Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

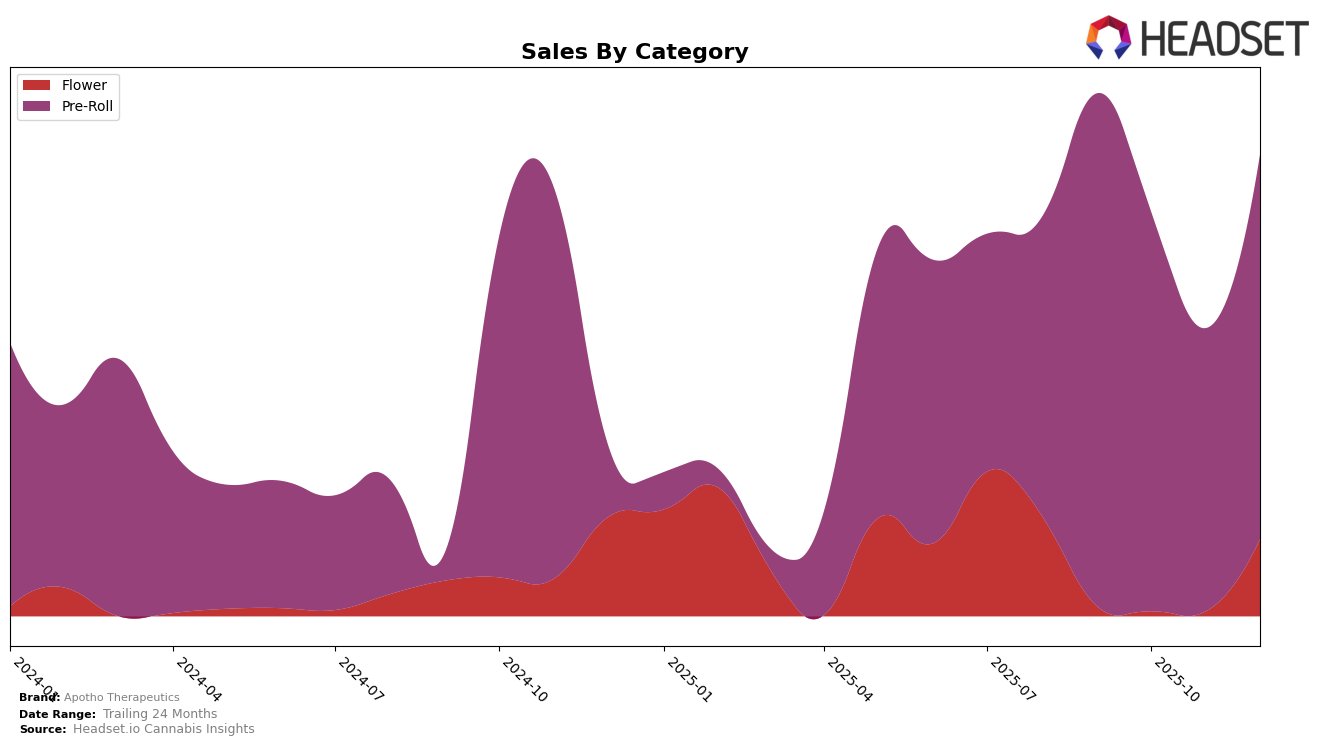

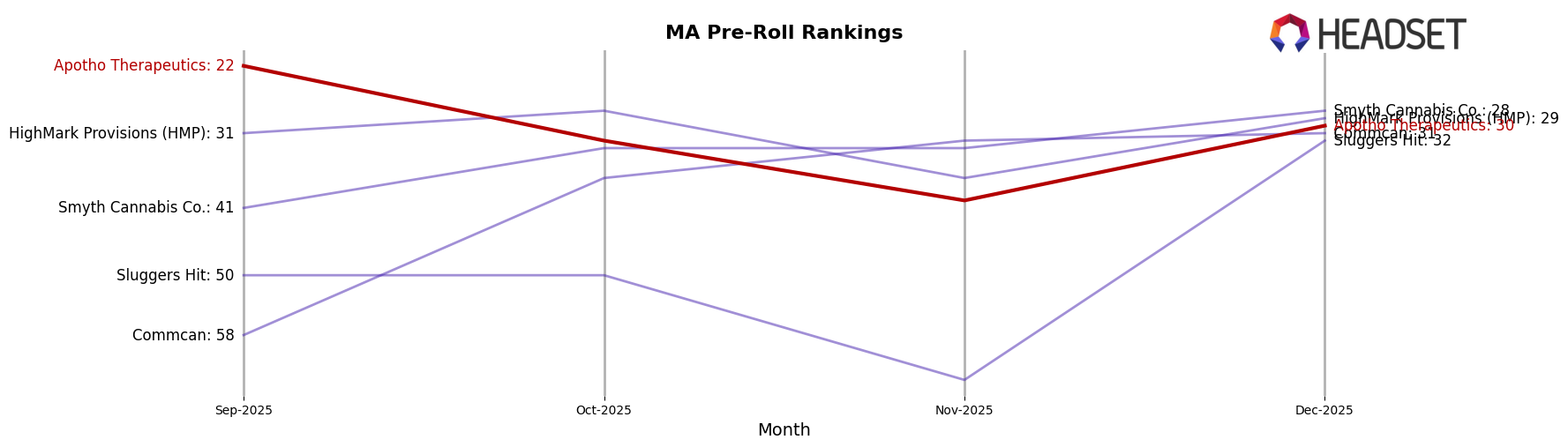

In the competitive landscape of cannabis brands, Apotho Therapeutics has shown varied performance across categories and regions. In the Massachusetts market, their presence in the Pre-Roll category has seen fluctuations. Notably, they were ranked 22nd in September 2025, but dropped out of the top 30 in October and November, before making a comeback to the 30th position by December. This movement indicates a potential struggle to maintain consistent market presence, although their return to the rankings by December could suggest a strategic adjustment or seasonal demand influencing their sales trajectory.

While Apotho Therapeutics experienced a decline in sales from September to November, there was a recovery in December, with sales figures showing an upward trend from the previous month. This rebound may be indicative of successful promotional efforts or product innovations that resonated with consumers during the holiday season. The absence of a ranking in October and November highlights the intense competition within the Pre-Roll category in Massachusetts, suggesting that Apotho Therapeutics may need to enhance their market strategies to sustain and improve their standing in the coming months.

Competitive Landscape

