Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

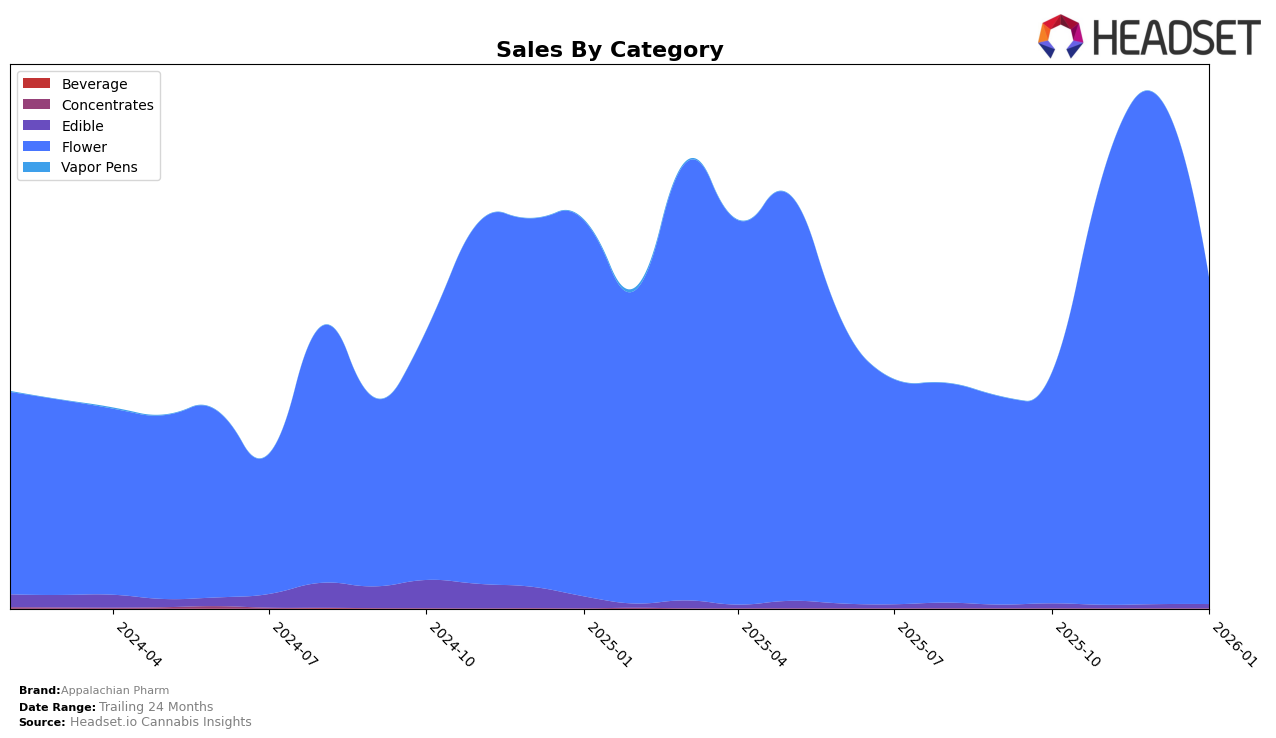

Appalachian Pharm has shown a dynamic performance across various categories and states, with notable fluctuations in their rankings. In Ohio, the brand's presence in the Flower category demonstrated a positive trend from October to December 2025, climbing from the 20th position to the 13th position. This upward movement indicates a strong market response to their products during this period. However, by January 2026, Appalachian Pharm experienced a slight decline, dropping back to the 18th position. This fluctuation might be attributed to seasonal changes or increased competition within the state. The brand's ability to maintain a position within the top 20 throughout these months suggests a resilient market presence, despite the challenges.

Interestingly, Appalachian Pharm's sales figures in Ohio reflect the shifts in ranking, with sales peaking in December 2025 before experiencing a downturn in January 2026. This peak aligns with their highest ranking in the 13th position, highlighting a potential correlation between increased consumer demand and improved brand visibility. The absence of rankings outside the top 30 in other states or categories indicates areas where Appalachian Pharm might not yet have a significant market impact, suggesting opportunities for growth and expansion. The brand's performance in Ohio serves as a valuable case study for understanding market dynamics and consumer preferences in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Appalachian Pharm has shown a dynamic performance over the past few months. Starting from October 2025, Appalachian Pharm was ranked 20th, but it climbed to 15th in November and further to 13th in December, before dropping to 18th in January 2026. This fluctuation in rank reflects a competitive market environment, with brands like Herbal Wellness Center consistently maintaining a close rank, moving from 19th to 17th, then 19th, and back to 17th. Meanwhile, Cookies has shown a steady upward trend, improving its rank from 27th in October to 16th by January, indicating a significant increase in market presence. Despite the drop in January, Appalachian Pharm's sales in November and December were notably strong, surpassing competitors like Find. and (the) Essence, suggesting that while rank fluctuations exist, their sales performance remains robust, positioning them as a formidable player in the Ohio Flower market.

Notable Products

In January 2026, Banana Cream Cake X Jealousy (2.83g) maintained its top position as the leading product for Appalachian Pharm, with sales reaching 7,682 units. Kaiju Kush (14.15g) emerged as the second-best performer, a new entry in the rankings for this month. Blanco Diamonds (2.83g) secured the third spot, showing a resurgence after not being ranked in the previous months. Cap J (2.83g) dropped to fourth place from its second position in December 2025, indicating a decline in sales momentum. Runtz Berries (2.83g) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.