Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

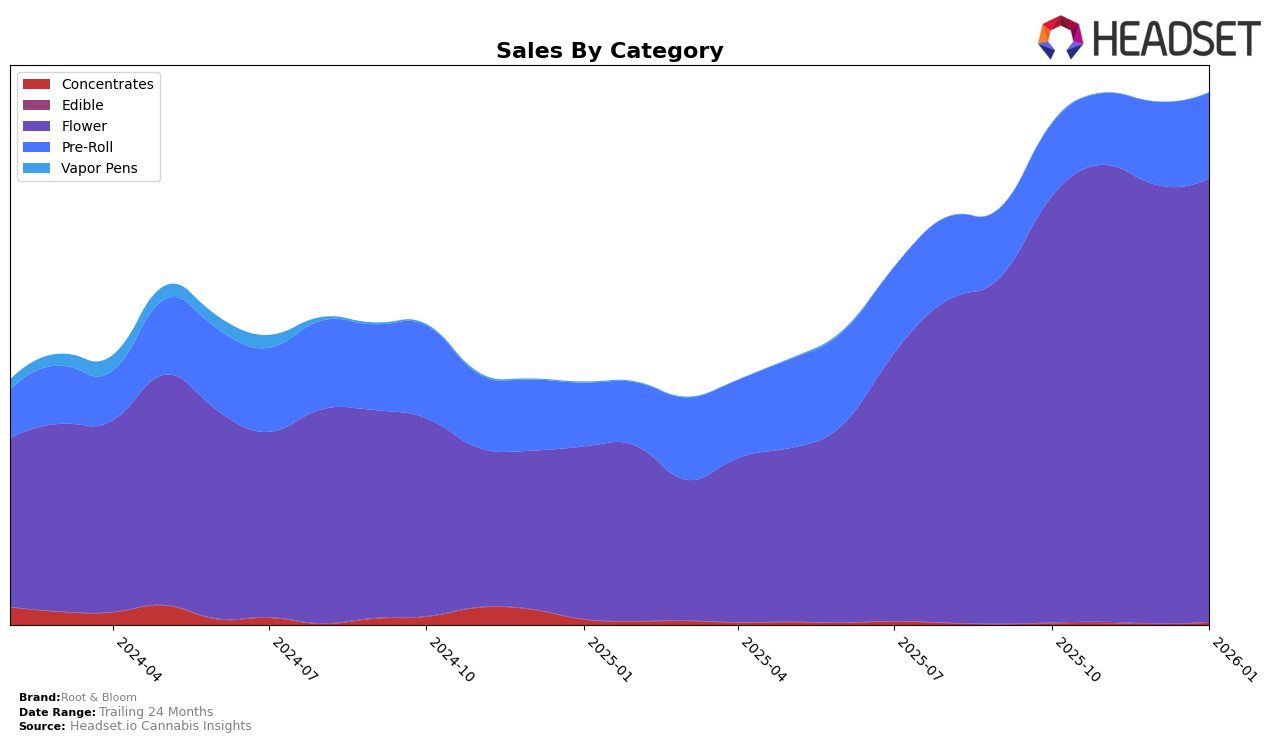

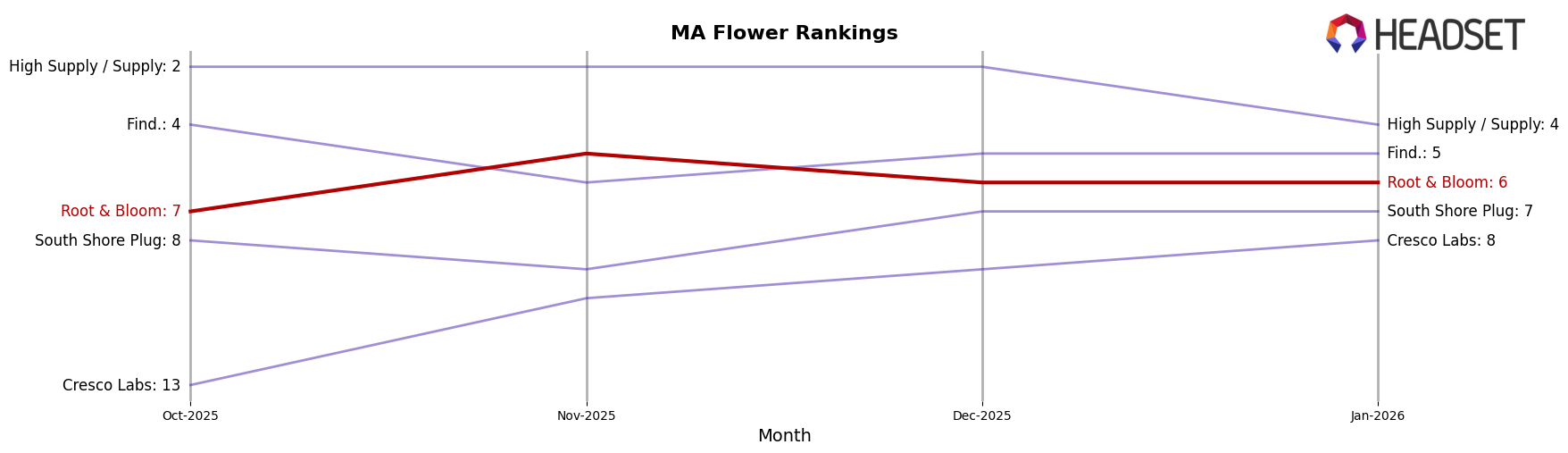

Root & Bloom has shown notable performance in the Massachusetts market, particularly within the Flower category. Over the four-month period from October 2025 to January 2026, Root & Bloom maintained a strong presence, consistently ranking within the top 10 brands. Starting at 7th place in October, the brand climbed to 5th in November before stabilizing at 6th place in both December and January. This stability in rankings, coupled with a steady increase in sales from October to November, indicates a robust consumer demand and effective market positioning within the Flower category. However, a slight dip in sales from November to December suggests there might be seasonal or competitive factors at play.

In contrast, the brand's performance in the Pre-Roll category in Massachusetts reveals a different trajectory. Initially ranked at 26th place in both October and November, Root & Bloom made a significant leap to 19th place by January 2026. This upward movement in rankings, alongside increased sales figures from November to January, highlights a growing acceptance and popularity of their Pre-Roll products. Despite not being in the top 20 at the start, the brand's ability to break into the top 20 by January is a positive indicator of its expanding market share in this category. However, the initial lower rankings suggest there might be room for growth and improvement in their market strategy or product offerings in the Pre-Roll segment.