In the Massachusetts Pre-Roll category, Apotho Therapeutics experienced notable fluctuations in its competitive positioning from September to December 2025. Initially ranked 22nd in September, Apotho saw a decline to 32nd in October and further slipped to 40th in November, before recovering slightly to 30th in December. This downward trend in rankings coincided with a decrease in sales, suggesting a challenging period for the brand. In contrast, competitors such as Smyth Cannabis Co. and HighMark Provisions (HMP) showed more stable or improving performance, with Smyth Cannabis Co. climbing from 41st to 28th and HighMark Provisions maintaining a relatively steady presence, despite a brief dip in November. These dynamics highlight the competitive pressures Apotho faces, emphasizing the need for strategic adjustments to regain market share and improve sales performance in this rapidly evolving market.

Notable Products

In December 2025, Blue Dream Pre-Roll (1g) emerged as the top-performing product for Apotho Therapeutics, climbing from fourth place in September to secure the number one spot with sales reaching 5,841 units. Maui Mac-nut Pre-Roll (1g) made a notable debut in the rankings, securing the second position with strong sales figures. Candy Milk Pre-Roll (1g) dropped from its second place in September to third in December, indicating a slight decline in its relative performance. White Burgundy Pre-Roll (1g) and Panama Red Pre-Roll (1g) filled the fourth and fifth spots, respectively, marking their entry into the top five for the first time. Overall, the pre-roll category dominated the sales for December, showcasing significant shifts in product popularity from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.