Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

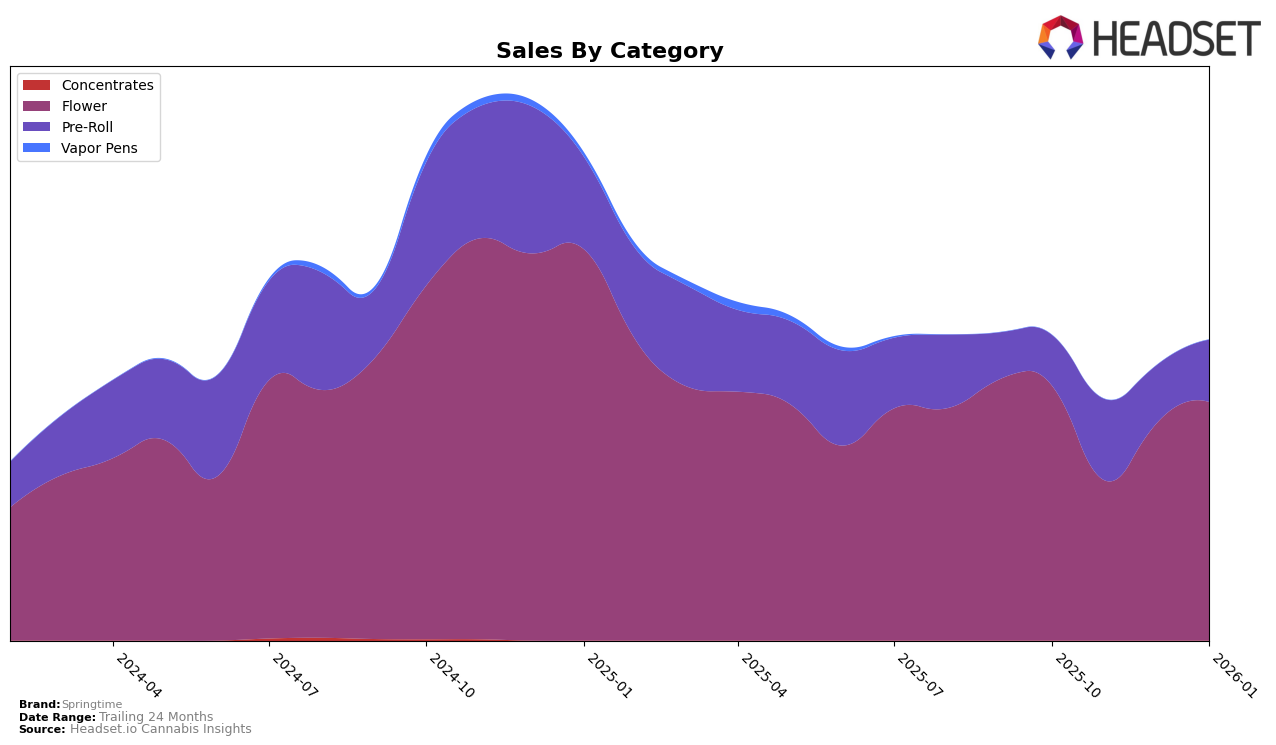

Springtime has shown varied performance across different categories and states, reflecting a mix of strengths and challenges. In the Connecticut market, Springtime's Flower category experienced a decline, slipping from 15th place in October 2025 to being absent from the top 30 in November, and then stabilizing at 19th place in December and January. This indicates a potential struggle to maintain competitive positioning in the Flower segment. Conversely, their Pre-Roll category in Connecticut saw a more positive trajectory, achieving a top 10 ranking in November and maintaining a strong presence with 10th place in January, suggesting a robust demand for their Pre-Roll offerings.

In Massachusetts, Springtime's performance in the Flower category fluctuated, with a notable drop from 24th to 44th place between October and November 2025, before recovering to 28th place by January 2026. This recovery could point to strategic adjustments or market conditions favoring their Flower products. However, their Pre-Roll category did not fare as well, with rankings sliding from 35th to 54th place over the same period, which might highlight competitive pressures or shifting consumer preferences. In Michigan, the Flower category showed a promising upward trend, climbing from 81st to 46th place by January, indicating growing market acceptance and potential for future growth.

