Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

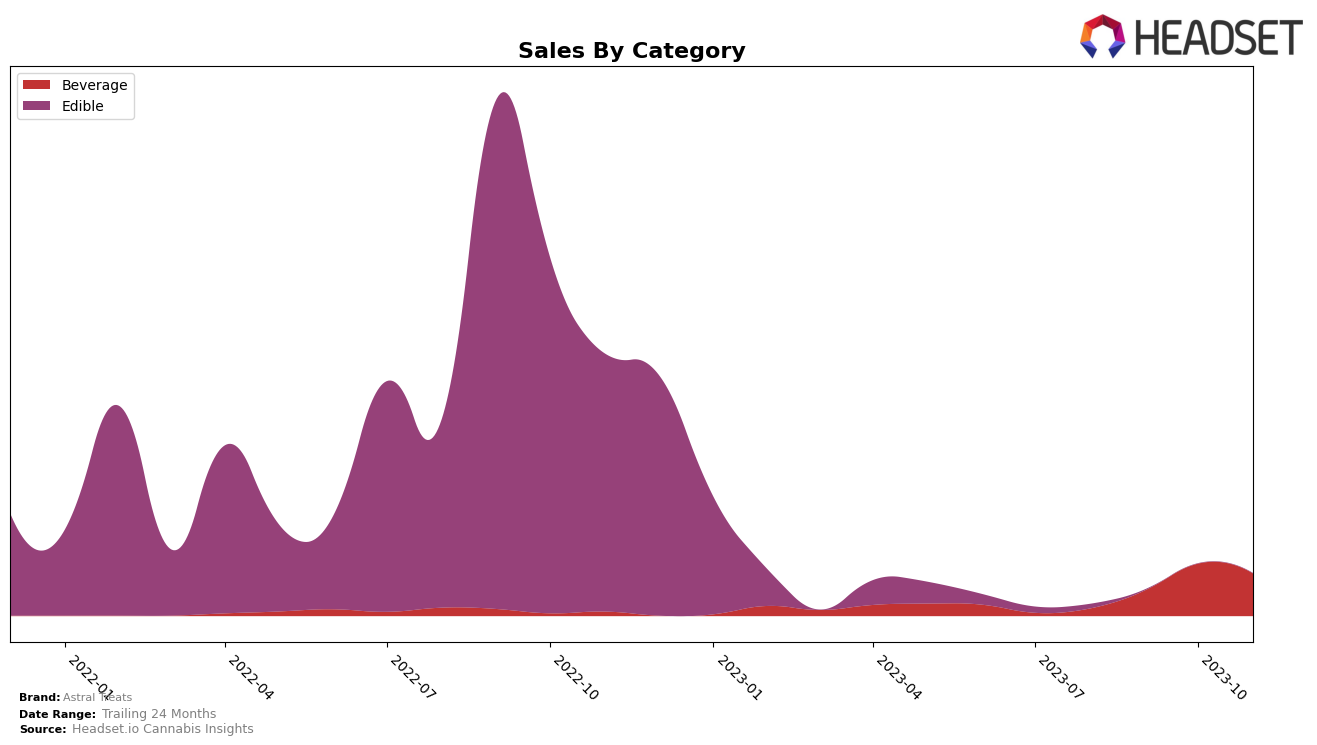

In Oregon, Astral Treats has shown a significant upward trajectory in the Beverage category. From August to November 2023, their ranking improved from 27th to 19th, breaking into the top 20 by October. This upward movement in rankings indicates a growing popularity and increased sales for the brand in this category. It's worth noting that their sales more than tripled from August to October, a positive sign of their performance in the Oregon market.

However, Astral Treats' performance in the Edible category in Oregon was not as promising. In August 2023, they were ranked 91st, and by September, they had fallen out of the top 20, as indicated by the missing ranking numbers for the subsequent months. This suggests that the brand may need to focus on improving their product offering or marketing strategy in the Edibles category to regain their standing in the market. Despite this, it's important to remember that market trends can change rapidly, and a single season's performance does not define a brand's overall potential.

Competitive Landscape

In the Oregon Beverage category, Astral Treats has shown a promising upward trend in rank from August to November 2023, moving from 27th to 19th. This improvement indicates a positive shift in market position, outperforming several competitors. For instance, Smokiez Edibles and Luminous Botanicals saw a decline in rank during the same period. Notably, Astral Treats surpassed Hush in November, a brand that had maintained a higher rank in the previous months. However, Astral Treats still trails behind WYLD, which consistently held a higher rank throughout the period. While sales data is not disclosed, the changes in rank suggest Astral Treats is gaining ground in the competitive Oregon Beverage market.

Notable Products

In November 2023, the top-performing product from Astral Treats was the Peach Cosmic Syrup (100mg) from the Beverage category, with an impressive sales figure of 580 units. This product climbed from the third rank in August to the top spot in November, demonstrating a consistent increase in popularity. The Huckleberry Cosmic Syrup (100mg), also in the Beverage category, was the second best-seller, despite dropping from the first rank in the previous three months. The Stardust Huckleberry Gummies 2-Pack (100mg), an Edible, held the third position in September, but did not feature in the top rankings for November. This analysis shows a dynamic market with shifting consumer preferences, as evident from the changes in product rankings over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.