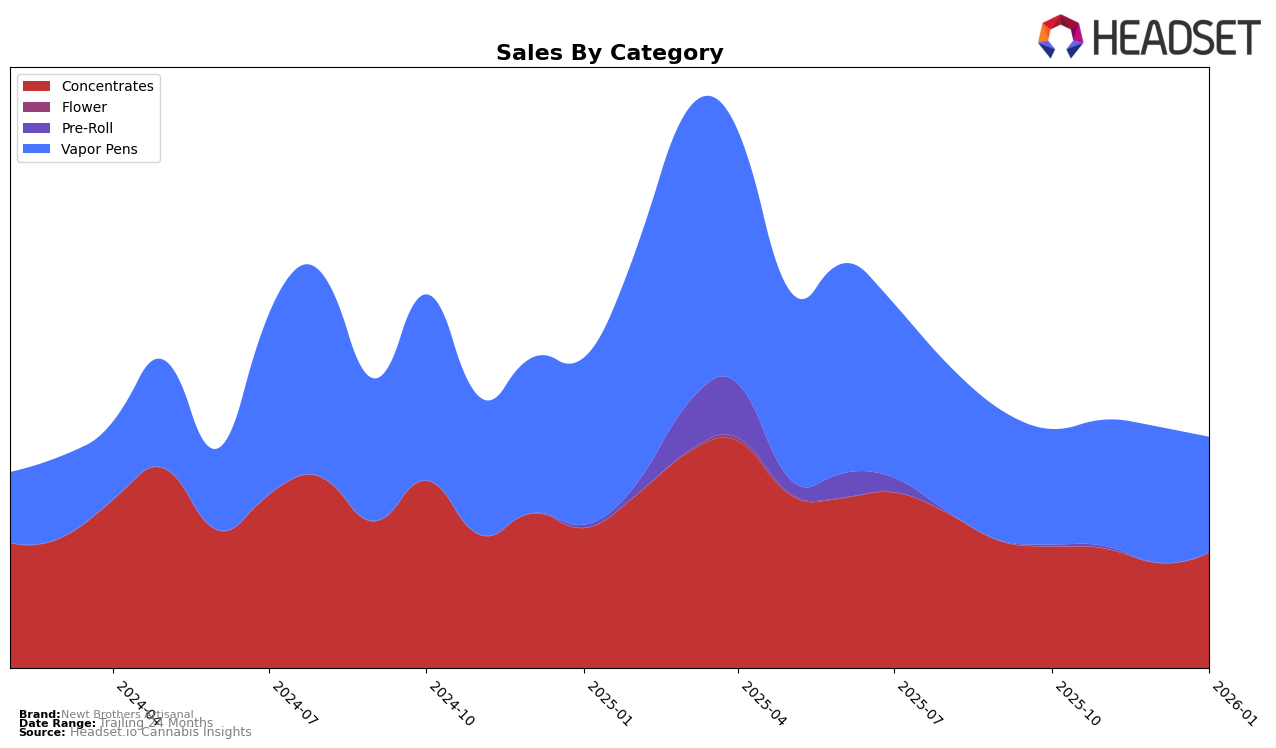

Newt Brothers Artisanal has shown a consistent performance in the Concentrates category in Colorado, with a notable improvement in rankings from October 2025 to January 2026. The brand moved from a rank of 32 in October to 29 in January, indicating a positive upward trend. This steady rise into the top 30 highlights their growing presence and competitiveness in the market. The sales figures reflect a slight fluctuation, with a dip in December but a recovery in January, suggesting resilience and potential for further growth in this category.

In the Vapor Pens category, Newt Brothers Artisanal has not yet secured a position within the top 30 in Colorado. Despite being ranked 56th in October and improving slightly to 52nd in November and December, the brand did not maintain its upward trajectory and slipped to 53rd in January. This indicates a more challenging market environment for the brand in this category, which could be attributed to increased competition or changing consumer preferences. Nevertheless, the sales data shows a peak in December, suggesting that there is still consumer interest and potential for future growth if the brand can capitalize on market opportunities.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Newt Brothers Artisanal has shown a steady improvement in its rankings, moving from 32nd place in October 2025 to 29th place by January 2026. This upward trend suggests a positive reception of their products, despite being outpaced in sales by competitors such as Seed and Smith (LBW Consulting) and The Greenery Hash Factory, which consistently maintained higher ranks. Notably, Next1 Labs LLC experienced a decline in sales, dropping from 29th to 32nd place, which may present an opportunity for Newt Brothers Artisanal to capture more market share. Meanwhile, White Mousse showed a significant jump from 38th to 30th place in January 2026, indicating a potential resurgence that Newt Brothers Artisanal should monitor closely. Overall, the data suggests a competitive but promising environment for Newt Brothers Artisanal to continue its growth trajectory in the Colorado concentrates category.

Notable Products

In January 2026, the top-performing product for Newt Brothers Artisanal was Dancing Bear Kush Axolotl Sugar Wax (1g) in the Concentrates category, maintaining its number one rank from December 2025 with notable sales of 835 units. Garlic Tootzy Axolotl Shatter (1g), also in Concentrates, held its second-place position from the previous month with consistent performance. MAC Sugar Wax (1g) improved its ranking from fourth in December 2025 to tie for second in January 2026, indicating a rise in popularity. Rainbow Ice Cream Axolotl Sugar Wax (1g) debuted in the rankings at third place, showcasing strong initial sales. Blueberry Banana Pancakes Live Resin Cartridge (1g) entered the list at fourth in the Vapor Pens category, highlighting a successful product launch.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.