Competitive Landscape

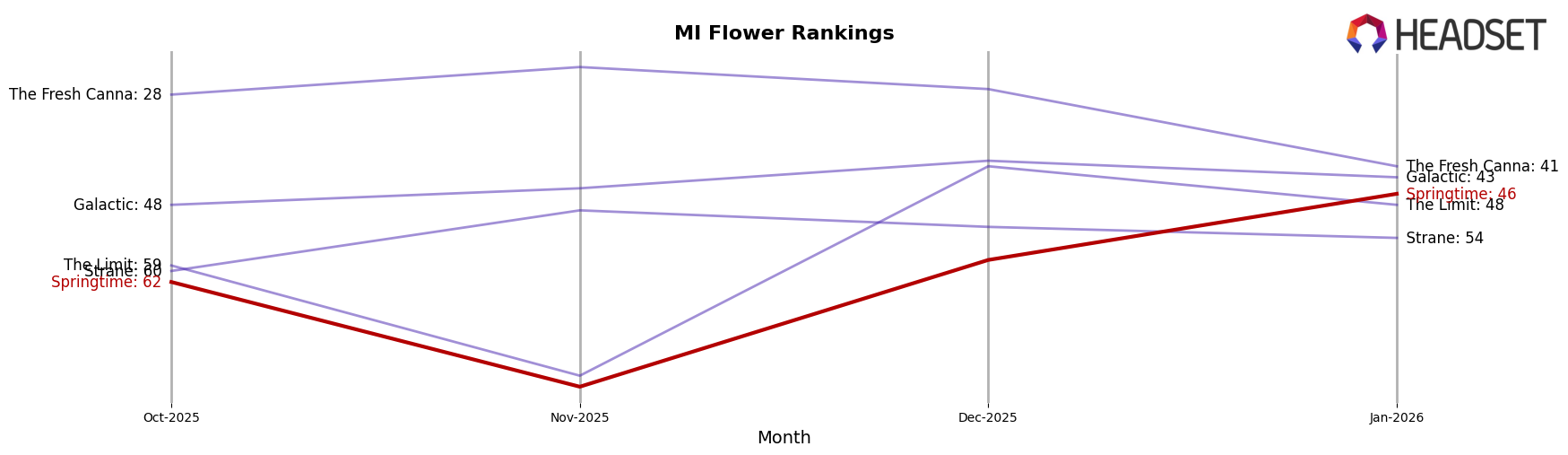

In the Michigan flower category, Springtime has shown a notable shift in its competitive positioning over the past few months. Starting from a rank of 62 in October 2025, Springtime experienced a dip to 81 in November, but then made a significant recovery to 46 by January 2026. This fluctuation suggests a competitive market landscape where brands like The Limit and Galactic have also seen changes in their rankings, with The Limit notably improving from 79 to 48 and Galactic maintaining a relatively stable position. Despite these fluctuations, Springtime's sales have shown a positive trend, culminating in its highest sales in January 2026. Meanwhile, The Fresh Canna consistently outperformed Springtime in both rank and sales, indicating a strong market presence. This dynamic suggests that while Springtime is gaining ground, it faces stiff competition from established brands, highlighting the importance of strategic marketing and product differentiation to enhance its market position.

Notable Products

In January 2026, the top-performing product from Springtime was Glitter Bomb (3.5g) in the Flower category, ranking first with sales of 6383 units. Following closely is Apple Fritter #3 Pre-Roll (1g), which secured the second position. Lemon Jack Pre-Roll (1g) moved from second place in December 2025 to third in January 2026, showing a slight decline in rank despite maintaining strong sales. Canal Street Runtz (3.5g) and Permanent Chimera #2 (3.5g) rounded out the top five, ranking fourth and fifth respectively. These rankings highlight a consistent preference for Flower and Pre-Roll categories among consumers, with notable shifts in positioning compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.