Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

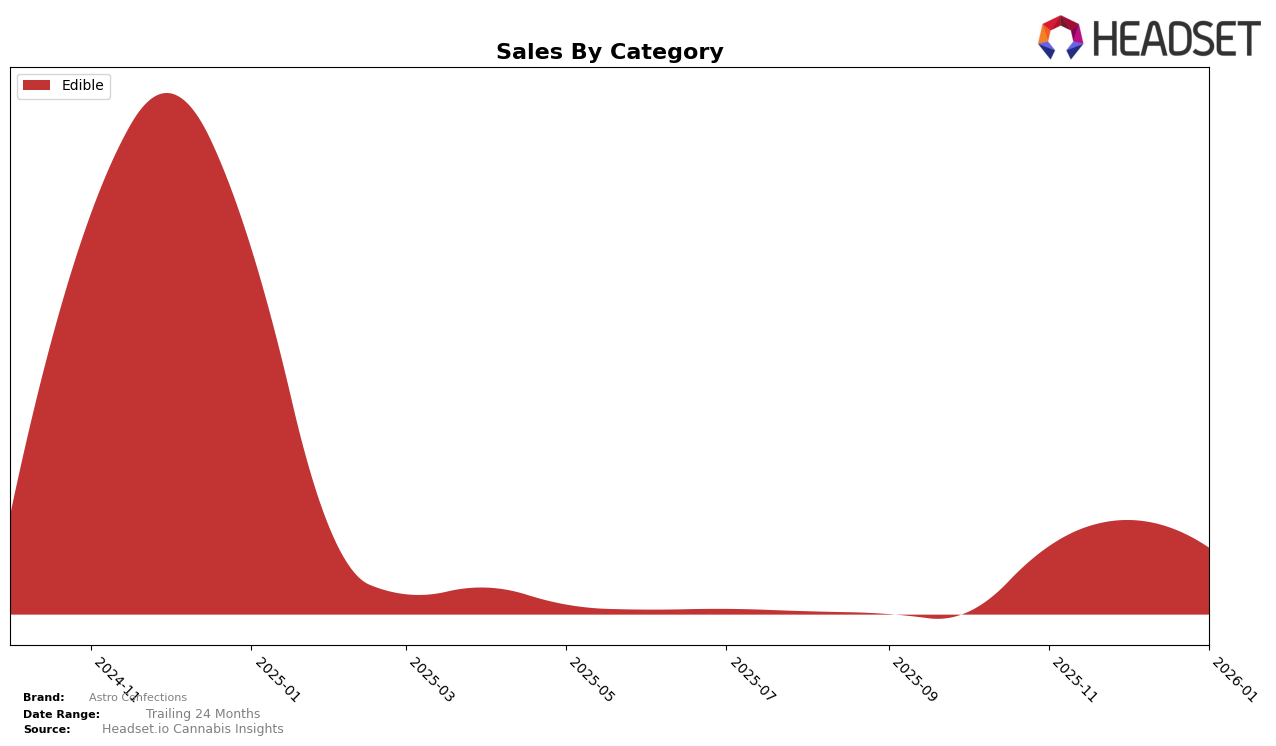

Astro Confections has shown a notable presence in the Connecticut edible market, consistently ranking within the top 20 brands over the past few months. In November 2025, they entered the rankings at 18th position, maintaining this rank in December before slightly improving to 17th in January 2026. This upward movement, albeit modest, indicates a steady demand and possibly effective brand strategies in the Connecticut market. However, it's important to note that Astro Confections did not make it into the top 30 brands in October 2025, which may suggest a significant boost in their market efforts or consumer interest starting in November.

Despite not being in the top 30 in October 2025, Astro Confections managed to generate a notable increase in sales from October to November, which could reflect a successful promotional campaign or a seasonal demand spike. The sales figures in December saw a slight dip compared to November, but the brand still maintained its ranking, suggesting that their market position was stable despite the fluctuation in sales. The consistent ranking improvement into January hints at a positive trend for the brand's future performance in the Connecticut market. However, without their presence in other state rankings, it raises questions about their market reach and brand recognition outside of Connecticut.

Competitive Landscape

In the Connecticut edibles market, Astro Confections has experienced fluctuating rankings and sales, highlighting a competitive landscape. Notably, Astro Confections was absent from the top 20 rankings in October 2025, but managed to secure the 18th position in November and December 2025, and improved slightly to 17th in January 2026. Despite this progress, its sales figures remain significantly lower compared to competitors. For instance, On The Rocks consistently ranks higher, maintaining positions between 10th and 13th with sales figures that are several times greater than Astro Confections. Similarly, Lucky Break and Craic have shown stronger sales performance, with Craic notably climbing from 18th to 14th place by November 2025. This competitive pressure suggests that Astro Confections needs to strategize effectively to enhance its market presence and close the sales gap with these leading brands.

Notable Products

In January 2026, Astro Confections' top-performing product was the Peanut Butter Milk Chocolate Cups 10-Pack (50mg), which rose to the number one spot with sales reaching $596. The Salted Caramel Milk Chocolate Squares 5-Pack (25mg) maintained its consistent second place from the previous month, although its sales decreased to 173 units. The Peanut Butter Milk Chocolate Cups 5-Pack (25mg) saw a drop in ranking to third place after leading in December 2025. Notably, the Milk and Toffee Milk Chocolate Melts 20-Pack (100mg), previously ranked first in October 2025, did not appear in the rankings for January 2026. These shifts reflect a dynamic change in consumer preferences within the Edible category over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.