Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

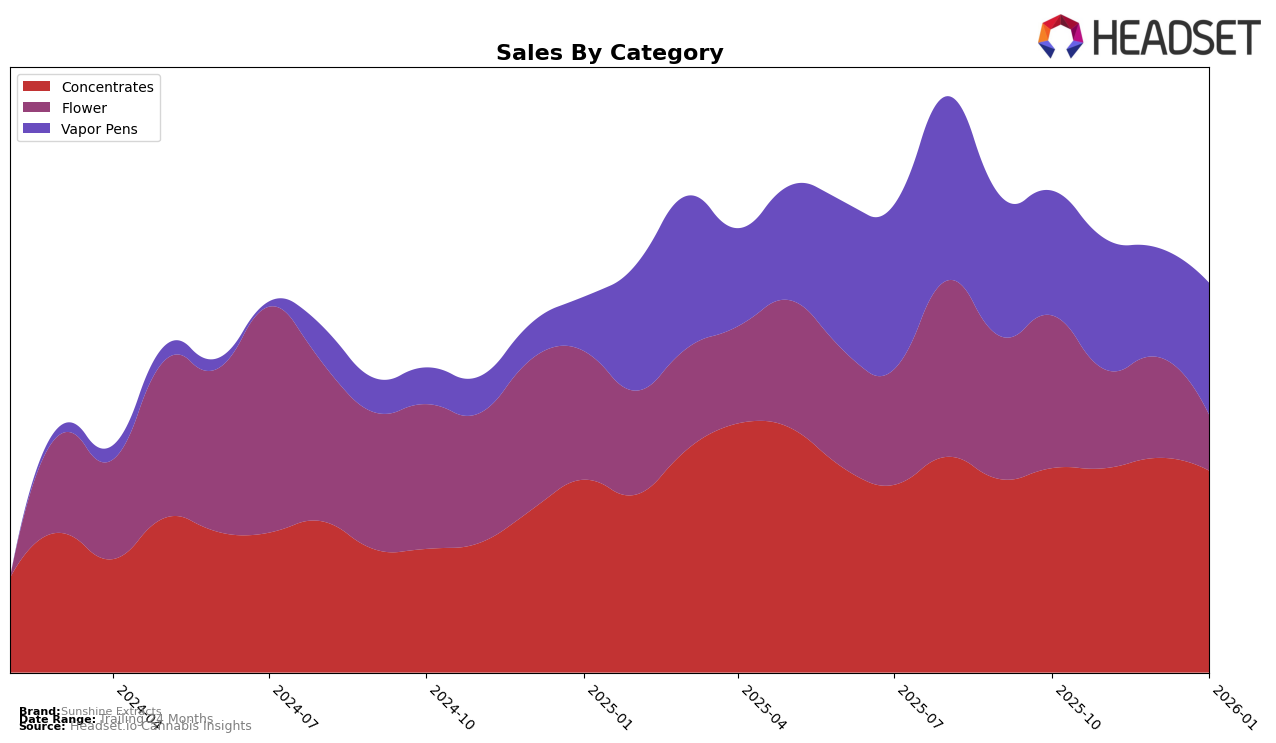

Sunshine Extracts has maintained a consistent performance in the Colorado concentrates category, holding steady at the 6th position from October 2025 through January 2026. This stability suggests a robust presence in the concentrates market, despite a slight fluctuation in sales figures, with a peak in December 2025. In contrast, their performance in the flower category has seen a downward trend, slipping from the 34th rank in October 2025 to 58th by January 2026, indicating potential challenges in maintaining competitiveness or consumer interest in this segment.

In the vapor pens category, Sunshine Extracts experienced some variability, starting at the 33rd position in October 2025, dipping slightly, and then recovering to 32nd by January 2026. This suggests a potential for growth in this segment, as they managed to improve their ranking despite the competitive landscape. However, the absence of Sunshine Extracts from the top 30 brands in the flower category during the observed months highlights a significant area for improvement. This disparity between categories underscores the importance of strategic adjustments to bolster their presence across different product lines.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Sunshine Extracts consistently maintained its 6th place rank from October 2025 to January 2026, showcasing stable performance amidst fluctuating sales figures. Despite a slight dip in sales from December 2025 to January 2026, Sunshine Extracts held its ground against competitors, such as Billo, which experienced more volatile rank changes, dropping to 12th in November before rebounding to 7th. Meanwhile, Green Dot Labs and Spectra consistently outperformed Sunshine Extracts, maintaining higher ranks at 4th and 5th, respectively, although Sunshine Extracts' sales were competitive, particularly against Denver Dab Co, which remained in 8th place. This stability in rank suggests that Sunshine Extracts has a solid customer base and brand loyalty, positioning it well for strategic growth and potential market share gains in the future.

Notable Products

In January 2026, Sunshine Extracts saw GMO Rootbeer Live Rosin Disposable (0.5g) as their top-performing product, ranking first among all offerings with a notable sales figure of 839 units. Grease Bucket (3.5g) improved its ranking significantly, climbing from fifth place in December 2025 to second place in January 2026. Tally Mon Live Rosin Disposable (0.5g) debuted strong, securing the third position, while Zeldaz (3.5g) and Black Maple Live Rosin Disposable (0.5g) followed in fourth and fifth places respectively. This shift in rankings highlights a growing consumer preference for vapor pens, with three out of the top five products belonging to this category. Overall, the sales trends suggest a dynamic market with changing consumer tastes, particularly favoring new and innovative vapor pen products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.