Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

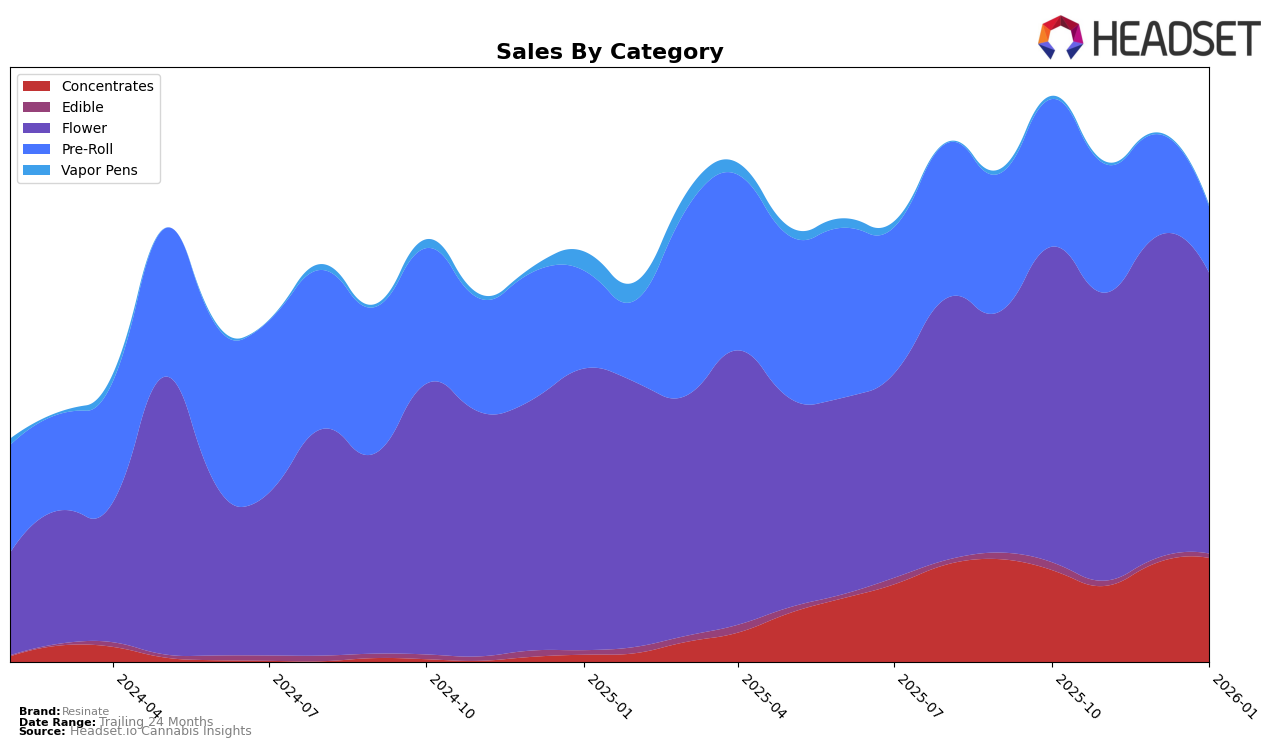

In reviewing Resinate's performance across various categories in Massachusetts, the brand shows notable consistency in the Concentrates category, maintaining a steady rank of 7th from October 2025 through January 2026. This stability is accompanied by a positive trend in sales, peaking in January 2026. Conversely, the Flower category reflects a more fluctuating performance, with Resinate hovering around the mid-20s in rank, suggesting competitive challenges. Despite a dip in sales in January 2026, the brand managed to climb in rank slightly in December, indicating a potential for recovery or strategic adjustments that could be capitalized on.

The Pre-Roll category presents a more concerning trajectory for Resinate, where the brand's rank dropped significantly from 29th in October 2025 to 63rd by January 2026. This decline in rank is mirrored by a substantial decrease in sales, highlighting a potential area for improvement or strategic reevaluation. The absence of Resinate from the top 30 in January 2026 in this category suggests increased competition or a shift in consumer preferences that the brand needs to address. These insights provide a mixed outlook for Resinate's market presence, with strengths in some areas and opportunities for growth in others.

