Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

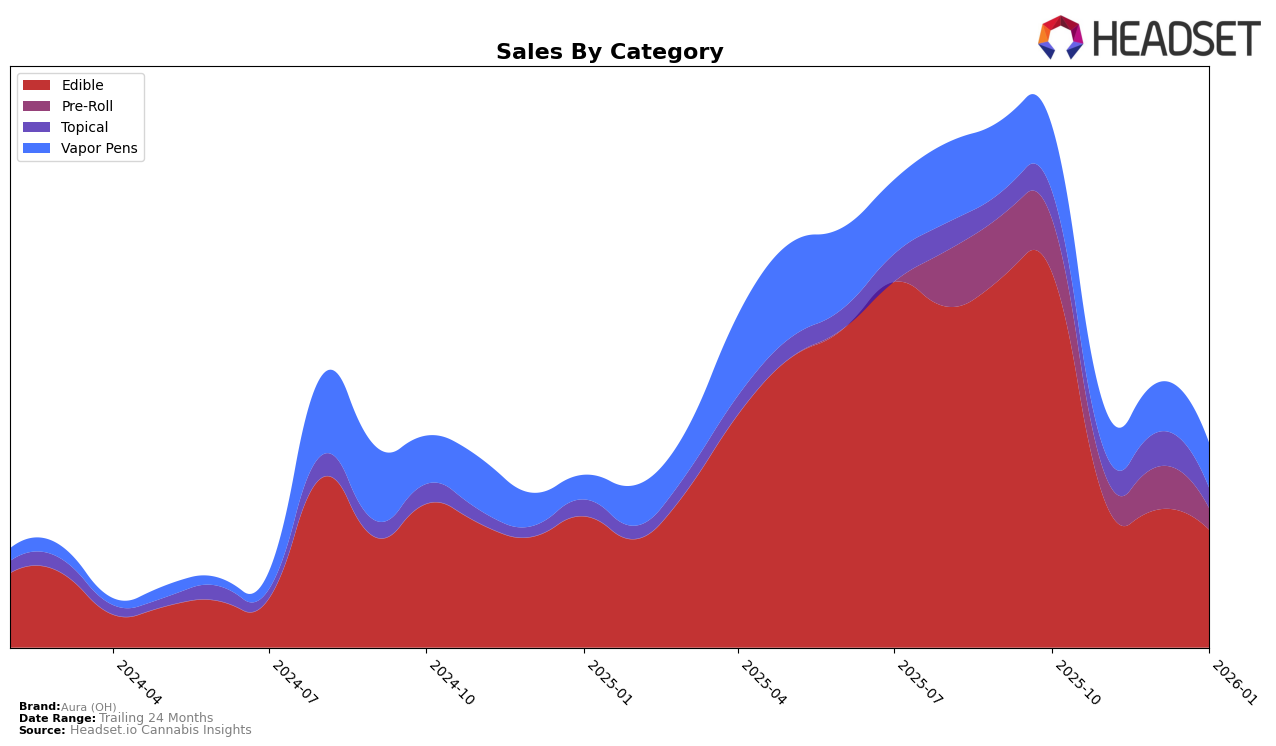

Aura (OH) has shown varied performance across different product categories in Ohio. In the Edible category, the brand experienced a noticeable decline in rankings, slipping from 9th in October 2025 to 19th by January 2026. This downward trend is accompanied by a decrease in sales, indicating potential challenges in maintaining consumer interest or market competition. In contrast, the Topical category presents a more dynamic picture. Aura (OH) improved its position from 6th in November 2025 to 3rd in December 2025, though it later dropped back to 6th in January 2026. This fluctuation suggests a competitive landscape where Aura (OH) is still able to capture significant market share at times.

In the Pre-Roll category within Ohio, Aura (OH) faced a decline, moving from 18th place in October 2025 to 28th by January 2026. This consistent drop out of the top 20 may indicate a need for strategic adjustments to regain traction. Meanwhile, in the Vapor Pens category, Aura (OH) did not manage to break into the top 30 at any point during this period, highlighting a potential area for growth or a reevaluation of their offerings. The brand's overall performance across these categories in Ohio suggests a mixed bag of opportunities and challenges, with some categories requiring more attention to improve their market standing.

Competitive Landscape

In the competitive landscape of the edible category in Ohio, Aura (OH) has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially holding a strong position at 9th place in October, Aura (OH) saw a decline to 14th in November and further dropped to 19th by December, maintaining this rank into January. This downward trend in rank is mirrored by a significant decrease in sales, from a high in October to a lower figure by January. In contrast, competitors such as BITS and Eden's Trees have shown more stable performance, with BITS maintaining a consistent presence in the mid-teens and Eden's Trees showing resilience with a slight improvement in sales from November to January. Meanwhile, The Standard and Lost Farm have struggled to maintain a top 20 position, with The Standard dropping out of the top 20 in December. These dynamics suggest that while Aura (OH) started strong, it faces significant competition from brands that are either stabilizing or improving their market positions, highlighting the need for strategic adjustments to regain its competitive edge.

Notable Products

In January 2026, Frosted Kush Pre-Roll (1g) emerged as the top-performing product for Aura (OH), climbing from the second position in December 2025 to first place. Thunder Sloth Pre-Roll (1g) dropped to the second rank after holding the top spot in the previous two months. Cherry Pie + CBN Gummies 22-Pack (220mg CBN) entered the rankings at third place, showcasing strong sales momentum. The Cherry Pie + CBN Gummies 12-Pack (110mg CBN) and CBD/THC 4:1 Tea Tree Eucalyptus Topical Cream (1180mg CBD, 295mg THC, 2oz) debuted in fourth and fifth positions, respectively. Notably, Frosted Kush Pre-Roll (1g) achieved a sales figure of 716 units in January 2026, highlighting its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.