Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

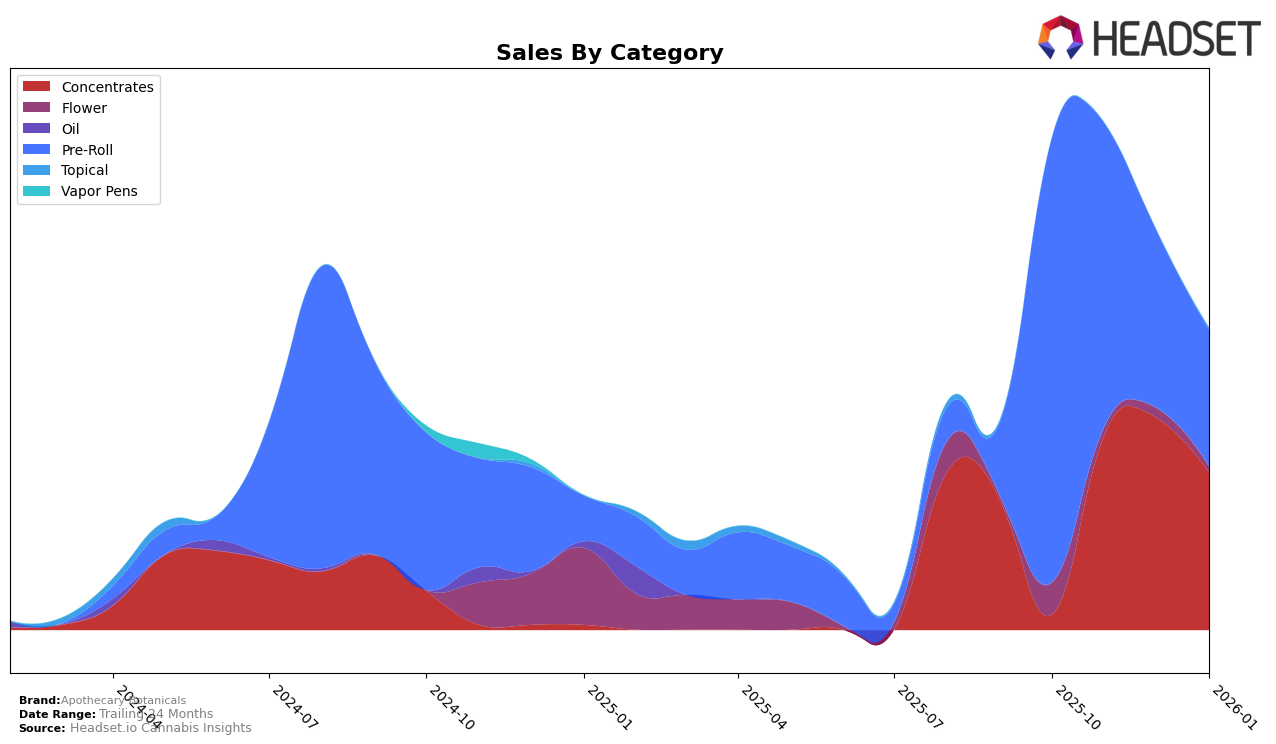

Apothecary Botanicals has shown a varied performance across different product categories and regions. In the Concentrates category within British Columbia, the brand managed to climb the rankings from 36th in November 2025 to 33rd in December 2025, before slightly dropping to 34th in January 2026. This movement indicates a relatively stable presence in the market, although not breaking into the top 30 suggests there is room for improvement. The sales figures reflect this trend, with a notable increase from October to November, followed by a decline in December, which could be indicative of seasonal fluctuations or competitive pressures.

In the Pre-Roll category, also within British Columbia, Apothecary Botanicals did not make it into the top 30 rankings, as evidenced by their 70th position in October 2025. This absence from the top rankings over the subsequent months suggests a challenging market landscape or perhaps a strategic shift in focus away from this category. The initial sales figure in October shows a significant volume, but without subsequent data, it's difficult to ascertain whether this was an anomaly or part of a broader trend. The brand's performance across these categories highlights the dynamic nature of the cannabis market in British Columbia and the importance of strategic positioning to capture market share.

Competitive Landscape

In the competitive landscape of the British Columbia concentrates market, Apothecary Botanicals has shown a steady presence, although it did not make the top 20 in October 2025. By November 2025, it ranked 36th, improving to 33rd by December, and slightly dropping to 34th in January 2026. This trajectory indicates a relatively stable position amidst fluctuating competition. Notably, Western Cannabis experienced a significant drop from 11th in October to 33rd by January, while Solid Gold saw a decline from 27th to 35th over the same period. Meanwhile, Thrifty improved its rank from 38th in November to 32nd by January. These shifts suggest that while Apothecary Botanicals faces strong competition, particularly from brands like Western Cannabis and Solid Gold, its consistent sales performance positions it well for potential upward mobility in the rankings.

Notable Products

In January 2026, Apothecary Botanicals' top-performing product was The Du-O Flower Rosin 2-Pack (1g) in the Concentrates category, maintaining its first-place ranking from the previous two months despite a decline in sales to 554 units. The Galactic Cake Pre-Roll 3-Pack (1.5g) rose to second place with sales of 226 units, marking a notable improvement from its fourth-place ranking in November. Grease Monkey Pre-Roll 3-Pack (1.5g) dropped to third place, continuing its downward trend from the top spot in October. Gelato Pre-Roll (1g) secured fourth place, showing a consistent presence in the top rankings since October. Meanwhile, the Gelato Pre-Roll 3-Pack (1.5g) remained steady in fifth place, despite a gradual decrease in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.