Competitive Landscape

In the Massachusetts flower category, Root & Bloom has maintained a relatively stable position, ranking between 5th and 7th from October 2025 to January 2026. Despite facing stiff competition, Root & Bloom's sales have shown consistent growth, peaking in November 2025. Notably, High Supply / Supply has been a dominant player, consistently holding the 2nd position until January 2026, when it dropped to 4th, indicating a potential opportunity for Root & Bloom to climb higher. Meanwhile, Cresco Labs has demonstrated a steady upward trend, moving from 13th to 8th place, which could pose a future threat if their growth continues. Find. has remained relatively stable around the 5th position, closely competing with Root & Bloom. The consistent performance of Root & Bloom amidst these dynamics suggests resilience and potential for further growth in the competitive Massachusetts market.

Notable Products

In January 2026, the top-performing product for Root & Bloom was the Wedding Cake Pre-Roll (1g) in the Pre-Roll category, climbing to the number one rank with sales of 8890 units. Ghost Dawg Pre-Roll (1g) made a notable entry into the rankings, securing the second spot. Durban Margy Pre-Roll (1g) fell to third place, despite previously holding the top rank in December 2025. Lemon OG Haze Pre-Roll (1g) maintained its position at fourth place for two consecutive months. Wedding Cake (3.5g) experienced a decline, dropping to fifth place from its third position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.