Competitive Landscape

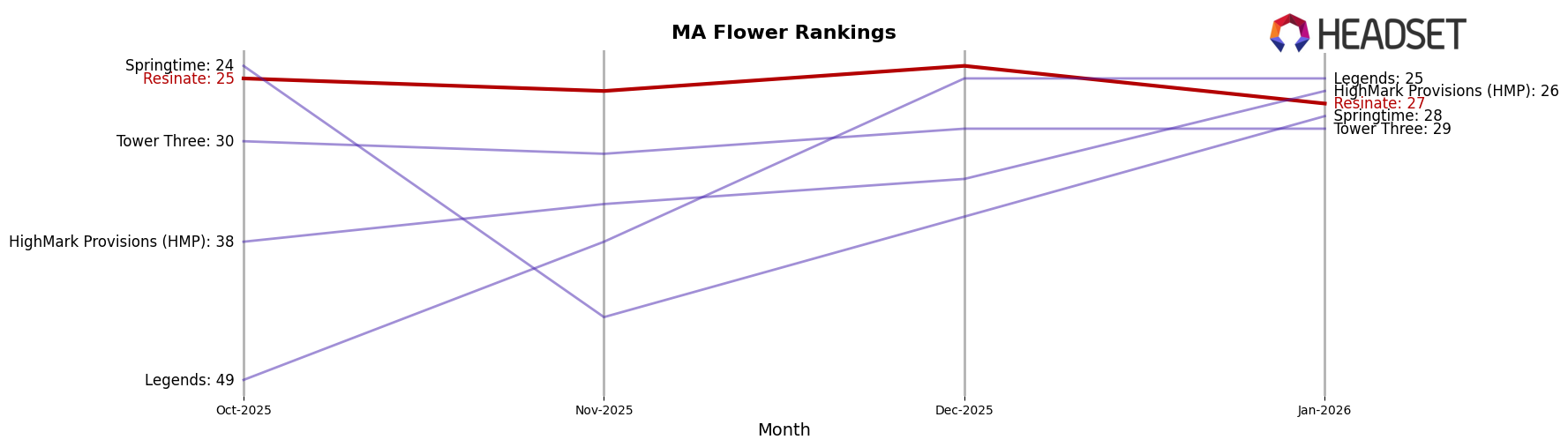

In the Massachusetts Flower market, Resinate has experienced fluctuating rankings from October 2025 to January 2026, consistently hovering around the mid-20s, with a slight dip in January to the 27th position. This indicates a competitive landscape where Resinate is maintaining a stable presence but facing pressure from brands like Springtime, which saw a significant drop from 24th to 44th in November but rebounded to 28th by January. Meanwhile, Legends showed a remarkable climb from 49th in October to 25th by December, maintaining its position in January, suggesting a strong upward trend that could challenge Resinate's market share. HighMark Provisions (HMP) also poses a competitive threat, improving its rank to 26th in January, surpassing Resinate. These shifts highlight the dynamic nature of the Massachusetts Flower market, where Resinate must strategize to enhance its competitive edge and sustain its sales momentum amidst rising competitors.

Notable Products

In January 2026, Socrates Sour (3.5g) led the sales for Resinate, claiming the top rank with a notable sales figure of 4766 units. Oregon Lemons Pre-Roll (1g) retained a strong position, moving up to rank 2 from its previous position of 5 in October 2025 and 2 in November 2025, with sales reaching 2370 units. Blue Dream Pre-Roll (1g) experienced a drop from its consistent first-place ranking in the preceding months to third place. Sundae Sunset (3.5g) entered the rankings at fourth place, while Melonade Gibson Pre-Roll (1g) secured the fifth position. This shift indicates a rising interest in flower products, as evidenced by the entry of Socrates Sour and Sundae Sunset into the top ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.