Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

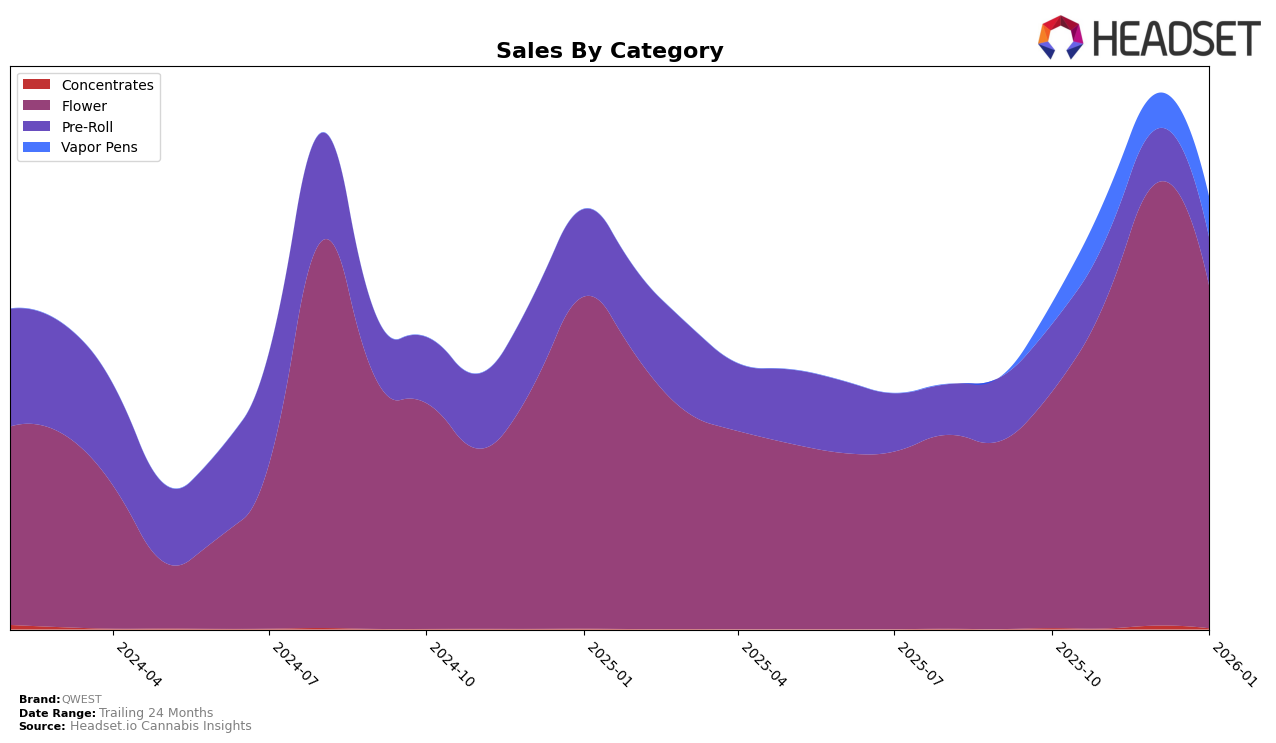

QWEST has shown varied performance across different categories and provinces, indicating a strong presence in some areas and room for growth in others. In Alberta, the brand has maintained a fairly consistent ranking in the Flower category, peaking at 11th in December 2025 before dropping to 15th by January 2026. This suggests a competitive landscape where QWEST is holding its ground. However, their performance in the Pre-Roll and Vapor Pens categories in Alberta has been less impressive, with rankings consistently outside the top 30, indicating potential challenges in these segments. In contrast, Saskatchewan has been a strong market for QWEST Flower, where the brand climbed to the 2nd position in December 2025, demonstrating significant market traction and consumer preference in this region.

In Ontario, QWEST has seen an upward trajectory in the Flower category, improving its ranking from 59th in October 2025 to 43rd by January 2026. This upward trend could indicate increasing brand recognition and consumer acceptance. However, their performance in Pre-Rolls and Vapor Pens has been less remarkable, with rankings not breaking into the top 30 until January 2026 for Vapor Pens. Meanwhile, in British Columbia, QWEST's Flower category entered the top 60 in December 2025, suggesting a gradual market penetration. These movements across different provinces highlight the brand's potential to capitalize on its strengths and address areas where it lags behind competitors.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, QWEST has demonstrated a notable upward trajectory in brand ranking and sales performance. From October 2025 to January 2026, QWEST improved its rank from 7th to 3rd, showcasing a significant climb amidst strong competition. This upward movement in rank is accompanied by a substantial increase in sales, peaking in December 2025. Despite not surpassing the leading brand, Back Forty / Back 40 Cannabis, which consistently held the top position, QWEST has outpaced other competitors such as Big Bag O' Buds and The Loud Plug. Notably, Bold has also shown improvement, moving from 15th to 5th, indicating a dynamic market environment. QWEST's strategic advancements in rank and sales highlight its growing influence and competitive edge in the Saskatchewan Flower market.

Notable Products

In January 2026, Georgia Pie (7g) maintained its position as the top-selling product for QWEST, continuing its streak from November and December 2025, with sales figures reaching 6424. Grape Cream Cake (7g) consistently held the second rank from October 2025 through January 2026, showing steady sales growth. Black Cherry Guava (7g) remained the third best-seller, unchanged from December 2025, despite a slight decrease in sales. The Georgia Pie Pre-Roll 10-Pack (3.5g) also retained its position at fourth place, showing stable sales performance over the months. A new entry in January 2026, Georgia Pi Live Resin Cartridge (1g), debuted at the fifth position, highlighting a potential area of growth for QWEST in the vapor pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.